Investments in available-for

advertisement

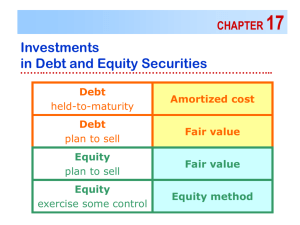

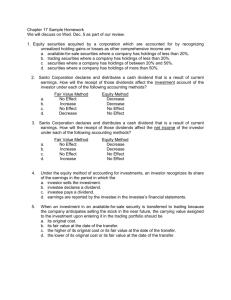

Chapter 15 Unit 09 Seminar Investments Intermediate Accounting 11th edition Nikolai Bazley Jones Presented by Professor Stanley Self 2 Why Companies Invest in Other Companies 1. Additional revenues from idle cash 2. Control over another company 3. Beneficial relationship with another company 3 Classification of Investments 1. Trading securities 2. Available-for-sale securities 3. Held-to-maturity debt securities 4 Trading Securities Trading securities are investments in debt and equity securities that are purchased and held principally for the purpose of selling them in the near term. These securities are reported at their fair market value on the ending balance sheet, and unrealized holding gains and losses are included in net income of the current period 5 Available-for-Sale Securities Investments in available-forsale securities are (a) debt securities that are not classified as being held to maturity, and…(b) debt and equity securities that are not classified as trading securities. 6 Available-for-Sale Securities Investments in available-for-sale securities are reported at their fair value on the ending balance sheet date, and the unrealized holding gains or losses are reported as a component of other comprehensive income. Therefore, the unrealized holding gains and losses for available-forsale securities are not included in net income. 7 Held-to-Maturity Debt Securities Investments in held-to-maturity debt securities are debt securities for which the company has the “positive intent and ability to hold those securities to maturity.” Investments in held-to-maturity debt securities are reported at their amortized cost on the balance sheet…not their fair value. 8 Accounting for Investments Investment Categories Investment in Equity Securities 1. No significant influence (less than 20% ownership) a. Trading b. Available for sale 2. Significant influence (20 to 50% ownership) 3. Control (more than 50% ownership) Accounting Method Fair value Fair value Reporting of Unrealized Holding Gains and Losses Equity method Net income Other comprehensive income Not recognized Consolidation Not recognized 9 Accounting for Investments Investment Categories Accounting Method Investment in Debt Securities 1. Trading 2. Available for sale Fair value Fair value 3. Held to maturity Amortized cost Reporting of Unrealized Holding Gains and Losses Net income Other comprehensive income Not recognized 10 Investments in Debt and Equity Trading Securities 1. The investment is initially recorded at cost. 2. It is subsequently reported at fair value on the ending balance sheet(s). 3. Unrealized holding gains and losses are included in net income of the current period. 4. Interest and dividend revenue, as well as realized gains and losses on sales, are included in net income of the current period. 11 Investments in Available-for-Sale Debt and Equity Securities 1. The investment is initially recorded at cost. 2. It is subsequently reported at fair value on the ending balance sheet(s). 3. Unrealized holding gains and losses are reported as a component of other comprehensive income. 4. The cumulative unrealized holding gains and losses are reported in the accumulated other comprehensive income section of stockholders’ equity 5. Interest and dividend revenue, as well as realized gains and losses on sales, are included in net income for the current period. 12 Page references for Investment Examples Available-for-Sale Debt & Equity Securities ……. 720 Realized Gains & Loses on sales of A4S ………….. 724 Held-to-Maturity (Remember, only Debt) ……… 726 Effective Interest Rate Method (Review) ...... 657 to 665 Accounting for Bond Premiums & Discounts 727 to 731 Amortization of bonds Acquired Between Int. Dates 729 Sale before Maturity Date ………………….... 730 to 731 13 Accounting for Investments Classify According to Management Intent as: Recognize Interest and Dividend Revenue in: Recognize Realized Gain or Loss in: Compute Realized Gain or Loss as: Trading Net Income Net Income Selling Price minus Fair Value at Most Recent Balance Sheet Date Available-for-Sale Net Income Net Income Selling price minus (Amortized) Cost Held-to-Maturity Net Income Net Income Selling Price minus (Amortized) Cost 14 Transfers of Investments Between Categories 1. 2. 3. 4. A transfer from the trading category A transfer into the trading category A transfer into the available-for-sale category A transfer of a debt security into the held-tomaturity category from the available-for-sale category (See Pages 732 to 734 for specific examples) 15 Impairments Impairments may be an “other than temporary” decline below the amortized cost of an investment in a debt security classified as available for sale or held to maturity. (See Page 734) Disclosures – see page 735. 