Investments - University of Texas at El Paso

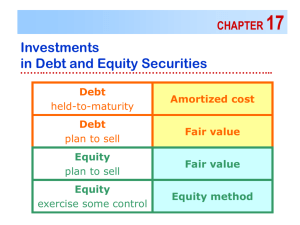

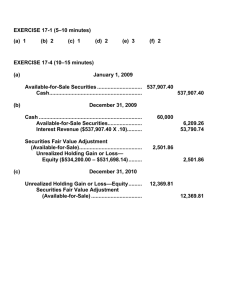

advertisement

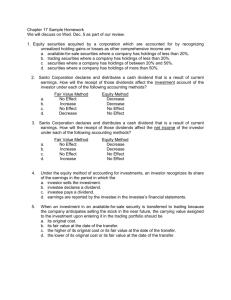

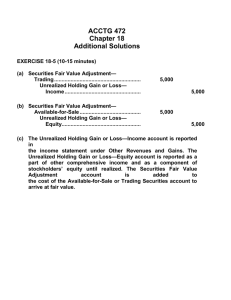

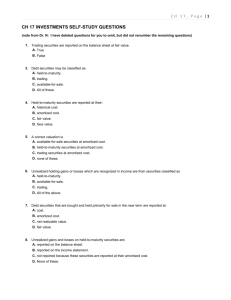

Investments Sid Glandon, DBA, CPA Assistant Professor of Accounting The University of Texas at El Paso Debt Securities Classified as held-to-maturity Classified as trading Positive intent and ability to hold to maturity Help for sale in near term to generate income Classified as available-for-sale Not classified as held-to-maturity or trading securities Debt Securities Classified as Held-to-Maturity Valuation Unrealized holding gains or losses Amortized cost Not recognized Other income Interest earned Realized gains and losses from sale Debt Securities Classified as Trading Valuation Unrealized holding gains or losses Fair value Recognized in net income Other income Interest earned Realized gains and losses from sale Debt Securities Classified as Available-for-Sale Valuation Unrealized holding gains or losses Fair value Recognized as other comprehensive income Recognized as separate component of stockholders’ equity Other income Interest earned Realized gains and losses from sale Investment in Debt Securities Cost to investing entity Par value Discount Stated interest rate Effective interest rate Fair value of security; End of year 1 End of year 2 $924,183 1,000,000 75,817 8% 10% 1,000,000 975,000 Classified as Trading: Journal Entry Account Debit Investment, trading debt security $924,183 Cash To record the purchase of a debt security classified as trading Credit $924,183 Classified as Trading Computation of Gain (Loss) at the End of Year 1 FMV $1,000,000 Original cost 924,183 Unrealized holding gain $75,817 Account Debit Securities Fair Value Adjustment, Trading $75,817 Unrealized holding gain, Income To recognized unrealized holding gain on debt security Credit $75,817 Classified as Trading Computation of Gain (Loss) at the End of Year 2 FMV $975,000 Original cost 924,183 Unrealized holding gain 50,817 Previously recognized holding gain 75,817 Unrealized holding loss ($25,000) Account Debit Unrealized holding loss, Income $25,000 Securities Fair Value Adjustment, Trading To recognized unrealized holding loss on debt security Credit $25,000 Classified as Available-for-sale Amortization Schedule Interest Interest Amortization Carrying Fair Value, Value End of Year Year Revenue received of Discount $924,183 1 $92,418 $80,000 $12,418 936,601 $1,000,000 2 93,660 80,000 13,660 950,261 975,000 Account Debit Investment, available-for-sale debt security $924,183 Cash To record the purchase of a debt security classified as available for sale Credit $924,183 Classified as Available-for-Sale Computation of Gain (Loss) at the End of Year 1 FMV $1,000,000 Carrying value 936,601 Unrealized holding gain $63,399 Account Securities Fair Value Adjustment, Available-for-Sale Unrealized holding gain, Equity To recognized unrealized holding gain on debt security Debit Credit $63,399 $63,399 Classified as Available-for-Sale Computation of Gain (Loss) at the End of Year 2 FMV $975,000 Original cost 950,261 Unrealized holding gain 24,739 Previously recognized holding gain 63,399 Unrealized holding loss ($38,660) Account Unrealized holding loss, Equity Securities Fair Value Adjustment, Available-for-Sale To recognized unrealized holding loss on debt security Debit $38,660 Credit $38,660 Classified as Held-to-Maturity No entry for fair value adjustment Fair value changes are not recognized at the balance sheet date Securities are reported at amortized cost Equity Securities Ownership interests Include rights to buy or sell ownership Extent of ownership determines accounting treatment for equity securities Degrees of Control 0% Little or None Ownership Percentage 20% 50% Significant Level of Influence 100% Control Available-for-Sale Less than 20% ownership interest Recorded at cost Valued and reported at fair value Dividends are recognized as income Unrealized holding gains and losses Part of comprehensive income A component of stockholders’ equity Trading Less than 20% ownership interest Recorded at cost Valued and reported at fair value Dividends are recognized as income Unrealized holding gains and losses Recognized in net income Equity Method Between 20% and 50% ownership interest Substantive economic relationship Investor’s carrying value Increased by proportionate share of earnings Decreased by Dividends, and Proportionate share of losses Consolidation More than 50% voting interest Investor is parent Investee is subsidiary Investor prepares consolidated financial statements Investor accounts for investment on its books using the equity method Investments In Equity Securities Ownership in Capital Stock < 20% voting 20-50% voting >50% voting Trading Available for Sale No Consolidation Consolidation Fair Value Fair Value Equity Method Equity Method Accounting by Category Category < 20% ownership Trading Available-for-Sale Valuation Unrealized Holding Gains and Losses Fair value Net income Fair value Dividends; gain or loss on sale Comprehensive income, Dividends; gain separate component of or loss on sale shareholders' equity 20% - 50% ownership Equity method Not recognized > 50% ownership Not recognized Consolidate Other Income Proportionate share of income or loss No applicable Transfers of Classifications UNREALIZED GAIN OR LOSS ON TRANSFER FROM TO Trading Available-for-sale None, already recognized in income Trading Held-to-maturity None, already recognized in income Available-for-sale Trading Include in current income Available-for-sale Held-to-maturity FV becomes amortized cost basis Held-to-maturity Trading Include in current income Held-to-maturity Available-for-sale Include in equity, other comprehensive income