Set 12 - Matt Will

advertisement

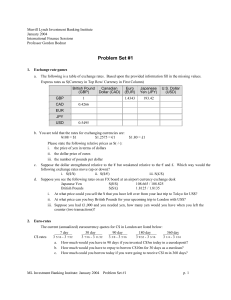

CORPORATE FINANCIAL THEORY Lecture 12 International Finance Today Capital Budgeting (international style) Financing (international style) Topics Exchange rates Currency risk Managing Currency Risk Capital Budgeting w/ currency risk Financing w/currency risk Foreign Exchange Markets Exchange Rate - Amount of one currency needed to purchase one unit of another. Spot Rate The price of a currency for immediate delivery (i.e. today’s exchange rate) Forward Rate The price of a currency on a specified future date (i.e. a forward contract in which the exercise price is the exchange rate) Futures - Same as forward (w/secondary markets) Options - on exchange rates & Future Ks Exchange Rates Forward Rate * Spot Rate * 1 Month 3 Months 1 Year Europe EMU (euro) Norway (krone) Sweden (krona) Switzerland (franc) United Kingdom (pound) Americas: Canada (dollar) Mexico (peso) Pacific/ Africa: Hong Kong (dollar) Japan (yen) South Africa (rand) South Korea (won) 1.3549 5.9566 6.8028 1.213 1.9901 1.3565 5.9514 6.7915 1.2099 1.99 1.3595 5.9436 6.7705 1.2038 1.9892 1.3689 5.9377 6.7041 1.1812 1.9811 1.1309 10.9892 1.1298 11.0055 1.1278 11.0408 1.1208 11.2274 7.8129 1119.795 7.0942 903.55 7.8071 119.33 7.116 929.85 7.7916 118.397 7.162 928.45 7.7429 114.571 7.3807 923.65 Foreign Exchange Markets Forward Premiums and Forward Discounts Example - The Peso spot price is 10.9892 peso per dollar and the 3 month forward rate is 11.0408 Peso per dollar, what is the premium and discount relationship? Spot Price T - 1 = Premium or (-Discount ) Forward Price 10.9892 4 - 1 = -1.90% 11.0408 Foreign Exchange Markets Forward Premiums and Forward Discounts Example - The Peso spot price is 10.9892 peso per dollar and the 3 month forward rate is 11.0408 Peso per dollar, what is the premium and discount relationship? Answer - The dollar is selling at a 1.90% premium, relative to the peso. The peso is selling at a 1.90% discount, relative to the dollar. Exchange Rates Example Swiss franc spot price is SF 1.4457 per $1 Swiss franc 6 mt forward price is SF1.4282 per $1 The franc is selling at a Forward Premium The Dollar is selling at a Forward Discount This means that the market expects the dollar to get weaker, relative to the franc Example (premium? discount?) The Japanese Yen spot price is 101.18 per $1 The Japanese 6mt fwd price is 103.52 per $1 Exchange Rates Example What is the franc premium (annualized)? Example What is the Yen discount (annualized)? Exchange Rate Relationships Basic Relationships 1 + rforeign 1 + r$ 1 + i foreign equals equals equals E(sforeign / $) f foreign / $ S foreign / $ 1 + i$ equals S foreign / $ Exchange Rate Relationships 1) Interest Rate Parity Theory 1 + rforeign 1 + r$ = f foreign / $ S foreign / $ The ratio between the risk free interest rates in two different countries is equal to the ratio between the forward and spot exchange rates. Exchange Rate Relationships Example - You have the opportunity to invest $1,000,000 for one year. All other things being equal, you have the opportunity to obtain a 1 year Mexican bond (in peso) @ 7.35 % or a 1 year US bond (in dollars) @ 5.05%. The spot rate is 10.9892 peso:$1 The 1 year forward rate is 11.2274 peso:$1 Which bond will you prefer and why? Ignore transaction costs Exchange Rate Relationships Example - You have the opportunity to invest $1,000,000 for one year. All other things being equal, you have the opportunity to obtain a 1 year Mexican bond (in peso) @ 7.35 % or a 1 year US bond (in dollars) @ 5.05%. The spot rate is 10.9892 peso:$1 The 1 year forward rate is 11.2274 peso:$1 Which bond will you prefer and why? Ignore transaction costs Value of US bond = $1,000,000 x 1.0505 = $1,050,500 Value of Mexican bond = $1,000,000 x 10.9892 = 10,989,200 peso exchange 10,989,200 peso x 1.0735 = 11,796,906 peso bond pmt 11,796,906 peso / 11.2274= $1,050,725 exchange Exchange Rate Relationships 2) Expectations Theory of Exchange Rates f foreign / $ S foreign / $ = E(sforeign / $) S foreign / $ Theory that the expected spot exchange rate equals the forward rate. Exchange Rate Relationships 3) Purchasing Power Parity 1 + i foreign 1 + i$ = E(sforeign / $) S foreign / $ The