Taxes

advertisement

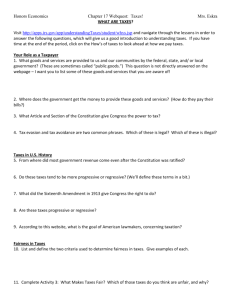

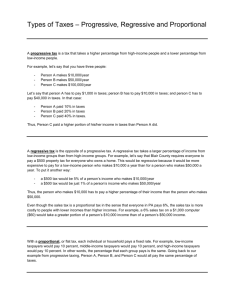

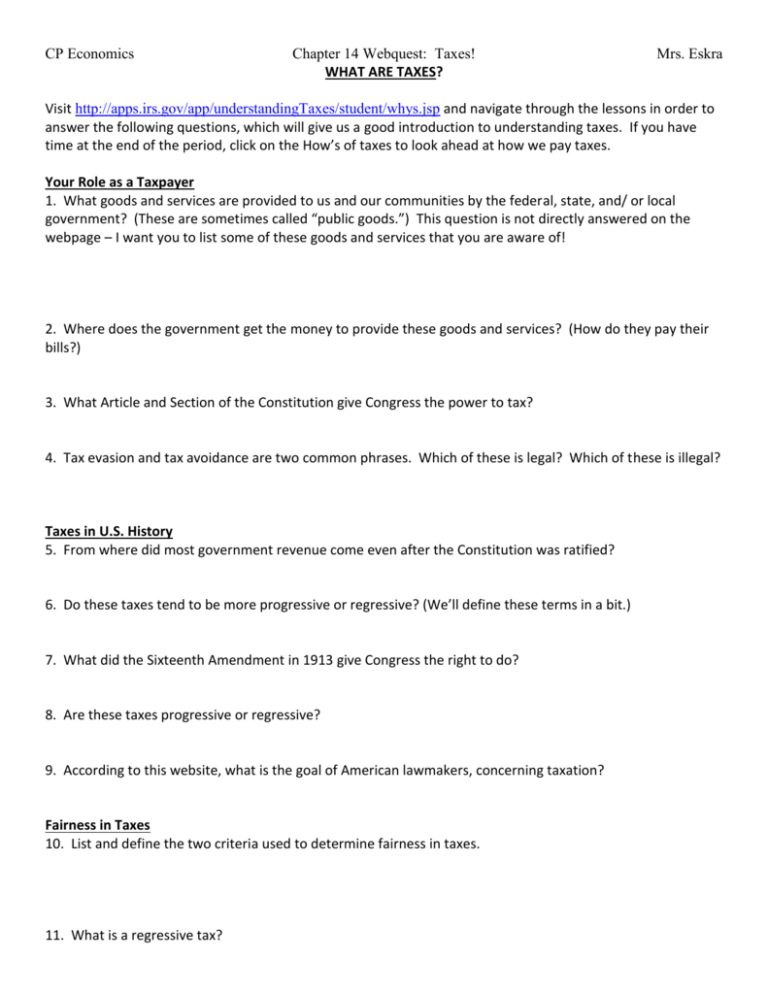

CP Economics Chapter 14 Webquest: Taxes! WHAT ARE TAXES? Mrs. Eskra Visit http://apps.irs.gov/app/understandingTaxes/student/whys.jsp and navigate through the lessons in order to answer the following questions, which will give us a good introduction to understanding taxes. If you have time at the end of the period, click on the How’s of taxes to look ahead at how we pay taxes. Your Role as a Taxpayer 1. What goods and services are provided to us and our communities by the federal, state, and/ or local government? (These are sometimes called “public goods.”) This question is not directly answered on the webpage – I want you to list some of these goods and services that you are aware of! 2. Where does the government get the money to provide these goods and services? (How do they pay their bills?) 3. What Article and Section of the Constitution give Congress the power to tax? 4. Tax evasion and tax avoidance are two common phrases. Which of these is legal? Which of these is illegal? Taxes in U.S. History 5. From where did most government revenue come even after the Constitution was ratified? 6. Do these taxes tend to be more progressive or regressive? (We’ll define these terms in a bit.) 7. What did the Sixteenth Amendment in 1913 give Congress the right to do? 8. Are these taxes progressive or regressive? 9. According to this website, what is the goal of American lawmakers, concerning taxation? Fairness in Taxes 10. List and define the two criteria used to determine fairness in taxes. 11. What is a regressive tax? CP Economics Chapter 14 Webquest: Taxes! 12. Why do regressive taxes at first seem like a fair way of taxing citizens? Mrs. Eskra 13. Give at least three examples of regressive taxes. 14. What is a progressive tax? 15. Give an example of a progressive tax. 16. Define proportional (flat) tax. 17. Give an example of a proportional tax. 18. Which kind of tax do you think is most fair? Our Current Tax Structure and Tax Brackets Go to http://www.bankrate.com/finance/taxes/2012-tax-bracket-rates.aspx to fill in the tax rates for each group of income earners in 2012. U.S. Tax Brackets - 2012 Single Taxpayer Up to $8,700 $8,701 - $35,350 $35,351 - $85,650 $85,651 - $178,650 $178,651 - $388,350 Over $388,351 Tax Rate 10% 1. What kind of tax structure (progressive, proportional, or regressive) does the above tax bracket represent? Why? 2. What principle of taxation (benefits received or ability-to-pay) does this tax structure follow? Do you think that this is fair, or do you feel that there is a fairer way for the government to collect greater tax revenue? CP Economics Chapter 14 Webquest: Taxes! Mrs. Eskra A hypothetical example to see if you really understand principles of taxation! Let’s say the senior class wanted to hold a dance, but the school would not help pay for it. How could we raise the funds if we wanted to follow the benefits-received principle? How could we raise the funds if we wanted to follow the ability-to-pay principle? Tax Incidence: Who Bears the Burden? **When there is a tax placed on a good or service, sometimes that burden is completely on the customer in the form of higher prices. Other times, people refuse to pay the tax and the producer or seller of the product is hurt through lost sales (or they have to pay the tax instead of raising prices. Most of the time, this burden is shared. In the following cases, consider who would bear more of the burden: the customer or the seller. If there was a tax placed on the price of insulin for diabetics, who would this hurt more: the diabetes patients or the pharmacies selling the insulin? Why? If lawmakers raised the tax placed on cigarettes, who would this hurt more: smokers or the places selling cigarettes? If there was a tax placed on Pepsi products (but no other soft drinks), who would this hurt more: Pepsi consumers or the manufacturer of Pepsi? If there was a tax placed on a certain brand of sugar (but no other brands), who would this hurt more: consumers of sugar or the maker of that brand of sugar? What do you think determines who pays more of a tax?