Set 14 - Matt Will

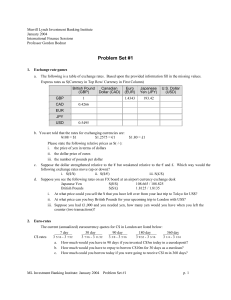

advertisement

Lecture 14 March 22, 2004 Forward Rate * Spot Rate * 1 Month 3 Months 1 Year Europe EMU (euro) Norway (krone) Sweden (krona) Switzerland (franc) United Kingdom (pound) Americas: Canada (dollar_ Mexico (peso) Pacific/ Africa: Hong Kong (dollar) Japan (yen) South Africa (rand) South Korea (won) 1.2375 6.8168 7.4509 1.2559 1.8472 1.2364 6.8217 7.4601 1.2549 1.8421 1.2346 6.8292 7.4738 1.2532 1.8325 1.2285 6.861 7.5284 1.2451 1.7877 1.3276 10.9815 1.3289 11.0338 1.3311 11.126 1.3388 11.5775 7.7928 106.83 6.4662 1160.5 7.7858 106.72 6.5107 1163.8 7.774 106.53 6.5917 1169.2 7.739 105.505 6.9812 1186 * Rates are per $US, other than Euro and UK Pounds Exchange Rate - Amount of one currency needed to purchase one unit of another. Spot Rate of Exchange - Exchange rate for an immediate transaction. Forward Exchange Rate - Exchange rate for a forward transaction. Forward Premiums and Forward Discounts Example - The Peso spot price is 10.9815 peso per dollar and the 1 year forward rate is 11.5775 Peso per dollar, what is the premium and discount relationship? Forward Premiums and Forward Discounts Example - The Peso spot price is 10.9815 peso per dollar and the 1 year forward rate is 11.5775 Peso per dollar, what is the premium and discount relationship? Spot Price T - 1 = Premium or (-Discount ) Forward Price 10.9815 1 - 1 = -5.15% 11.5775 Forward Premiums and Forward Discounts Example - The Peso spot price is 10.9815 peso per dollar and the 1 year forward rate is 11.5775 Peso per dollar, what is the premium and discount relationship? Answer - The dollar is selling at a 5.15% premium, relative to the peso. The peso is selling at a 5.15% discount, relative to the dollar. Basic Relationships 1 + rforeign 1 + r$ 1 + i foreign equals equals equals E(sforeign / $) f foreign / $ S foreign / $ 1 + i$ equals S foreign / $ 1) Interest Rate Parity Theory 1 + rforeign 1 + r$ = f foreign / $ S foreign / $ The ratio between the risk free interest rates in two different countries is equal to the ratio between the forward and spot exchange rates. Example - You have the opportunity to invest $1,000,000 for one year. All other things being equal, you have the opportunity to obtain a 1 year Mexican bond (in peso) @ 6.7 % or a 1 year US bond (in dollars) @ 1.22%. The spot rate is 10.9815 peso:$1 The 1 year forward rate is 11.5775 peso:$1 Which bond will you prefer and why? Ignore transaction costs Example - You have the opportunity to invest $1,000,000 for one year. All other things being equal, you have the opportunity to obtain a 1 year Mexican bond (in peso) @ 6.7 % or a 1 year US bond (in dollars) @ 1.22%. The spot rate is 10.9815 peso:$1 The 1 year forward rate is 11.5775 peso:$1 Which bond will you prefer and why? Ignore transaction costs Value of US bond = $1,000,000 x 1.0122 = $1,012,200 Value of Mexican bond = $1,000,000 x 10.9815 = 10,981,500 peso exchange 10,981,500 peso x 1.067 = 11,717,261 peso 11,717,261 peso / 11.5775 = $1,012,072 bond pmt exchange 2) Expectations Theory of Exchange Rates f foreign / $ S foreign / $ = E(sforeign / $) S foreign / $ Theory that the expected spot exchange rate equals the forward rate. 3) Purchasing Power Parity 1 + i foreign 1 + i$ = E(sforeign / $) S foreign / $ The expected change in the spot rate equals the expected difference in inflation between the two countries. Example - If inflation in the US is forecasted at 1.5% this year and Mexico is forecasted at 6.5%, what do we know about the expected spot rate? Given a spot rate of 10.9815 peso:$1 1 + i foreign 1 + i$ = E(sforeign/$) S foreign/$ 1 .065 E(sforeign/$ ) = 1 + .015 10.9815 solve for Es Es = 11.5225 4) International Fisher effect 1 + rforeign 1 + r$ = 1 + i foreign 1 + i$ The expected difference in inflation rates equals the difference in current interest rates. Also called common real interest rates 4) International Fisher effect 1.067 1.065 1.05 1.0122 1.015 The expected difference in inflation rates equals the difference in current interest rates. Also called common real interest rates Example - The real interest rate in each country is about the same r ( real ) 1 + rforeign 1 + iforeign 1.067 = - 1 = .0019 1.065 1 + r$ 1.0122 r ( real ) = - 1 = -.0028 1 + i$ 1.015 Percent error in the one month forward rate for Swiss Franc per US $ compared to actual spot rate 15 5 -10 -15 4/1/2004 4/1/2002 4/1/2000 4/1/1998 4/1/1996 4/1/1994 4/1/1992 4/1/1990 4/1/1988 -5 4/1/1986 0 4/1/1984 Percent error 10 The Big Mac Index – The price of a Big Mac in different countries (Jan 22, 2015) Relative change in exchange rate, percent 100 80 60 40 20 -100 -50 0 -20 0 50 -40 -60 -80 -100 Relative change in purchasing power, percent 100 Nominal versus Real Exchange Rates 10 U.S. Dollar / British Pound (in log scale) 1999 1989 1979 1969 1959 1949 1940 1930 1920 1910 1900 1 Countries with the highest interest rates generally have the highest inflation rates. In this diagram each of the 129 points represents a different country. 40 Average money market rate, percent, latest 5 years to 2003 35 30 25 20 15 10 5 0 -10 0 10 20 Average inflation rate, percent, latest 5 years to 2003 30 Example - Honda builds a new car in Japan for a cost + profit of 1,715,000 yen. At an exchange rate of 120.700Y:$1 the car sells for $14,209 in Indianapolis. If the dollar rises in value, against the yen, to an exchange rate of 134Y:$1, what will be the price of the car? 1,715,000 = $12,799 134 Conversely, if the yen is trading at a forward discount, Japan will experience a decrease in purchasing power. Example - Harley Davidson builds a motorcycle for a cost plus profit of $12,000. At an exchange rate of 120.700Y:$1, the motorcycle sells for 1,448,400 yen in Japan. If the dollar rises in value and the exchange rate is 134Y:$1, what will the motorcycle cost in Japan? $12,000 x 134 = 1,608,000 yen Currency Risk can be reduced by using various financial instruments Currency forward contracts, futures contracts, and even options on these contracts are available to control the risk