Accounting II Unit 3

advertisement

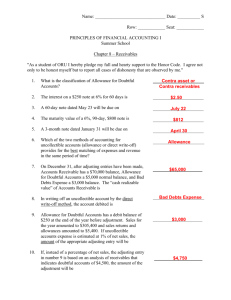

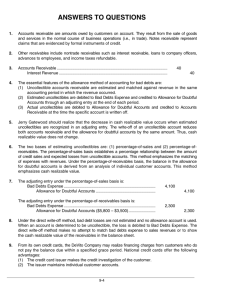

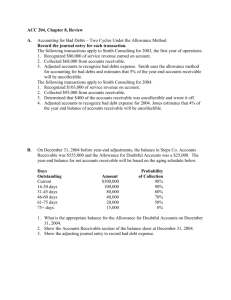

Accounting II Unit 3 Receivables 1 Classification of Receivables p398 The term receivables includes all money claims against other entities, including people, business firms, and other organizations. So Money Owed to Us! 2 Accounts Receivable Accounts receivable are normally expected to be collected within a relatively short period, such as 30 or 60 days. This normally does not include interest unless payment is late. 3 Notes Receivable Notes receivable are amounts that customers owe for which a formal, written instrument of credit has been issued. Now, this normally does include interest. 4 Uncollectible Receivables p399 There are two methods of accounting for receivables that appear to be uncollectible: the direct write off method and the allowance method. In my opinion, one method is easier but the other creates more accurate record keeping. 5 The direct write off method records bad debt expense only when an account is judged to be worthless. The allowance method records bad debt expense by estimating uncollectible accounts at the end of the accounting period. So which one is the easier one and which one is the more accurate record keeping option? 6 Example Exercise 9-1 (pg 400) Journalize the following transactions using the direct write-off method of accounting for uncollectible receivables. July 9 Received $1,200 from Jay Burke and wrote off the remainder owed of $3,900 as uncollectible. Oct. 11 Reinstated the account of Jay Burke and received $3,900 cash in full payment. 7 Example Exercise 9-1 (pg 400) July 9 Cash 1,200 Bad Debt Expense 3,900 Accounts Receivable—Jay Burke 5,100 Oct. 11 Accounts Receivable—Jay Burke Bad Debt Expense 3,900 3,900 11 Cash 3,900 Accounts Receivable—Jay Burke 3,900 8 Example Exercise 9-2 (pg 403) Journalize the following transactions using the allowance method of accounting for uncollectible receivables. July 9 Received $1,200 from Jay Burke and wrote off the remainder owed of $3,900 as uncollectible. Oct. 11 Reinstated the account of Jay Burke and received $3,900 cash in full payment. 9 Example Exercise 9-2 (pg 403) July 9 Cash Allowance for Doubtful Accounts Accounts Receivable—Jay Burke 1,200 3,900 Oct. 11 Accounts Receivable—Jay Burke Allowance for Doubtful Accounts 3,900 11 Cash Accounts Receivable—Jay Burke 3,900 5,100 3,900 3,900 10 Wait, you said one was more challenging? • If we look back at the two practice exercises that we just completed I see the same number of journal entries (pages 400 and 403). We just used the account Bad Debts Expense in one and Allowance for Doubtful Accounts in the other. Hang on, we are getting there – grin. 11 Estimating Uncollectibles p403 The allowance method uses two ways to estimate the amount debited to Bad Debt Expense. 1. Estimate based on a percentage of sales. 2. Estimate based on analysis of receivables. 12 First, a quick refresher. • What is the normal balance of our Accounts Receivable account? Debit or Credit? • What is the normal balance of our Allowance account? Debit or credit? • Does this make sense? The Allowance Balance would be subtracted from the A/R account. 13 Example Exercise 9-3 p405 • This exercise uses the Sales Method. • If we are going to base the amount that we don’t believe we will collect on sales then we need to keep adding to the allowance account for every new sale, right? I like to say that we ignore the prior balance in the allowance account with the sales method. 14 Example Exercise 9-3 (pg 405) At the end of the current year, Accounts Receivable has a balance of $800,000; Allowance for Doubtful Accounts has a credit balance of $7,500; and net sales for the year total $3,500,000. Bad debt expense is estimated at ½ of 1% of net sales. Determine (a) the amount of the adjusting entry for uncollectible accounts; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense; and (c) the net realizable value of accounts receivable. 