Chapter 27

Principles of

Corporate Finance

Tenth Edition

Managing

International Risks

Slides by

Matthew Will

McGraw-Hill/Irwin

Copyright © 2011 by the McGraw-Hill Companies, Inc. All rights reserved.

Topics Covered

The Foreign Exchange Market

Some Basic Relationships

Hedging Currency Risk

Exchange Risk and International Investment

Decisions

Political Risk

27-2

27-3

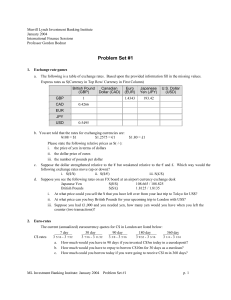

Exchange Rates

July 24, 2009

Forward Rate *

Spot Rate * 1 Month 3 Months 1 Year

Europe

EMU (euro)

Norway (krone)

Sweden (krona)

Switzerland (franc)

United Kingdom (pound)

Americas:

Canada (dollar)

Mexico (peso)

Pacific/ Africa:

Hong Kong (dollar)

Japan (yen)

South Africa (rand)

South Korea (won)

1.4201

6.2452

7.4533

1.0723

1.6414

1.4201

6.2502

7.4523

1.0719

1.6413

1.42

6.2603

7.4502

1.0711

1.6411

1.4207

6.3007

7.4313

1.0643

1.6396

1.0808

13.2155

1.0807

13.2705

1.0804

13.3805

1.0801

13.8891

7.7501

94.705

7.784

1249.55

7.748

94.678

7.833

1249.1

7.7437

94.6161

7.9263

1247.65

7.7311

94.087

8.3283

1241.05

Foreign Exchange Markets

Exchange Rate - Amount of one currency needed

to purchase one unit of another.

Spot Rate of Exchange - Exchange rate for an

immediate transaction.

Forward Exchange Rate - Exchange rate for a

forward transaction.

27-4

Foreign Exchange Markets

Forward Premiums and Forward Discounts

Example - The Peso spot price is 13.2155 peso per

dollar and the 3 month forward rate is 13.3805 Peso

per dollar, what is the premium and discount

relationship?

27-5

Foreign Exchange Markets

Forward Premiums and Forward Discounts

Example - The Peso spot price is 13.2155 peso per

dollar and the 3 month forward rate is 13.3805 Peso

per dollar, what is the premium and discount

relationship?

Spot Price

T

- 1 = Premium or (-Discount )

Forward Price

4

13.2155

- 1 = -1.20%

13.3805

27-6

Foreign Exchange Markets

Forward Premiums and Forward Discounts

Example - The Peso spot price is 13.2155 peso per dollar and

the 3 month forward rate is 13.3805 Peso per dollar, what

is the premium and discount relationship?

Answer - The dollar is selling at a 1.20% premium, relative

to the peso. The peso is selling at a 1.20% discount,

relative to the dollar.

27-7

Exchange Rates

Example

Swiss franc spot price is SF 1.0723 per $1

Swiss franc 1 yr forward price is SF 1.0643 per $1

The franc is selling at a Forward Premium

The Dollar is selling at a Forward Discount

This means that the market expects the dollar to get weaker,

relative to the franc

Example (premium? discount?)

The Japanese Yen spot price is 94.705 per $1

The Japanese 1 yr fwd price is 94.087 per $1

27-8

Exchange Rates

Example

What is the franc premium (annualized)?

Spot Price

T

- 1 = Premium or (-Discount )

Forward Price

1.0723

1

- 1 = 0.75%

1.0643

Example

What is the Yen discount (annualized)?

T

Spot Price

- 1 = Premium or (-Discount )

Forward Price

94.705

1

- 1 = 0.66%

94.087

27-9

Exchange Rate Relationships

Basic Relationships

1 + rforeign

1 + r$

1 + i foreign

equals

equals

equals

E(sforeign / $)

f foreign / $

S foreign / $

1 + i$

equals

S foreign / $

27-10

Exchange Rate Relationships

1) Interest Rate Parity Theory

1 + rforeign

1 + r$

=

f foreign / $

S foreign / $

The ratio between the risk free interest rates in two

different countries is equal to the ratio between the

forward and spot exchange rates.

27-11

Exchange Rate Relationships

Example - You have the opportunity to invest

$1,000,000 for one year. All other things being

equal, you have the opportunity to obtain a 1 year

Mexican bond (in peso) @ 6.67 % or a 1 year US

bond (in dollars) @ 1.505%. The spot rate is

13.2155 peso:$1 The 1 year forward rate is 13.8891

peso:$1

Which bond will you prefer and why?

Ignore transaction costs

27-12

Exchange Rate Relationships

27-13

Example - You have the opportunity to invest $1,000,000 for one year. All

other things being equal, you have the opportunity to obtain a 1 year Mexican

bond (in peso) @ 6.67 % or a 1 year US bond (in dollars) @ 1.505%. The

spot rate is 13.2155 peso:$1 The 1 year forward rate is 13.8891 peso:$1.

Which bond will you prefer and why? Ignore transaction costs

Value of US bond = $1,000,000 x 1.0150 = $1,015,000

Value of Mexican bond = $1,000,000 x 13.2155 = 13,215,500 peso exchange

13,215,500 peso x 1.0667 = 14,096,974 peso

bond pmt

14,096,974 peso / 13.8891= $1,014,967

exchange

Exchange Rate Relationships

2) Expectations Theory of Exchange Rates

f foreign / $

S foreign / $

=

E(sforeign / $)

S foreign / $

Theory that the expected spot exchange rate equals

the forward rate.

27-14

Exchange Rate Relationships

3) Purchasing Power Parity

1 + i foreign

1 + i$

=

E(sforeign / $)

S foreign / $

The expected change in the spot rate equals the

expected difference in inflation between the two

countries.

27-15

Exchange Rate Relationships

Example - If inflation in the US is forecasted at

1.0% this year and Mexico is forecasted at 6.0%,

what do we know about the expected spot rate?

Given a spot rate of 13.2155 peso:$1

1 + i foreign

1 + i$

=

E(sforeign/$)

S foreign/$

1 .060 E(sforeign/$ )

=

1 + .010

13.2155

solve for Es

Es = 13.87

27-16

Exchange Rate Relationships

4) International Fisher effect

1 + rforeign

1 + r$

=

1 + i foreign

1 + i$

The expected difference in inflation rates equals the

difference in current interest rates.

Also called common real interest rates

27-17

Exchange Rate Relationships

Example - The real interest rate in each country is

about the same

r (real )

1 + rforeign

1 + i foreign

1.0667

=

- 1 = .006

1.060

1 + r$ 1.015

r (real )

=

- 1 = .005

1 + i $ 1.010

27-18

Exchange Rates

Another Example

You are doing a project in Switzerland which has an initial cost of $100,000.

All other things being equal, you have the opportunity to obtain a 1 year

Swiss loan (in francs) @ 6.0% or a 1 year US loan (in dollars) @ 6.8%. The

spot rate is 1.0723 sf:$1 The 1 year forward rate is 1.0643 sf:$1

Which loan will you prefer and why? Ignore transaction costs

Cost of US loan = $100,000 x 1.068 = $106,800

Cost of Swiss Loan = $100,000 x 1.0723 = 107,230 sf

exchange

107,230 sf x 1.06 = 113,664 sf

loan pmt

113,664 sf / 1.0643 = $106,797

If the two loans created a different result, arbitrage exists!

exchange

27-19

Exchange Rates

% Forecast Error in Forward Rate for Swiss Francs

40.0%

30.0%

20.0%

10.0%

0.0%

-10.0%

-20.0%

-30.0%

-40.0%

-50.0%

Source: Global Financial Data

27-20

27-21

International Prices

The Big Mac Index – The price of a Big Mac in

different countries (July 16, 2009)

Country

Canada

China

Denmark

Euro area

Japan

Mexico

Local Price Converted

to U.S. Dollars

Country

Local Price Converted

to U.S. Dollars

3.35

1.83

5.53

4.62

3.46

2.39

Philippines

Russia

South Africa

Switzerland

United Kingdom

United States

2.05

2.04

2.17

5.98

3.69

3.57

27-22

Purchasing Power & Exchange Rates

25.00

Relative change in exchange rate, %

20.00

15.00

10.00

5.00

0.00

-5.00

-10.00

-15.00

Turkey

-25.00

USA

-20.00

-20.00

-15.00

-10.00

-5.00

-25.00

0.00

5.00

10.00

Relative change in purchasing power, %

15.00

20.00

25.00

Exchange Rates

Nominal versus Real Exchange Rates

U.S. Dollar /

UK (in log

scale)

27-23

Exchange Rates

Nominal versus Real Exchange Rates

U.S. Dollar /

France (in log

scale)

27-24

Exchange Rates

Nominal versus Real Exchange Rates

U.S. Dollar /

Italy (in log

scale)

27-25

Interest Rates and Inflation

Countries with the highest interest rates generally have the highest

inflation rates. In this diagram each of the 55 points represents a

different country.