expected change in the spot rate equals the expected difference in inflation between the two countries. Exchange Rate Relationships Example - If inflation in the US is forecasted at 2.5% this year and Mexico is forecasted at 4.7%, what do we know about the expected spot rate? Given a spot rate of 10.9892 peso:$1 1 + i foreign 1 + i$ = E(sforeign/$) S foreign/$ 1 .047 E(sforeign/$ ) = 1 + .025 10.9892 solve for Es Es = 11.2251 Exchange Rate Relationships 4) International Fisher effect 1 + rforeign 1 + r$ = 1 + i foreign 1 + i$ The expected difference in inflation rates equals the difference in current interest rates. Also called common real interest rates Exchange Rate Relationships Example - The real interest rate in each country is about the same r (real ) 1 + rforeign 1 + i foreign 1.0735 = - 1 = .025 1.047 1 + r$ 1.0505 r (real ) = - 1 = .025 1 + i $ 1.025 Exchange Rates Another Example You are doing a project in Switzerland which has an initial cost of $100,000. All other things being equal, you have the opportunity to obtain a 1 year Swiss loan (in francs) @ 8.0% or a 1 year US loan (in dollars) @ 10%. The spot rate is 1.4457sf:$1 The 1 year forward rate is 1.4194sf:$1 Which loan will you prefer and why? Ignore transaction costs Cost of US loan = $100,000 x 1.10 = $110,000 Cost of Swiss Loan = $100,000 x 1.4457 = 144,570 sf 144,570 sf x 1.08 = 156,135 sf 156,135 sf / 1.4194 = $110,000 If the two loans created a different result, arbitrage exists! exchange loan pmt exchange Exchange Rates Swiss Example Given a spot rate of sf:$ 1.4457:$1 Given a 1yr fwd rate of 1.4194:$1 If inflation in the US is forecasted at 4.5% this year, what do we know about the forecasted inflation rate in Switzerland? 𝐸 𝑆𝑓 $ 𝐸(1 + 𝑖𝑓 ) = 𝑆𝑓 $ 𝐸(1 + 𝑖$ ) (1 + 𝑖𝑓 ) 1.4194 = 1.4457 1 + .045 Solve for 𝑖𝑓 𝑖𝑓 =.026 or 2.6% Exchange Rates Swiss Example In the previous examples, show the equilibrium of interest rates and inflation rates 1 + 𝑟𝑓 1.08 = = .9818 1 + 𝑟$ 1.10 𝐸(1 + 𝑖𝑓 ) 1.026 = = .9818 𝐸(1 + 𝑖$ ) 1.045 Currency Risk Example Your US company is building a plant in Switzerland. Your cost will be 2,000,000 sf, with full payment due in 6 months. You are concerned about currency risk. The spot rate is 1.4397sf:$1 and the 6 mt forward rate is 1.4350sf:$1. How can you eliminate the currency risk? How does this help in evaluating the project? Currency Risk Example Your US company is building a plant in Switzerland. Your cost will be 2,000,000 sf, with full payment due in 6 months. You are concerned about currency risk. The spot rate is 1.4397sf:$1 and the 6 mt forward rate is 1.4350sf:$1. How can you eliminate the currency risk? How does this help in evaluating the project? •Since you are short in Swiss Francs, you should long sf contracts •2,000,000sf / 1.4350 = $1,393,728 worth of 6mt sf Ks. •This will lock in your Co cash flow at $1,393,728 •The forward premium paid is 0.33% (using capital market equilibrium, this premium probably equals the inflation rate. Exchange Rates Applications Q: What does it mean to a business if the dollar is trading at a forward premium? A: Stronger purchasing power Exchange Rate Risk Currency Risk can be reduced by using various financial instruments Currency forward contracts, futures contracts, and even options on these contracts are available to control the risk Capital Budgeting Techniques 1) Exchange to $ and analyze 2) Discount using foreign cash flows and interest rates, then exchange to $. Option 1 preferred because discount rates in US are more reliable. Example Outland Corporation is building a plant in Holland to produce reindeer repellant to sell in that country. The plant is expected to produce a cash flow (in guilders ,000s) as follows. The US risk free rate is 8%, the Dutch rate is 9%. US inflation is forecasted at 5% per year and the current spot rate is 2.0g:$1. year 1 2 3 4 5 400 450 510 575 650 Q: What are the 1, 2, 3, 4, 5 year forward rates? A: 𝐸 𝑆𝑓 𝐸 𝑆𝑓 $ 𝐸(1 + 𝑟𝑓 )𝑡 = 𝑆𝑓 $ 𝐸(1 + 𝑟$ )𝑡 $ 2.02 2.04 2.06 𝐸 𝑆𝑓 $ (1 + .09)𝑡 = 2.0 (1 + .08)𝑡 2.08 2.10 Example Outland Corporation is building a plant in Holland to produce reindeer repellant to sell in that country. The plant is expected to produce a cash flow (in guilders ,000s) as follows. The US risk free rate is 8%, the Dutch rate is 9%. US inflation is forecasted at 5% per year and the current spot rate is 2.0g:$1. year 1 2 3 4 5 400 450 510 575 650 Q: Convert the CF to $ using the forward rates. 