INTERNATIONAL TRADE THEORY

advertisement

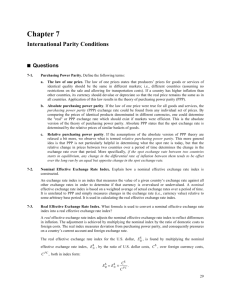

INTERNATIONAL PARITY CONDITIONS Remember, an indirect quote is the foreign currency over the domestic currency. This is the “normal form” for the formulas we will cover. indirect quote Pf Pd The “Law of One Price” states that a product sold in two different markets should be the same price. If 1) the products are identical and 2) there are no frictions (i.e. transportation costs or government restrictions). Law of one price : P d x S P f Pf where, the spot rate ( S ) is d P Purchasing Power Parity (PPP) takes the law of one price a step further. It states that since the prices should be the same across countries, the exchange rate between two countries should be the ratio of the prices in each country. PPP : Price of a product in Country A Spot rate ( S ) Price of a product in Country B where, the spot rate ( S ) is PA PB Example: If a hamburger is $2.54 in the United States and 3.60 real (R$) in Brazil, then the PPP spot rate should be: S 3.60 R$ 1.42 R$ , which reduces to $2.54 1$ If the actual exchange rate is S 2.19 R$ , then according to the PPP theory the Brazilian 1$ real is undervalued by 35%. 1.42 R$ 2.19 R$ PPP implied rate 1$ Actual exchange rate 1$ 1 % over (or under )valued FYI McDonalds' Big Mac is produced locally in almost 120 countries!1 1 Source: The Economist, “Food for thought,” May 27, 2004. 1 Relative Purchasing Power Parity (RPPP) takes things a step further. This theory states that if inflation is higher in Country A than in Country B, then Country A’s currency will fall. Why? Because inflation causes goods to become more expensive (and therefore less competitive) in a country; this will lead to a deficit in the current account (more imports then exports). Remember from your homework in Chapter 3: If the currency is fixed, a deficit in the current account will cause an initial decrease in the country’s foreign exchange reserves2 caused by increased flight from the local currency to stronger foreign currencies… if this continues, the country will have to devalue its currency. And if the currency is floating, deficit in the current account will cause private parties to judge the economy as being weak; and the currency will probably drop in value in the free exchange markets. This drop might be self-correcting because a cheaper local currency will encourage more exports and make imports more expensive. (Note: No specific reason exists to expect foreign exchange reserves to change.) Example: If inflation in Colombia is 2% and inflation in the United States is 6%, then RPPP would predict that the peso would appreciate by 4% relative to the dollar. % ∆ in the spot exchange rate = (-) % ∆ in expected rates of inflation According to PPP the expected spot rate (S2) is derived from the following formula: 1 ( E )i x 1 ( E )i f ( E ) S2 S1 d where, the spot rate ( S ) is Pf E (S2 ) is the expected spot rate and ( E )i is expected inflation Pd Sometimes it is better to compare one country to a group of countries to get a better feel for a currency’s position (i.e. over/under valuation). This is done with an index. A nominal effective exchange rate index uses actual exchange rates to create an index and a real effective exchange rate index uses the purchasing power parity exchange rate to create an index. 2 As the Central Bank buys local currency with foreign exchange reserves to support the currency, the foreign exchange reserves will decrease—“supporting” a currency means decreasing the supply –the money in circulation—so that the “price”—the exchange rate—increases. 2 To find the real effective exchange rate for Country A (versus Country B) use the following formula: ERA ENA x CA CB Pass-through is the degree to which the prices of imported and exported goods change as a result of exchange rate changes. Remember according to “the law of one price” a product sold in two different markets should be the same price. But this is not always the case due to factors such as component costs, lags in exchange rate changes, and the price elasticity of demand. Price elasticity of demand is the percentage change (% ∆) in the quantity of the good demanded as a result of a % ∆ in the price. Here is the formula: price elasticity of demand e p %Qd %P Note: If the absolute value of ep is < 