Average money

market rate, %,

2000-08

40

35

30

25

Turkey

20

15

10

5

0

-5

Japan

-5

-10

0

5

10

15

20

Average inflation rate, %, 2000-08

25

30

27-26

Auto Industry Data 2003

Home Country

Europe

North America

Japan

Other

Panel A: Sales %

Ford

GM

Hyundai

Honda

Isuzu

Mazda

Mitsubishi

Nissan

Suzuki

Toyota

Fiat

BMW

DaimlerChrysler

Volkswagen

Peugeot

Renault

United States

United States

South Korea

Japan

Japan

Japan

Japan

Japan

Japan

Japan

Italy

Germany

Germany

Germany

France

France

30.30%

20.2

17.5

7.5

1.8

23.5

14.5

18.8

14.2

13.2

80.1

64.6

28.4

62.9

92.8

90.6

62.30%

67.6

31.1

54.8

14

34.6

22.8

40.2

4.5

32.8

0

30.6

68.4

13.4

0.5

0.8

0.00%

0

0

25.6

27.8

29.7

37.1

31.5

41.9

36.8

0

0

0

0

0

0

7.40%

12.2

51.4

12.1

56.4

12.2

25.7

9.5

39.4

17.2

19.8

4.9

3.2

23.7

6.7

8.6

Panel B: Production %

Ford

GM

Hyundai

Honda

Isuzu

Mazda

Mitsubishi

Nissan

Suzuki

Toyota

Fiat

BMW

DaimlerChrysler

Volkswagen

Peugeot

Renault

United States

United States

South Korea

Japan

Japan

Japan

Japan

Japan

Japan

Japan

Italy

Germany

Germany

Germany

France

France

35.20%

24.2

1.3

6.7

1

0

6

15.3

6.7

6.9

79.4

80.3

34.6

68.1

94.3

95.7

56.10%

64.5

0

43.2

7.2

16.9

10.7

27.8

0.5

18.8

0

14.8

63

5.8

0

0.8

0.00%

0

0

40.2

56.2

80.2

64.6

51.5

59.3

62.6

0

0

0

0

0

0

8.70%

11.3

98.7

9.9

35.6

2.9

18.6

5.4

33.5

11.6

20.6

4.9

2.4

26.1

5.7

3.6

27-27

Exchange Rate Risk

Example - Honda builds a new car in Japan for a cost +

profit of 1,715,000 yen. At an exchange rate of 94.705Y:$1

the car sells for $14,209 in Indianapolis. If the dollar rises

in value, against the yen, to an exchange rate of 134Y:$1,

what will be the price of the car?

1,715,000 = $18,109

94.705

Conversely, if the yen is trading at a

forward discount, Japan will

experience a decrease in purchasing

power.

27-28

Exchange Rate Risk

Example - Harley Davidson builds a motorcycle for a

cost plus profit of $12,000. At an exchange rate of

94.705Y:$1, the motorcycle sells for 1,136,460 yen in

Japan. If the dollar rises in value and the exchange rate is

103Y:$1, what will the motorcycle cost in Japan?

$12,000 x 103 = 1,236,000 yen

27-29

Exchange Rate Risk

Currency Risk can be reduced by using

various financial instruments

Currency forward contracts, futures

contracts, and even options on these

contracts are available to control the risk

27-30

Capital Budgeting

Techniques

1) Exchange to $ and analyze

2) Discount using foreign cash flows and

interest rates, then exchange to $.

3) Choose a currency standard ($) and

hedge all non dollar CF.

27-31

27-32

Example

Suppose that the Swiss pharmaceutical company, Roche, is evaluating

a proposal to build a new plant in the United States. To calculate the

project’s net present value, Roche forecasts the following dollar cash

flows from the project. The US cost of capital is 12% and the spot

exchange rate is 1.2sf / 1 $ . What is the project value in US dollars and

Swiss francs?

year

0

1

2

3

4

5

-1300

400

450

510

575

650

NPV ($) = $ 513 million

NPV (sf) = $513 x 1.2 (sf/$) = 616 sf million

27-33

Example

Suppose that the Swiss pharmaceutical company, Roche, is evaluating

a proposal to build a new plant in the United States. To calculate the

project’s net present value, Roche forecasts the following dollar cash

flows from the project. The US cost of capital is 12% and the spot

exchange rate is 1.2sf / 1 $ . What are the forward rates in each year, if

risk free rates are US = 6% and Swiss = 4%?

year

A:

