Tax Unit American Government

advertisement

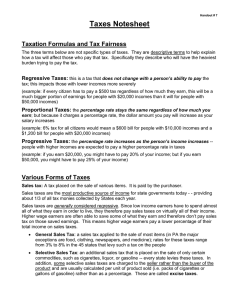

Tax Unit American Government General Overview Governments need financial resources to carry out their activities Government is required to follow a budget that balances money taken in by the government (revenue) with money it spends (expenditures) A TAX is money paid by individuals, businesses, and organizations to support the government Americans pay a variety of different taxes About taxes The federal government require employers to take money for income taxes from the paychecks of their employees (payroll deductions) Employers turn the tax money over to the government Taxpayers report his/her income on an income tax form every year on or before April 15 Taxpayers take deductions from income: Examples: home mortgage payments, interest paid on bank loans, large medical expenses… Issue a refund if the income on which the person pays taxes is smaller Types of Taxes Regressive Taxes: this is a tax that does not change with a persons ability to pay the tax Proportional Taxes: the percentage rate stays the same regardless of how much you earn (dollar amount will increase as your salary increases) Progressive Taxes: the percentage rate increases as the person’s income increases-people with higher incomes are expected to pay a higher percentage rate in taxes Democrats vs. Republicans Democrats-favor a tax system that is significantly progressive Republicans favor a tax system that is proportional or even regressive. Federal Taxes Income Tax: levied on most sources of income and/or corporations Social Security and Medicare: taxes are places on wages and salaries Estate Tax is collected from property left behind by those that have died. State and Local Tax Income tax: a tax levied on the yearly earnings of individuals and/or corporations Sales tax: a tax places on the sale of various items It is paid by the purchaser. Property tax: a tax levied on the assessed value of a property that you own. (Largest source of income for local governments) Licenses and fees: are charges from a specific government agency for things such as court fines, hunting ad fishing licenses, car registration…ect. Inheritance Tax: this is a generally a state tax paid on the specific items that a person inherits. Amusement tax: a selective sales tax levied specifically on activities for entertainment (movie tickets, concert tickets and sporting events). Summarize the slides: