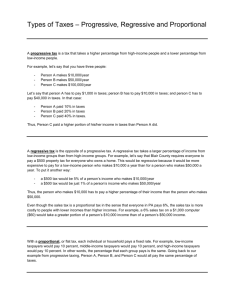

Types of Taxes

advertisement

2014′s Most & Least Fair State Tax Systems Tax Structures • Under the proportional taxes, each income group has the same percentage rate of tax to pay – 10% • In the progressive scenario, the lower income individuals pay a lower percentage of their income than do the • In the regressive tax upper income. As structure, the lower income income increases, so individuals pay a greater does the percentage of percentage of their income in taxes paid taxes than do the upper income individuals Proportional Taxes A proportional tax requires the same percentage from each person’s income A sales tax is an example 9.75% Sales Tax This tax affects the less wealthy persons more heavily than it does the richer ones The amount taxed on any item is the same dollar amount for each, but it represents a larger share of the less well-off person’s financial resources Proportional Sales Taxes can be Regressive on Individuals Poorer people tend to spend a greater %age of their income on basic living cost items – – Food, Clothing – Shelter, Transportation… in contrast to those at the higher income levels. Proportional Sales Taxes, cont. The spending habits of two families with incomes of $50,000 and $75,000 may differ significantly. The basic necessities of life – bread, milk, and butter, for example – differ little in quantity purchased by a family of four at these income levels. Example: Proportional Tax -Regressive Effect • Groceries for a family of 4 (2 teenagers) might cost $200/week • A sales tax of 4.5% would be $9/wk • Over 1 year, the sales tax on groceries would total $468 • For a family with an income of $100,000/yr. = .468% of income • For the same family (same eating habits) earning $50,000/yr., sales tax on groceries = .936% of income Proportional Sales Taxes Tax the Wealthier, Less The family with the higher income level spends a lower percentage on the sales tax related to these items. But Proportional Sales Taxes Tax The Less Wealthy, More The family with the lower income level spends a higher percentage on the sales tax related to these items. Regressive Taxes A regressive tax Social security taxation system requires those with At the beginning income higher incomes pay levels all individuals pay lower percentages of 7.65% of their income in their income. FICA tax FICA taxes are not collected after one’s income reaches $68,400 Regressive Taxes, cont. FICA* is a regressive tax. An individual earning $68,400 would pay $5,232.60 each year in FICA taxes. An individual earning twice that rate, or $136,800, would pay the same FICA tax amount or 3.825% - 1/2 the % of income that the $68,400 earner would pay!! *FICA - Federal Insurance Contributions Act Progressive Taxes Progressive taxes are those that increase as a percentage along with income Federal income taxes are designed to be progressive Tax Brackets – 2014 Taxable Income Examples of the 3 Tax Classifications Individual Income Taxes Paid Taxes as a % of Income Proportional Taxes 1 2 3 $10,000 $50,000 $100,000 $1,000 $5,000 $10,000 10% 10% 10% Regressive Taxes 1 2 3 $10,000 $50,000 $100,000 $500 $2,000 $3,000 5% 4% 3% Progressive Taxes 1 2 3 $10,000 $50,000 $100,000 $300 $2,000 $5,000 3% 4% 5% Illustration: Proportional, Regressive, & Progressive Taxes “Good” taxes are are generally considered to be progressive while “Bad” taxes are considered to be regressive.