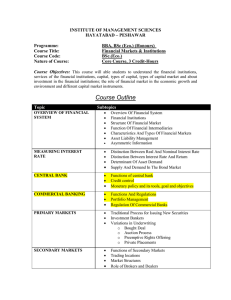

Economic and Financial Market Overview

advertisement

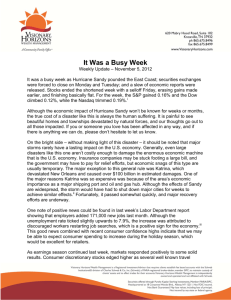

Economic and Financial Market Overview February 17, 2011 Equity Markets Index Total Returns: Other Markets Index Total Returns: Index DJIA S&P 500 Level 12318.14 1340.43 1 Month 4.50% 3.85% YTD 6.40% 6.86% One Year 19.40% 24.27% NASDAQ 2831.58 2.77% 6.74% 27.07% S&P 400 981.49 5.54% 8.35% 35.80% Russell 2000 834.02 3.35% 6.53% 34.96% MSCI EAFE 1753.83 4.33% 5.96% 20.28% MSCI Emg Mkt 1111.92 -3.56% -3.24% 20.45% Index Level US Dollar 78.00 Gold (oz.) 1385.10 Oil (barrel) 86.36 Commodity 341.27 S&P BMI REIT* 196.02 Agg. Bond 103.99 TIPS 107.53 1 Month 0.33% 1.77% -5.66% 2.47% 5.85% -0.55% -1.37% YTD -1.31% -2.65% -5.49% 2.55% 7.41% -0.43% -1.18% One Year -2.95% 23.51% 11.68% 24.20% 40.93% 4.53% 4.27% * Price only TOP-DOWN Viewpoint: 2009 Actuals The Known Economic Risks 2010 2011 Cons/Actual* Consensus* Bonds market balks at increased developed market sovereign debt. Real GDP -2.60% 2.90% 3.20% Operating Profit Growth -11.80% 30.50% 15.80% Commodity prices shoot higher. 1115 1257 1388 Treasury yields gap higher. CPI -0.30% 1.60% 1.90% Fed Funds Rate 0.25% 0.25% 0.25% Germany tests solvency of Euro. 10Y Treasury 3.84% 3.30% 3.96% China clamps down hard on growth. S&P 500 * consensus from Bloomberg monthly surveys of economists/analysts/strategists Current VIEWPOINT for Investors: 1. US economy officially moved from recovery to expansion during 2010, though unemployment is still too high and capacity utilization is still too low (…where the Fed is focused). • • US economic growth in the 3% range in 2011 – due to twin monetary & fiscal policy accommodation. Continued strong economic growth in Asia combined with expansion in North America is likely to result in upward pressure on commodity prices – which could act as a tax to the pace of economic growth. 2. Continuation of economic rebuilding should = continuation of investment portfolio rebuilding. 3. Stocks have potential for a double-digit return year; bond 30-year bull market recedes. • • • 4. Federal government continued ability to step back from economic & business influence during 2011 is a positive. • • 5. S&P 500 could have an above average return year on robust earnings growth – and – PE multiple expansion. Corporate balance sheets very healthy - allowing for robust M&A, dividend increases and stock buybacks. Fixed income markets likely to stay volatile, and should be approached with caution. Progression of business decoupling from Citigroup > GM > AIG > TARP > Fannie/Freddie important. Providing near-term fiscal stimulus with a longer-term deficit reduction framework should be a focus in 2011. Current portfolio themes: Incremental broad-based buying of stocks and commodities; selective buying of TIPS, preferred stocks, high yield corporate bonds and municipal bonds. Index performance is used to illustrate historical market trends and performance. Indexes are unmanaged and do not incur investment management fees. An investor is unable to invest in an index. Past performance is no guarantee of future results. The opinions expressed herein are those of Fifth Third Bank and may not actually come to pass. This information is current as of the date of this piece and is subject to change at any time, based on market and other conditions. Fifth Third Bancorp provides access to investments and investment services through various subsidiaries. Investments and investment services: Not FDIC Insured Offer No Bank Guarantee Not Insured By Any Federal Government Agency May Lose Value Not A Deposit Important Information Dow Jones Industrial Average: The most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. S&P 500® Index: Widely regarded as the best single gauge of the U.S. equities market, this world-renowned index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. NASDAQ Composite Index: Measures all NASDAQ domestic and non-U.S. based common stocks listed in the NASDAQ Stock Market. The index is market-value weighted and currently includes over 5,000 companies. The NASDAQ Composite Index is unmanaged and does not represent the performance of any particular investment. You cannot invest directly into the NASDAQ Composite Index. S&P® MidCap 400 Index: Consists of 400 domestic stocks chosen for market size, liquidity, and industry group representation. It is a market-weighted index, with each stock affecting the Index in proportion to its market value. The Lehman Brothers U.S. Aggregate Bond Index: An unmanaged index composed of investment-grade securities from the Lehman Brothers U.S. Government/Credit Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index. Treasury Inflation-Protected Securities (TIPS): TIPS provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. The Lehman High Yield Bond Index: An unmanaged index of performance that represents the market action of the high yield bond market. The index is generally representative of corporate bonds rated below investment-grade. U.S. Treasury Bills: Direct debt obligations issued and backed by the “full faith and credit” of the United States government (i.e. timely payment of principal and interest is guaranteed) and are issued with maturities of three months to six months in denominations beginning at $1,000. GDP (Gross Domestic Product): The total market value of all final goods and services produced in a country in a given year, equal to total consumer, investment and government spending, plus the value of exports, minus the value of imports. Treasury Bonds: Treasury bonds are debt instruments of the U.S. government issued in minimum denominations of $1,000. Considered to be long term investments, Treasury bonds have maturities of 10 years or longer. Treasury bonds carry the lowest degree of risk and are the benchmark against which all other types of bonds are measured. Although their market value fluctuates, they are considered to be the safest of bonds due to the fact that they are secured by the full faith and credit of the U.S. government. MSCI Emerging Markets Index Fund (EEM): The iShares MSCI Emerging Markets Index Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of publicly traded securities in emerging markets, as represented by the MSCI Emerging Markets Index. Russell 2000: The Russell 2000 Index measures the performance of the 2000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. MSCI EAFE (Europe, Australia and Far East): The MSCI EAFE index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes, and is widely accepted as a benchmark for international stock performance. The S&P® REIT: Tracks the performance of U.S. Real Estate Investment Trusts. The REIT Composite consists of 100 REIT’s chosen their liquidity and importance in representing a diversified real estate portfolio. Gold: Quoted as U.S. Dollars per Troy Ounce. The CRB/Reuters Futures Price Index: An equal-weighted geometric average of commodity price levels relative to the base year average price. 2