1.0, then the good is relatively “inelastic.” An absolute value of greater than 1.0 indicates a relatively “elastic” good. A product that is relatively “inelastic” means that the quantity demanded is relatively unresponsive to price changes. Example: Inelastic product - textbooks in the U.S. market If the price of textbooks increases by 10% (from $100 to $110), the same number of books will be sold. Note: this theory holds for most high-priced items. Most people who have the money to buy something for $15,000 will be less likely to notice a price increase of 10%. A product that is relatively “elastic” means that the quantity demanded is responsive to price changes. Example: Elastic product - computers in the U.S. market If the price of a computer increases, people will wait to purchase. (Instead of buying a computer in two years a percentage of consumers will wait a third year to update their computer) 3 Pass through steps Step 1: Find the price at the end of the period (P2). P1 x expected inflation = P2 Step 2: Find S2. Assuming PPP, you can find S2 with the following formula: 1 ( E )i x 1 ( E )i f ( E ) S2 S1 d where, the spot rate ( S ) is Pf E (S2 ) is the expected spot rate and ( E )i is expected inflation Pd Step 3: Find the % ∆ in exchange rates. S1 S2 x 100 % S2 Pf where, the spot rate ( S ) is d and (% ) is the percent change P Step 4: Using the pass through rate, discount the % ∆. pass through rate x % ∆ = discounted rate Step 5: Insert the discounted rate into the following formula to find the effective exchange rate. S1 effective rate 1 discounted rate Pf where, the spot rate and the effective rates are d P Step 6: Divide P2 by the effective exchange rate to get the price at the end of the period. P2 / effective rate = price after pass through 4 The Fisher effect states that the nominal interest rate (i) in a country should be equal to the real rate of interest (r) plus expected inflation (π). Here is the formula: i=r+π Remember, the nominal exchange rate is the actual spot rate while the real exchange rate is adjusted for inflation. The International Fisher effect extends this to account for differences in interest rates across borders. Here is the formula: S1 S2 d f i i S2 Pf where, the spot rate (S ) is d P Example: U.S. bond earning 5% interest Turkish bond earning 20% interest If an investor in Turkey is indifferent and would invest in either of the above bonds, then she expects the dollar to appreciate by 15% against the Turkish lira over the next ten years. 1) If she chooses the U.S. bond, she expects the dollar to appreciate by more than 15% over the ten year period. 2) If she chooses the Turkish bond, then she expects the dollar to appreciate by less than 15% against the Turkish lira over the ten year period. If she invests in the U.S. bond and the dollar appreciates by 18% over the ten year period, she will earn an extra 3% when she converts her income into the local currency (lira). Forward rate: An exchange rate quoted today for settlement at a future date. Note: with forwards no money changes hands until settlement. Here is the formula for the forward rate: f days 1 i x 360 F Fdays S x F d days 1 i x 360 Pf where, the spot rate ( S ) is d and (i ) is the annual interest rate P f days d days 5 The forward premium (or discount) is the percentage difference between the spot exchange rate and the forward exchange rate. Here is the formula: ff S Fdays Fdays x 360 x 100 days where, the spot rate ( S ) is f Fdays Pf and the forward rate ( F ) is days d Pd Fdays Note: the forward premium is an annual figure. Futures contracts: exchange-traded agreements that call for the future delivery of a standard amount of any good (i.e. foreign currency) at a fixed time, place, and price. Interest rate parity (IRP) states the difference in national interest rates for securities of similar risks and maturities should be equal to, (but have the opposite sign), the forward rate discount or premium for the foreign currency (without considering transaction costs3). 1 i S x 1 i x F1 d days f days days where, idays is the annual rate x Also, the spot rate ( S ) is days 360 f Fdays Pf and the forward rate ( F ) is days d Pd Fdays Exhibit 6.6 Interest Rate Parity i $ = 8.00 % per annum (2.00 % per 90 days) Start $1,000,000 End x 1.02 $1,020,000 $1,019,993* Dollar money market S = SF 1.4800/$ 90 days F90 = SF 1.4655/$ Swiss franc money market SF 1,480,000 x 1.01 SF 1,494,800 i SF = 4.00 % per annum (1.00 % per 90 days) 3 You could expect transaction costs to be about 0.18% to 0.25% of the total transaction. 