Problem Set #1

Merrill Lynch Investment Banking Institute

January 2004

International Finance Sessions

Professor Gordon Bodnar

Problem Set #1

1.

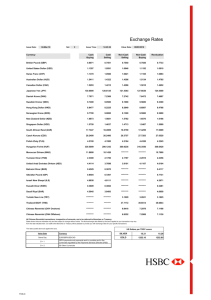

Exchange rate games a.

The following is a table of exchange rates. Based upon the provided information fill in the missing values.

Express rates as S(Currency in Top Row/ Currency in First Column)

GBP

CAD

EUR

JPY

USD

British Pound

(GBP)

1

0.4266

0.5495

Canadian

Dollar (CAD)

Euro

(EUR)

1.4343

Japanese

Yen (JPY)

193.42

U.S. Dollar

(USD) b.

You are told that the rates for exchanging currencies are:

¥108 = $1 $1.2575 = €1 $1.80 = £1

Please state the following relative prices as S(·/·): i.

the price of yen in terms of dollars ii.

the dollar price of euros iii.

the number of pounds per dollar c.

Suppose the dollar strengthened relative to the ¥ but weakened relative to the € and £. Which way would the following exchange rates move (up or down)? i. S($/¥) ii. S($/€) iii. S(£/$) d.

Suppose you see the following rates on an FX board at an airport currency exchange desk

Japanese Yen S(¥/$) 108.665 / 108.825

British Pounds S($/£) 1.8125 / 1.8135 i. At what price could you sell the ¥ that you have left over from your last trip to Tokyo for US$? ii. At what price can you buy British Pounds for your upcoming trip to London with US$? iii. Suppose you had £1,000 and you needed yen, how many yen would you have when you left the counter (two transactions)?

2.

Euro-rates

The current (annualized) eurocurrency quotes for C$ in London are listed below:

7 day

C$ rates 3 5/16 - 3 7/32

30 day 90 day

3 7/16 - 3 11/32 3 3/8 - 3 5/16

180 day 360 day

3 9/32 - 3 3/16 3 1/4 - 3 1/16 a.

How much would you have in 90 days if you invested C$5m today in a eurodeposit? b.

How much would you have to repay to borrow C$10m for 30 days as a euroloan? c.

How much could you borrow today if you were going to receive C$1m in 360 days?

ML Investment Banking Institute: January 2004 Problem Set #1 p. 1

Please obtain the Excel file ps1data.xls from the session website http://finance.wharton.upenn.edu/~bodnarg/ml/outline.html

for questions 3 and 4. In answering these questions, please include a plot of the relevant graph.

3.

£ Real Exchange Rates

Calculate and graph a Real Exchange Rate Index (with a base period of June 1973) based upon the Consumer

Price Index (CPI), for the $/£ exchange rate. a.

In September 1992, the £ left the ERM of the European Monetary System and depreciated sharply. Discuss the size of this devaluation (September 1992 - February 1993) in terms of PPP for the £ versus the $. b.

Based upon PPP, is the dollar expected to appreciate or depreciate in real terms against the pound? For

September 2003, determine the percentage under/overvaluation of the US$ against the £ based upon the June

1973 assumption of parity. (Be careful about the size and sign of the change.)

4.

Mexican Peso Inflation Adjusted Exchange Rates

Mexico devalued their currency in December of 1987. Assume that the exchange rate at the end of January

1988 represents an equilibrium rate (benchmark for APPP). a.

Using both the CPI and WPI data, plot the inflation-adjusted and the nominal spot rates for the Mex

Peso /US$ exchange rate from January 1988 onward. b.

Using the plot, discuss the size of the nominal peso devaluation in mid December 1994 (between Nov and Dec 1994 data) in terms the PPP and the real value of the peso versus the US dollar? c.

Identify the inflation adjusted exchange rate levels using WPI for September 2003. Compare this with the nominal rate at this time. Determine the % over or under valuation for the Mexican peso. (% overvaluation of peso = [NXR($/peso) – IAXR($/peso)]/IAXR($/peso). Compare this deviation to the deviation in November 1994 just prior to the last devaluation. Based upon APPP, is there cause for concern about a peso devaluation?

5.

Parity Conditions

The following table shows interest rates and exchange rates for the United States dollar (US$)and the Danish Krone

(DKr). The current spot exchange rate for Krone is 6.7317 (DKr/US$). a.

Complete the missing entries using the exact formulas (ratios) whenever possible for the parity conditions.

3 Months 6 Months 1 Year

Dollar interest rate (annual)

Krone interest rate (annual)

1 3/32 %

2 1/4 %

Forward rate of krone per dollar i.

Forward premium on DKr, (annual %/yr) ii.

1 5/32 %

iii.

iv.

-1.05%

v.

2 3/8 %

6.7981

vi. b.

If expected US inflation for the next year is 1.0% and we assume the International Fisher condition holds, what it is the world’s real rate of interest for one year and what is inflation expected to be in Denmark over the coming year (use exact formulas)? c.

Suppose you expected the 12-month ahead spot rate to be DKr 7.00/US$. Explain how you could take a position and expect to make an arbitrage profit using the 12-month forward contract. d.

Suppose the current 5-year DKr Danish government note has an annualized yield to maturity of 5.15% while the equivalent maturity US Treasury (US$) note had a yield to maturity of 4.37%. Determine the future exchange rate (DKr/US$) 5 years from now that is consistent with no speculative profits.

ML Investment Banking Institute: January 2004 Problem Set #1 p. 2