0

1

2

3

4

5

-1300

400

450

510

575

650

(Ff/$) = ( 1 + rf )t solve for Ff/$

( 1 + r$ )t

Sf/$

year

Ff/$

0

1.2

1

2

3

4

5

1.177

1.155

1.133

1.112

1.091

27-34

Example

Suppose that the Swiss pharmaceutical company, Roche, is evaluating

a proposal to build a new plant in the United States. To calculate the

project’s net present value, Roche forecasts the following dollar cash

flows from the project. The US cost of capital is 12% and the spot

exchange rate is 1.2sf / 1 $ . What are the cash flows in each year,

given the forward rates?

year

0

1

2

3

4

5

-1300

400

450

510

575

650

1

2

3

4

5

A: CFf = (Ff/$) x CF$

year

0

CF$

-1300

400

450

510

575

650

Ff/$

1.2

1.177

1.155

1.133

1.112

1.091

CFf

-1560

471

520

578

639

709

Example

Suppose that the Swiss pharmaceutical company, Roche, is evaluating

a proposal to build a new plant in the United States. To calculate the

project’s net present value, Roche forecasts the following dollar cash

flows from the project. The US cost of capital is 12% and the spot

exchange rate is 1.2sf / 1 $ . What is the NPV of the project in Swiss

francs?

A:

1+ franc return = ( 1 + rf ) solve for Franc return

1+dollar return

Franc return = 9.9%

NPV (sf) = 616 sf

( 1 + r$ )

27-35

27-36

Political Risk

A

Maximium

12

Finland

9.5

Sweden

7.5

Switzerland

9.0

Australia

10.0

Germany

10.0

Singapore

11.0

United Kingdom 8.0

France

9.5

Japan

6.5

United States

6.0

China, Peoples' Rep.

11.0

Russian Federation.

11.5

Brazil

8.5

Turkey

9.0

India

6.0

Pakistan

4.0

Somalia

5.5

B

12

9.5

9.0

10.5

10.5

8.0

9.5

9.5

8.0

8.0

8.0

9.0

7.0

6.0

6.5

5.5

5.0

0.0

A = Govt stability

B = Socioeonmic conditions

C = Investment profile

D = Internal conflict

E = External conflict

F = Corruption

C

12

12.0

12.0

12.0

12.0

12.0

12.0

12.0

12.0

11.5

12.0

7.0

9.5

7.5

8.0

8.5

7.5

2.0

D

12

11.0

11.5

12.0

10.0

11.0

10.5

9.5

10.0

10.5

10.0

10.0

8.0

10.0

8.0

6.5

5.5

4.0

E

12

11.5

11.0

11.0

9.5

10.5

10.5

7.0

10.0

9.5

7.0

10.0

8.5

10.5

7.5

10.0

8.5

4.0

F

G

6

6.0

5.0

4.5

4.5

5.0

4.5

4.0

5.0

3.0

4.0

2.5

2.0

2.0

2.5

2.5

2.0

1.0

G = Military in politics

H = Religious tensions

I = Law and order

J = Ethnic tensions

K = Democratic accountability

L = Bureaucracy quality

H

6

6.0

5.5

6.0

6.0

6.0

5.0

6.0

5.5

5.0

4.0

3.0

4.5

4.0

2.0

4.0

1.0

1.0

I

6

6.0

6.0

4.5

6.0

5.0

4.5

6.0

4.0

5.5

5.5

5.0

5.5

6.0

4.5

2.5

1.0

3.0

J

6

6.0

6.0

5.0

5.5

5.0

5.0

5.5

5.0

5.0

5.0

4.5

4.0

2.0

4.5

4.0

3.0

0.5

K

6

6.0

5.0

4.0

4.0

4.0

6.0

4.0

2.5

5.5

5.0

4.5

3.0

3.0

2.5

2.5

1.0

2.0

as of January 2008

L

6

6.0

6.0

6.0

6.0

6.0

2.0

6.0

6.0

5.0

6.0

1.5

2.5

5.0

5.0

6.0

1.0

1.0

Total

4

4.0

4.0

4.0

4.0

4.0

4.0

4.0

3.0

4.0

4.0

2.0

1.0

2.0

2.0

3.0

2.0

0.0

100

93.5

88.5

88.5

88.0

86.5

84.5

81.5

80.5

79.0

76.5

70.0

67.0

66.5

62.0

61.0

41.5

24.0

Web Resources

Click to access web sites

Internet connection required

www.oecd.org

www.bankofengland.co.uk

www.ecb.int

www.oanda.com

www.x-rates.com

www.emgmkts.com

www.securities.com

www.prsgroup.com

27-37