Document

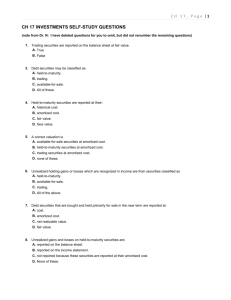

advertisement

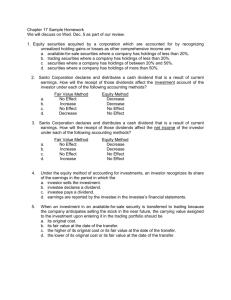

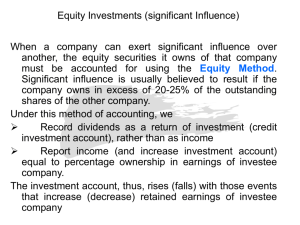

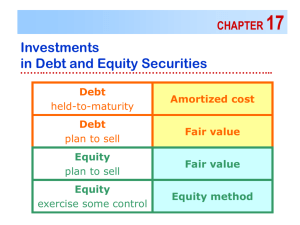

MANAGEMENT DECISIONS AND FINANCIAL ACCOUNTING REPORTS Baginski & Hassell Chapter 8 • Topics – Methods of accounting for investments in common stock – “Mark-to-Market accounting” for certain investments in equity securities – Opportunity for gains trading – Legal forms of business combinations – Accounting methods for business combinations – Consolidated financial statements Methods of Accounting for Investments in Common Stock • Cost Method – Investor has no significant influence over increase • Presumed to be ownership of < 20% of investee’s outstanding common stock • Equity method – Investor has significant influence, but does not have control over investee • Presumed to be ownership of 20% - 50% of investee’s outstanding common stock FAQ? When should a corporation consider consolidation, i.e., consolidated financial statements? When the investor is “in control” which is clearly the case when over 50% of the investee’s outstanding common shares are owned. Effective control can often take somewhat less than 50%! Cost Method • An investor uses the cost method if it has no significant influence over investee – Investment is recorded at the cost of acquiring the shares • If marketable, securities are classified as either trading or available-for-sale (in accordance with SFAS No. 115). • The investee’s pro rata share of dividends declared by investee is recorded as dividend income – Dividend income is shown in the other income section of the income statement. – Dividends received are shown as an operating activity in the SCF. Equity Method • An investor uses the equity method if it has significant influence over the investee, but it does not have control – The investment is initially recorded at the cost of acquiring the shares. – The investor’s pro rata share of investee net income is recorded as (1) an increase in the investment, and (2) investment income (reported in the “other income” section of the income statement; not dependent on cash flows). Equity Method & Dividend Collections – The investor’s pro rata share of dividends declared by investee is recorded as a reduction of the investor’s investment – Under the equity method, the investment is not marked-to-market Example: Compare and Contrast Cost and Equity Methods (for long-term investments) Facts: On January 1, the O’Brien Co. purchased 100,000 shares of Gilly Co.’s common stock for $18 per share (or 15% of Gilly’s outstanding common stock). For the year, Gilly reported net income of $5,000,000 and declared and paid dividends of $800,000. Illustration of cost and equity methods Assumption 1: The investment (15%) does not give O’Brien significant influence Assumption 2: The investment (15%) does give O’Brien significant influence The effects on O’Brien’s current year financial statements are as follows: O’Brien: Cost Method Balance Sheet Investment in common stock (1) $1,800,000 Income Statement Other income: Dividend income (2) (1) 100,000 shares × $18 (2) $800,000 × 15% 120,000 Cost Method, continued Statement of Cash Flows Operating Activities Dividends received $ 120,000 Investing Activities Purchase of investment (1,800,000) O’Brien: Equity Method Balance Sheet Investment in common stock (1) Income Statement Other income: Equity in subsidiary earnings (2) $2,430,000 $750,000 (1) ($100,000 shares × $18) + ($5,000,000 × 15%) – ($800,000 × 15%) (2) $5,000,000 × 15% Equity Method, continued Statement of Cash Flows Operating Activities Dividends Received Adjust for non-cash revenue Investing Activities Purchase of investment 120,000 (750,000) $(1,800,000) Compare and Contrast Effect of Cost and Equity Methods • Balance sheet: Investment account is different – Cost: carry at historical cost – Equity: carry at historical cost adjusted for • Income statement: Revenue is different – Cost: dividends – Equity: pro-rata share of investee’s Net Income • Statement of cash flows is different – Cost: no adjustment required for non-cash revenue – Equity: remove non-cash revenue from net income “Mark-to-Market Accounting” for Investments in Equity Securities FMV • SFAS No. 115 classifies certain securities as trading, available-for-sale, or held-to-maturity. • Equity securities can only be classified as trading or available-for-sale. Only debt securities can be classified as held-to-maturity. • To be classified as trading or available-forsale, the securities must have readily determinable FMVs. • Types of equity securities that qualify for trading or available-for-sale classification – Common stock (accounted for under the cost method) – Preferred stock – Stock rights, warrants, options SFAS No. 115: Trading and Availablefor-Sale Securities • Trading – Marked-to-Market at balance sheet date – Unrealized gain/loss is reported in the other income (expenses) section of the income statement – Unrealized gain/loss is a noncash event that requires adjustment in the operating section of the SCF • Available-For-Sale – Marked-to-Market