Term project

advertisement

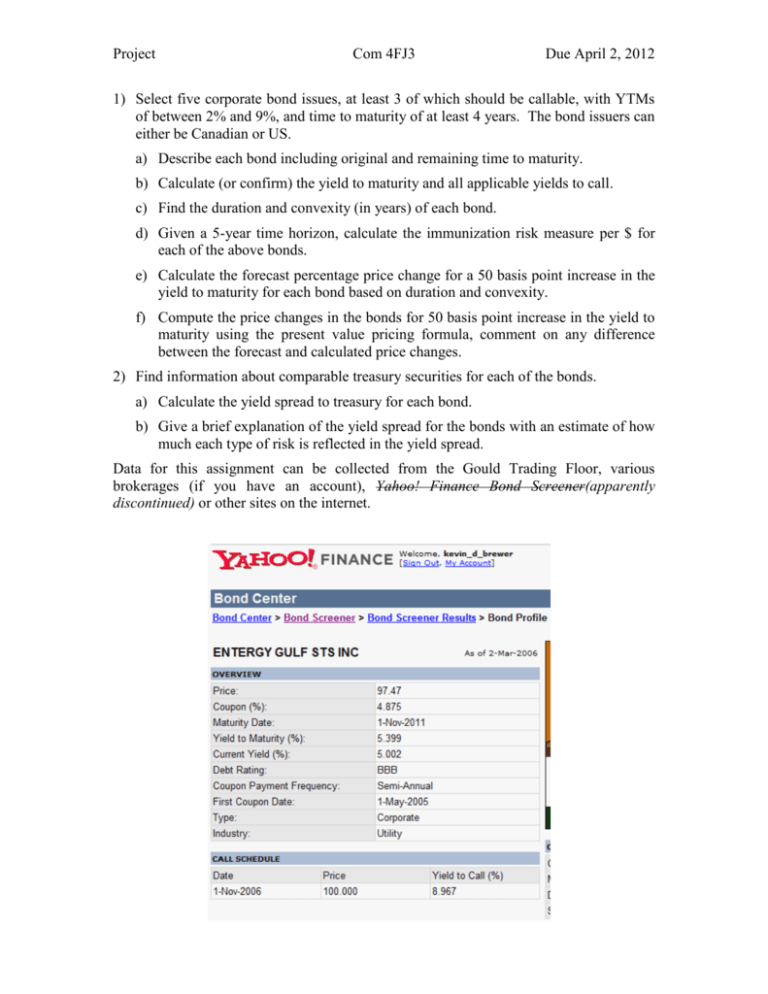

Project Com 4FJ3 Due April 2, 2012 1) Select five corporate bond issues, at least 3 of which should be callable, with YTMs of between 2% and 9%, and time to maturity of at least 4 years. The bond issuers can either be Canadian or US. a) Describe each bond including original and remaining time to maturity. b) Calculate (or confirm) the yield to maturity and all applicable yields to call. c) Find the duration and convexity (in years) of each bond. d) Given a 5-year time horizon, calculate the immunization risk measure per $ for each of the above bonds. e) Calculate the forecast percentage price change for a 50 basis point increase in the yield to maturity for each bond based on duration and convexity. f) Compute the price changes in the bonds for 50 basis point increase in the yield to maturity using the present value pricing formula, comment on any difference between the forecast and calculated price changes. 2) Find information about comparable treasury securities for each of the bonds. a) Calculate the yield spread to treasury for each bond. b) Give a brief explanation of the yield spread for the bonds with an estimate of how much each type of risk is reflected in the yield spread. Data for this assignment can be collected from the Gould Trading Floor, various brokerages (if you have an account), Yahoo! Finance Bond Screener(apparently discontinued) or other sites on the internet.