15 Example Exercise 9-3 (pg 405) (a) $17,500 ($3,500,000 x .005) (b) Accounts Receivable Allowance for Doubtful Accounts ($7,500 + $17,500) Bad Debt Expense Adjusted Balance $800,000 25,000 17,500 (c) $775,000 ($800,000 – $25,000) 16 Estimating Uncollectibles Based on Analysis of Receivables p405 The longer an account receivable is outstanding, the less likely that it will be collected. Basing the estimate of uncollectible accounts on how long specific amounts have been outstanding is called aging the receivables. 17 Example Exercise 9-4 p407 • This exercise uses an analysis of our accounts receivables. • If we are going to base the amount that we don’t believe we will collect on receivables then we need to match the balance in the allowance account to the figure that we recalculate every time we make this analysis, right? I like to say that we have to consider the prior balance in the allowance account with the receivables method. 18 Example Exercise 9-4 (pg 407) At the end of the current year, Accounts Receivable has a balance of $800,000; Allowance for Doubtful Accounts has a credit balance of $7,500; and net sales for the year total $3,500,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $30,000. Determine (a) the amount of the adjusting entry for uncollectible accounts; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense, and (c) the net realizable value of accounts receivable. 19 Example Exercise 9-4 (pg 407) (a) $22,500 ($30,000 – $7,500) Keep in mind that we only want a total of $30,000 in the account, right? We already have the $7500 so we just need to add the difference. Adjusted Balance (b) Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense $800,000 30,000 22,500 (c) $770,000 ($800,000 – $30,000) 20 Characteristics of Notes Receivable p410 A note receivable, or promissory note, is a written document containing a promise to pay: • a specific amount of money (face amount) • on demand or at a definite time • to an individual or a business (payee), or to the bearer or holder of the note. 21 Interest on the Note • How do we figure out the date it is due? • Knuckle Trick… • Don’t count the day the note is written but you do count the day it is paid back. So no interest on the day you get the money, but you have to pay interest on the day you pay it back. 22 Example Exercise 9-5 p 413 Same day Surgery Center Received a 120 day, 6% note for $40,000, dated March 14 from a patient on account. a. Determine the due date of the note. b. Determine the maturity of the note. c. Journalize the entry to record the receipt of the payment of the note at maturity. A. Let’s start with the knuckle trick, how many days in the month of March? 31? So since we don’t count the day we get the note we can subtract 14 days from the 31 days in the month, right? From there we just keep adding months until we come up with 120 days. Keep in mind that the due date never lands on the end of a month 23 Example Exercise 9-5 • a. What did you get? I came up with July 12th. • March 17 days, April 30 days, May 31 days, June 30 days and July 31 but that took me over. So I added everything but July to get: 17 + 30 + 31 + 30 = 108 Then I subtracted the 108 from the number of days that I needed: 120-108 = 12 Giving me July 12! 24 Example Exercise 9-5 b. • Maturity Value is the amount that is due at maturity or the due date. So we need the face of the note plus the interest in this case. Interest is Principle X Rate X Time (PRT) $40,000 X 6% (.06) X 120/360 (divide by 360 and multiple by 120). Don’t forget to add that back to the face!! 25 Part C, The JE July 12 Cash 40,800 Note Receivable 40,000 Interest Revenue 800 The credit to the note wipes out that debt. 26 Questions? Does anyone have any questions? Your textbook exercises for this week are: PR 9-2A – complete PR 9-2B first PR 9-5A – complete PR 9-5B first 27