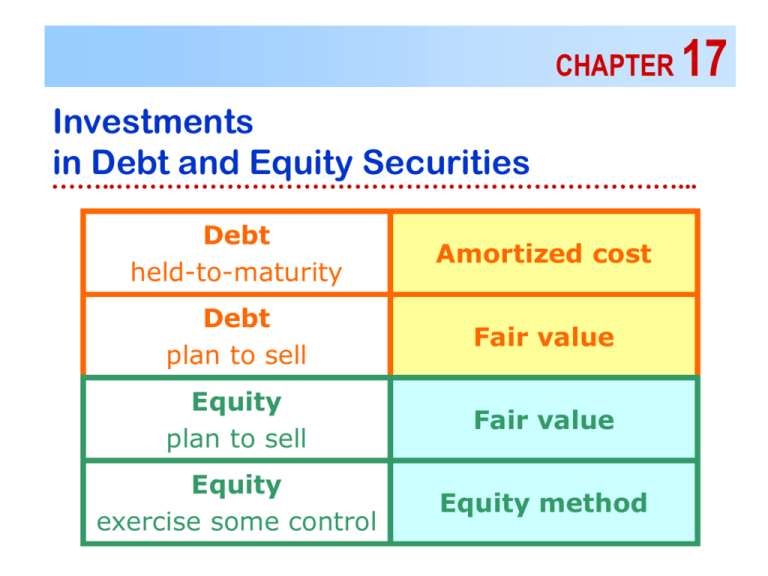

Chapter 17

advertisement

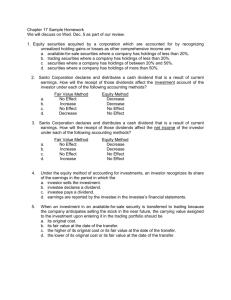

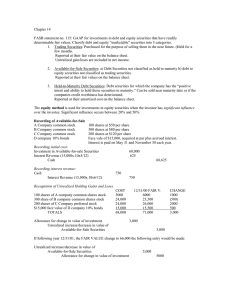

CHAPTER 17 Investments in Debt and Equity Securities ……..…………………………………………………………... Debt held-to-maturity Amortized cost Debt plan to sell Fair value Equity plan to sell Fair value Equity exercise some control Equity method DEBT SECURITIES Held-to-maturity intent and ability to hold security until it matures Trading held primarily for sale in the near term Available-for-sale none of the above HELD-TO-MATURITY SECURITIES 1/1/03 Purchased a $50,000, 10% bond for $51,388. The bond pays semiannual interest and matures 7/1/04. Periods Rate PV Annuity FV 1/1/03 Most firms do not record separate premium or discount. AD? Effective interest = 8% Date 1/1/03 7/1/03 1/1/04 7/1/04 7/1/03 Cash Rec’d Interest Rev. Premium Amortiz Carrying Amount $51,388 Date Cash Rec’d Interest Rev. Premium Amortiz Carrying Amount 1/1/04 2,500 2,038 462 50,482 7/1/04 2,500 2,018 482 50,000 12/31/03 6/1/04 Sold bond for $50,050 plus $2,083 accrd interest. 6/1/04 AVAILABLE-FOR-SALE SECURITIES 6/30/02 Purchased a $20,000, 4-year, 7% bond for $18,681 (effective yield=9%). 6/30/02 Date Cash Rec’d Interest Rev. Premium Amortiz Carrying Amount 12/31/02 700 841 141 18,822 12/31/02 12/31/02 Fair value = $19,340; carrying amount = $18,822. 12/31/02 1/1/03 Sold bonds for $19,440. 1/1/03 12/31/03 Adjust fair value adjustment account. 12/31/03 Adjusting Securities to Fair Value Securities Fair Value Adjustment (AFS) is an asset valuation account that is added to or subtracted from the Available-for-Sale Securities account. Unrealized Holding Gain or Loss - Equity is reported as part of Other Comprehensive Income. The year-end adjustment will eliminate any unrealized gains or losses accumulated in the Securities Fair Value Adjustment (AFS) account related to securities that have been sold. TRADING SECURITIES Similar to available-for-sale securities, except unrealized gains and losses are closed to net income. 12/31/02 Secur FV Adjustment (Trading) 518 Unrealiz Holding G/L - Income 518 EQUITY SECURITIES Holdings of less than 20% • fair value method • AFS or trading Accounting treatment the same as with debt securities. Holdings between 20% and 50% • equity method Holdings of more than 50% • consolidated statements HOLDINGS BETWEEN 20% AND 50% Investor is presumed to exercise “significant influence” if holding 20% or more of voting stock. Unless there is evidence to the contrary. Investment: recorded at cost not adjusted to market price increased by share of net income (revenue distinguished from extraordinary G/L) decreased by amortization of excess of cost over share of book value decreased by amount of dividends received OTHER REPORTING ISSUES Financial Statement Presentation Notes for AFS & Held-to Maturity Total fair value, unreal holding G/L, amortized cost for each major security type Summary info. about debt maturities Notes for Equity Method Investments Name of investee & % ownership Underlying equity (if different from carrying value) Fair value Reclassification Adjustments Trading Secur 50,000 10,000 40,000 Loss: Sale of Sec 600 Other comprehensive income Total holding gains for period Less: Reclass adj for losses included in net income Sec FV Adjust 1,400 1,000 400 Unreal Hold G/L 1,000 Impairment of Value Trading Secur 50,000 Sec FV Adjust 1,400 If decline in value in not temporary, record impairment. 2/1/07 Loss on Impairment Sec FV Adjust Unrealiz Hold G/L Trading Securities 1,400 1,400 1,400 1,400