1 2 3 4 5 CFg 400 450 510 575 650 E(S) 2.02 2.04 2.06 2.08 2.10 CF$ 198 221 248 276 310 Political Risk Political Risk Trade Policy Exchange Rate Risk Example - Honda builds a new car in Japan for a cost + profit of 1,715,000 yen. At an exchange rate of 120.700Y:$1 the car sells for $14,209 in Indianapolis. If the dollar rises in value, against the yen, to an exchange rate of 134Y:$1, what will be the price of the car? 1,715,000 = $12,799 134 Conversely, if the yen is trading at a forward discount, Japan will experience a decrease in purchasing power. Exchange Rate Risk Example - Harley Davidson builds a motorcycle for a cost plus profit of $12,000. At an exchange rate of 120.700Y:$1, the motorcycle sells for 1,448,400 yen in Japan. If the dollar rises in value and the exchange rate is 134Y:$1, what will the motorcycle cost in Japan? $12,000 x 134 = 1,608,000 yen Trade Policy Employment Conventional wisdom We are losing all of our jobs to Mexico, China, and India? FALSE Employment Trend Unemployment Rate Population % of Work Force 12 10 8 2007 = 301 mil 6 1970 = 203 mil 4 2 Source: Bureau of Labor Statistics 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 0 Employment & Foreign Trade Population 2007 = 301 mil 1970 = 203 mil Source: Bureau of Labor Statistics Employed UIndy Nightly News News Alert on the unemployment report released today by the Department of Labor. PR - News Releases “Last month the unemployment rate in the United States increased slightly from 4.6% to 4.7%. White House officials were quick to point out that at the same time the U.S. economy added 141,000 new jobs.” “Last month 322,000 manufacturing jobs were lost. Union leaders site cheap overseas labor costs as the culprit, saying that good jobs are leaving the US and the economy will suffer.” Behind The Numbers September 2007 Unemployment = 4.7% Jobs added Jobs lost Net change Source: Bureau of Labor Statistics 463,000 322,000 +141,000 Behind The Numbers Totals for 2006 Unemployment = 4.6% Jobs added Jobs lost Net change Source: Bureau of Labor Statistics 2,697,000 625,000 +2,072,000 Comparative Advantage Wants Needs Comparative Advantage Wants Needs Comparative Advantage Wants Needs Employment But are they better paying jobs? Wages & Inflation % Change (year over year) 8 Actual Wage Increase 7 Inflation Rate 6 5 4 3 2 1 Source: Bureau of Labor Statistics Sep-07 Aug-07 Jul-07 Jun-07 May-07 Apr-07 Mar-07 Feb-07 Jan-07 Dec-06 Nov-06 Oct-06 Sep-06 0 Employment $20.00 $18.00 $16.00 $14.00 $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00 1964 1966 1968 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 Average Hourly Earnings Source: Bureau of Labor Statistics Foreign Trade Conventional wisdom We have huge trade deficits with other countries. These large trade deficits are destroying our economy. FALSE Foreign Trade US vs. Japan Trade Deficit Cumulative Deficit $bil (1985 base) 1,600 1,400 1,200 1,000 800 600 400 Source: US Census Bureau 2007 2005 2003 2001 1999 1997 1995 1993 1991 1989 1987 - 1985 200 Trade Deficit and Economic Strength Stock Market Values U.S. Stock Index Source: S&P & Nikkei Jan-07 Jan-05 Jan-03 Jan-01 Jan-99 Jan-97 Jan-95 Jan-93 Jan-91 Jan-89 Jan-87 Jan-85 Value (base 100) Japan Stock Index Foreign Trade Why does this work? Stuff China Cash Wall Street & (Indiana) Wall Street invests this money, which… 1. creates more jobs, which… 2. grows the economy, which… 3. strengthens the dollars, which… 4. starts the cycle again KEY Strong Dollar What We Know Net Present Value Capital Asset Pricing Model (CAPM) Efficient Capital markets Value Additivity & Conservation Option Theory Agency Theory What We Do Not Know How major decisions are made What determines the risk & PV ? CAPM shortfalls Why are some markets inefficient? Is management a liability? What We Do Not Know Why do IPOs succeed & new markets emerge? Why is capital structure not optimized? Dividend policy - Answer? Liquidity value? Why do mergers come in waves? Review for Final In normal class room Topics Format Difficulty Bonus Points