16 Disclosures 1. Trading Securities. A company must disclose the change in the net unrealized holding gain or loss that is included in each income statement. 2. Available-for-Sale Securities. For each balance sheet date, a company must disclose the aggregate fair value, gross unrealized holding gains and gross unrealized holding losses, and (amortized) cost by major security types. 3. Held-to-Maturity Debt Securities. For each balance sheet date, a company must disclose the aggregate fair value, gross unrealized holding gains, gross unrealized holding losses, and amortized cost by major security types. 17 Financial Statement Classification See page 737. 18 A Conceptual Evaluation 1. Fair value is required in the balance sheet for trading securities and available-for-sale securities, but amortized cost is required for held-to-maturity securities. 2. Fair value is not required for certain liabilities. 3. Unrealized holding gains and losses are reported in net income for trading securities but in other comprehensive income for available-for-sale securities. 4. The classification of securities is based on management intent. 19 IFRS vs. U.S. GAAP IFRS also use the trading, available-for-sale, and held-to-maturity categories. The valuation methods are the same for each category as under U.S. GAAP. IFRS also apply these categories to all financial instruments, such as loans and receivables. IFRS allow for the reversal of impairment losses related to held-to-maturity securities and available-for-sale securities. 20 Equity Method When an investor corporation owns a significantly large percentage of common stock, it is able to exert significant influence over the operating and financial policies of the investee corporation. The equity method is used to account for this investment. 21 Equity Method Acknowledges the existence of a material economic relationship between the investor and the investee Is based upon the requirements of accrual accounting Supplies more relevant information for decision makers who rely on financial statements 22 Equity Method In the absence of evidence to the contrary, an investment of 20% or more in the outstanding common stock of the investee leads to the presumption of significant influence. 23 Equity Method According to GAAP, what are the facts and circumstances that indicate that investors with 20% or more in the investee’s stock should not use the equity method? (See Page 741) 24 Equity Method See Journal Examples – Pages 742 – 743 See Disclosure Examples – Page 743 See Change to Equity Method – Page 744 See Change from Equity Method – Page 744 25 Additional Issues Non-marketable Securities Stock Splits Stock Dividends Stock Warrants Convertible Securities Life Insurance Cash Surrender Value 26 Sample Exercises Assigned Exercise E15-4, p. 762 Exercise E15-8, p. 763 Problem 15-18, p. 771 Similar E15-5 p. 762 P15-9 p. 769 E15-16 p. 764 27 Exercise 15-5 (Page 1 of 2) 28 Exercise 15-5 (Page 2 of 2) 2. Noncurrent assets: Investment in available-for-sale securities (at cost) Plus: Allowance for change in value of investment Investment in available-for-sale securities (at fair value) $92,000 1,500 $93,500 Stockholders' equity: Accumulated Other Comprehensive Income: Unrealized increase in value of available-for-sale securities $ 1,500 29 Problem 15-9 (Page 1 of 4) HYDE CORPORATION Bond Investment Interest Revenue and Premium Amortization Schedule Effective Interest Method Date 01/01/10 06/30/10 12/31/10 03/31/11 06/30/11 12/31/11 06/30/12 12/31/12 06/30/13 Cash Debita $ 19,500.00 19,500.00 157,754.03e 9,750.00 9,750.00 9,750.00 9,750.00 159,750.00 Investment in Interest Revenue Debt Securities Creditb Creditc $18,502.41 18,442.56 4,594.78e 9,189.56 9,155.93 9,120.28 9,082.50 9,042.48f $ 997.59 1,057.44 153,159.25e 560.44 594.07 629.72 667.50 150,707.52 Carrying Value of Debt Securitiesd $308,373.53 307,375.94 306,318.50 153,159.25 152,598.81 152,004.74 151,375.02 150,707.52 -0- 30 Problem 15-9 (Page 2 of 4) aBonds outstanding x 0.13 x 1/2 + Cash received to retire bonds bCarrying value of bonds x 0.12 x 1/2 (except 3/31/11 when times ¼ instead of 1/2) cFootnote a - footnote b dPrevious carrying value - footnote c eSee March 31, 2011 journal entries; for Cash, $159,500.00 less $1,745.97 gain fDifference due to $0.03 rounding error 31 Problem 15-9 (Page 3 of 4) 32 Problem 15-9 (Page 4 of 4) 33 Exercise 15-16 2010 Jan. During the year Dec. 1 Investment in Stock: Fink Company Cash (3,000 x $16) 48,000 Investment in Stock: Fink Company Investment Income ($22,000 x 0.30) 6,600 Cash ($6,000 x 0.30) Investment in Stock: Fink Company 1,800 31 Investment Income Investment in Stock: Fink Company a[($115,000 - $90,000) x 0.30] 10 years 48,000 6,600 1,800 750a 750 34 Q & A Session ? 35 Chapter 15