6 Covered Interest Rate Arbitrage (CIA) is the idea that an imbalance in parity conditions can create a “risk less” opportunity for an arbitrager. Exhibit 6.7 Covered Interest Arbitrage (CIA) Eurodollar rate = 8.00 % per annum Start End $1,000,000 x 1.04 $1,040,000 $1,044,638 Arbitrage Potential Dollar money market 180 days S =¥ 106.00/$ F180 = ¥ 103.50/$ Yen money market ¥ 106,000,000 x 1.02 ¥ 108,120,000 Euroyen rate = 4.00 % per annum Example: Step 1: Convert $1,000,000 at the spot rate of ¥106.00/$ to ¥106,000,000 Step 2: Invest the proceeds, (¥106,000,000), in a euroyen account for six months, earning 4% per annum, or 2% for 180 days. Step 3: Simultaneously sell the future yen proceeds (¥108,120,000) forward for dollars at the 180-day forward rate of ¥103.50/$. Note: at this point you have “locked in” the amount of $1,044,638 in 180 days (or 6 months). Step 4: Out of the $1,044,638 you have to repay the loan (plus interest), this is called your opportunity cost of capital. To do this, calculate the interest rate for the period (8% per year is 4% for 180 days)4. So to borrow $1,000,000 you have to pay $40,000 in interest at the end of 6 months. Subtract the $1,040,000 from the $1,044,638 that you will receive from your forward contract for a “risk less” profit of $4,638. Notice that these activities should help the currencies return to equilibrium. 4 To use our formula: 8% x 180 4% 360 7 Uncovered Interest Arbitrage (UIA) Uncovered interest arbitrage is great when you are dealing with fixed exchange currencies, because the profit at the end of the period is dependant of the exchange rate (and since this is “uncovered” it is a very risky investment). Exhibit 6.7 Uncovered Interest Arbitrage Investors borrow yen at 0.40% per annum Start ¥ 10,000,000 End x 1.004 Japanese yen money market S =¥ 120.00/$ 360 days ¥ 10,040,000 Repay ¥ 10,500,000 Earn ¥ 460,000 Profit S360 = ¥ 120.00/$ $83,333.33 and $87,500.00 US dollar money market $ 83,333,333 x 1.05 Note: there is a typo in the book. The correct figures are: $ 87,500,000 Since there are men and women making a killing in this business, the opportunities for smaller investors are almost impossible… It is these two types of arbitrage that keep exchange rates more or less in equilibrium. 8 Definitions: Unbiased Predictor – means that “on average” the estimation will be wrong on the up side or the downside with equal frequency and degree. In other words, the errors are normally distributed. -∞% 0% +∞% Note: if you can find something to be right about >50% of the time, you could make a fortune (or if you could be right only about the side-positive or negative) with certainty. So if you knew for certain only that a stock would go down (but not by how much), you could short the currency5 for a profit. Market efficiency – is the theory that states you cannot know for certain anything about the future price (side or percentage). The assumptions behind this theory are that 1) all relevant information is quickly reflected in both the spot and forward exchange markets, 2) there are no transaction costs (or they are trivial), and 3) instruments denominated in different currencies are perfect substitutes for one another (i.e. that you would be just as happy with a - Eastern Caribbean dollar denominated bond, a gourde bond from Haiti, or a U.S. dollar denominated bond). Global developments such as technology and regulations are making market efficiency more and more possible. 5 Shorting a currency means selling it at a high price and then buying it back later (hopefully at a lower price). 9 Final Project Session 1 The World Factbook: http://www.cia.gov/cia/publications/factbook/index.html Potential value drivers (destroyers) Chapter 1 Session 2 The World Bank: http://www.worldbank.org/data/countrydata/countrydata.html Session 3 www.countryreports.org International Finance Corporation: www.ifc.org Resources for Finance Courses Session 1 www.investopedia.com Session 3 www.wikipedia.org Resources for your Career Session 1 LIFA Exam: www.the-ira.org CFA Exam: www.cfainstitute.org Session 2 www.jobsinthemoney.com 10