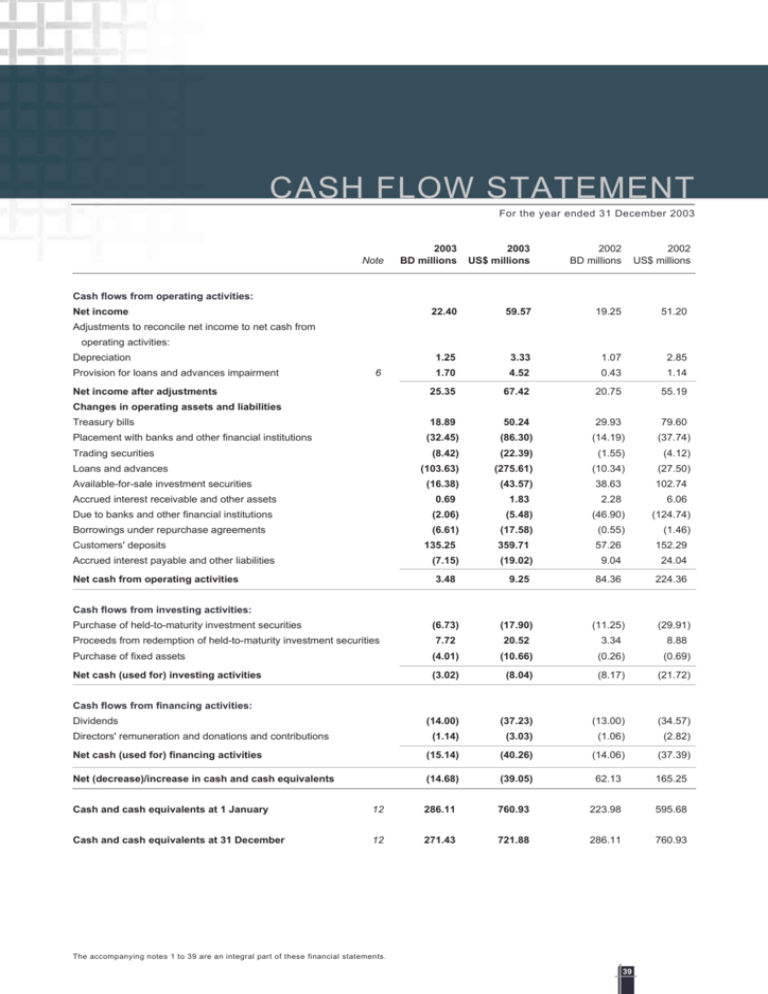

CASH FLOW STATEMENT

advertisement

CASH FLOW STATEMENT For the year ended 31 December 2003 Note 2003 BD millions 2003 US$ millions 2002 BD millions 22.40 59.57 19.25 2002 US$ millions Cash flows from operating activities: Net income 51.20 Adjustments to reconcile net income to net cash from operating activities: Depreciation Provision for loans and advances impairment 6 Net income after adjustments 1.25 3.33 1.07 2.85 1.70 4.52 0.43 1.14 25.35 67.42 20.75 55.19 Changes in operating assets and liabilities Treasury bills Placement with banks and other financial institutions Trading securities Loans and advances Available-for-sale investment securities 18.89 50.24 29.93 79.60 (32.45) (86.30) (14.19) (37.74) (8.42) (22.39) (1.55) (4.12) (103.63) (275.61) (10.34) (27.50) 102.74 (16.38) (43.57) 38.63 Accrued interest receivable and other assets 0.69 1.83 2.28 Due to banks and other financial institutions (2.06) (5.48) (46.90) (124.74) Borrowings under repurchase agreements (6.61) (17.58) (0.55) (1.46) Customers' deposits 135.25 6.06 359.71 57.26 152.29 (7.15) (19.02) 9.04 24.04 3.48 9.25 84.36 224.36 (6.73) (17.90) (11.25) (29.91) 7.72 20.52 3.34 8.88 Purchase of fixed assets (4.01) (10.66) (0.26) (0.69) Net cash (used for) investing activities (3.02) (8.04) (8.17) (21.72) (14.00) (37.23) (13.00) (34.57) (1.14) (3.03) (1.06) (2.82) Net cash (used for) financing activities (15.14) (40.26) (14.06) (37.39) Net (decrease)/increase in cash and cash equivalents (14.68) (39.05) 62.13 165.25 Accrued interest payable and other liabilities Net cash from operating activities Cash flows from investing activities: Purchase of held-to-maturity investment securities Proceeds from redemption of held-to-maturity investment securities Cash flows from financing activities: Dividends Directors' remuneration and donations and contributions Cash and cash equivalents at 1 January 12 286.11 760.93 223.98 595.68 Cash and cash equivalents at 31 December 12 271.43 721.88 286.11 760.93 The accompanying notes 1 to 39 are an integral part of these financial statements. 39