at balance sheet date – Unrealized gain/loss is reported in the other comprehensive income section of the statement of comprehensive income • Other comprehensive income is closed to the accumulated other comprehensive income section of stockholders’ equity – Unrealized gain does not impact net income so no adjustment is required on the SCF Example: Compare and Contrast Trading and Available-For-Sale Classifications Facts: On January 1, the O’Brien Co. purchased 100,000 shares of Gilly Co.’s common stock for $18 per share (15% of Gilly’s outstanding common stock). For the year, O’Gill reported net income of $5,000,000 and declared and paid dividends of $800,000. The investment (15%) does not give O’Brien significant influence therefore the cost method is used. Gilly’s year-end common stock FMV is $20 per share. Illustration of cost and equity methods Assumption 1: The investment is classified as trading. Assumption 2: The investment is classified as available-for-sale. O’Brien’s current year financial statement effects for the investments are as follows: O’Brien: Trading Classification Balance Sheet Investment in common stock (1) Income Statement Other income: Dividend income (2) Unrealized gain (loss) on trading securities (3) (1) 100,000 shares × $20 (2) $800,000 × 15% (3) 100,000 × ($20 - $18 ) $2,000,000 $120,000 200,000 Trading Classification, continued Statement of Comprehensive Income Other comprehensive income $0 Statement of Cash Flows Operating Activities Purchase of investments Dividends received Adjustment for noncash revenue $(1,800,000) 120,000 (200,000) O’Brien: Available-for-Sale Classification Balance Sheet Investment in common stock (1) Income Statement Other income: Dividend income (2) (1) 100,000 shares × $20 (2) $5,000,000 × 15% $2,000,000 $120,000 Available-for-Sale Classification, continued Statement of Comprehensive Income Other comprehensive income(3) Statement of Cash Flows Operating Activities Dividends received Investing Activities Purchase of investments (3)100,000 × ($20 - $18 ) $ 200,000 $120,000 $(1,800,000) Compare and Contrast Effects of Trading and Available-for-Sale Classifications • Balance sheet investment account is the same • Income statement amounts are different • Statement of comprehensive income amounts are different • Cash flows on the SCF different; classification affects ‘type’ of cash flow; Trading’s noncash revenue from mark-to-market requires adjustment Opportunity for “Gains Trading” • A company with available-for-sale securities has unrealized gains/losses associated with the securities • “Gains trading” is the strategic planning of sales of available-for-sale securities in such a manner as to create either – profits (sell securities with unrealized gains) – losses (sell securities with unrealized losses) BUSINESS COMBINATIONS Legal Forms of Business Combinations Three general forms (types) of business combinations occur – Merger: One entity retains its identity. – Consolidation: New entity identity is created. – Parent/Subsidiary Relationship: All entities maintain identity. • Merger: A + B = A One company acquires a second company and the second company ceases to exist. • Consolidation: A + B = C Two companies form a third company and the original two companies cease to exist. • Parent & Subsidiaries: A + B = A + B One company acquires the common stock of a second company, and after the transaction both companies continue to exist. Accounting Methods for Business Combinations: “Purchase” • The transaction is recorded at the fair market value of the consideration given by the acquiring company • The net assets of the acquired company are written up or down to fair market value • Any excess of the value paid over the sum of the fair market values of the net assets acquired is recorded as goodwill Accounting Methods for Business Combinations: “Poolings” • FASB eliminated ‘pooling’ for all combinations after June 30, 2001 • Historically, many combinations were recorded as pooling – Net assets acquired recorded at their book value – No goodwill was recognized Goodwill • Goodwill reported on a balance sheet can only result from a business combination accounted for as a purchase. • Goodwill is tested annually for impairment Goodwill Impairment Procedure 1) Compare fair value of the reporting unit to the unit’s book value including goodwill • • If FV > carrying amount, no impairment If FV < carrying amount, proceed to second step 2) Compare GW’s bookvalue to its implied fair value • If BV > Implied FV recognize impairment equal to the excess Consolidated Financial Statements Note: The use of the term consolidation in the next slide is different than when used to refer to the legal form of a type of business combination (i.e., consolidation: A + B = C) Consolidated Financial Statements • Companies that reflect a parent/subsidiary relationship prepare consolidated financial statements • The financial statements of the parent company are combined with those of the subsidiary company(s) into one set of consolidated financial statements – Intercompany amounts are eliminated in the consolidation process End of Chapter 8