Module3.8.1

advertisement

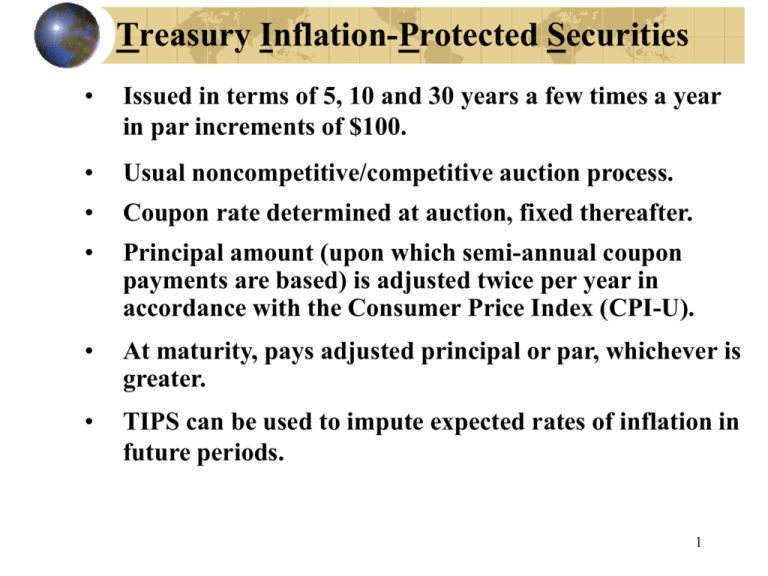

Treasury Inflation-Protected Securities • Issued in terms of 5, 10 and 30 years a few times a year in par increments of $100. • Usual noncompetitive/competitive auction process. • Coupon rate determined at auction, fixed thereafter. • Principal amount (upon which semi-annual coupon payments are based) is adjusted twice per year in accordance with the Consumer Price Index (CPI-U). • At maturity, pays adjusted principal or par, whichever is greater. • TIPS can be used to impute expected rates of inflation in future periods. 1 Consumer Price Index (CPI-U) end Jan End yr Dec ave 2 Example 1 Assume a $1,000 TIPS with a 2.5% coupon rate. If first three semiannual inflations are 1.8%, 2.3% and 2.1%, what are the first three coupon payments? What is adjusted principal after 1.5 years? 3 Treasury STRIPS Program • Separate Trading of Registered Interest and Principal of Securities. • When a Treasury is stripped, each cash flow is used to construct separate zero-coupon securities denominated in $1,000 increments. • Not created by Treasury Department. Created by any of the dealers that work with Treasury. • At the request of any such dealer, Treasury will procure separate CUSIP numbers for each strip component. • Strips created when sum of parts worth more than the whole. • Used for duration matching, lottery annuity payments, by pension funds, insurance companies, etc. 4 Example 2 How many $1,000 strip securities can a dealer create from the purchase of $1 million in face value of a 5% 4-year Treasury note? 5 National Debt http://https://www.treasurydirect.gov/govt/reports/pd/mspd/2015/opds092015.pdf 9/30/2015 9/30/2014 9/30/2013 9/30/2012 9/30/2011 9/30/2010 Held by Public 13.12 12.78 11.97 11.26 10.21 9.02 Intragovernmental Holdings 5.03 5.04 4.76 4.79 4.66 4.53 Total 18.15 17.82 16.73 16.05 14.78 13.55 9/30/2009 9/30/2008 9/30/2007 9/30/2006 9/30/2005 7.55 5.80 5.05 4.84 4.60 4.35 4.21 3.95 3.66 3.33 11.90 10.01 9.00 8.50 7.93 Intragovernmental Holdings include: Social security trust fund Fed employees and military retirement trust funds Disability insurance trust funds Other (airport, highway, unemployment, etc.) 6 Distribution of Debt Held by Public Of the $13.12 trillion held by the public, roughly T-Bills Notes Bonds TIPs Other 10 % 60 % 15 % 10 % 5% Half held by foreign governments. Ave interest rate is 2.35%. Intergovernmental Holdings are not marketable. 7 Social Security (OASI) Trust Fund 2014: $2.728 trillion in trust fund (“piggybank”) Old-Age and Survivors Insurance 2014: $769 billion in, $714 billion out. Piggybank forecast to be empty by 2040. Then will only be able to pay 8 out about 70% of promised benefits. OASI Trust Fund (in billions) http://www.ssa.gov/OACT/STATS/table4a1.html 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Receipts 604 642 675 695 698 677 699 731 743 769 Expendi Net tures Increase 442 162 461 181 496 179 516 179 564 134 585 92 604 95 645 86 679 64 714 55 Balance 1,663 1,844 2,024 2,203 2,337 2,429 2,524 2,610 2,673 2,728 9 Municipal Bonds • General Obligation Bonds. Backed by “full faith and credit” of issuing political entity. Require voters’ approval which often refused. Very safe when available. • Revenue Bonds. Be careful. Coupon and principal payments can only be made with cash flows from the specific project (toll roads, sewage treatment plants, professional sport facilities, etc.) 10 Municipal Bonds • Issued by states, counties, cities, school districts, university systems, transit systems, etc. • Distinguishing feature of munis is that coupon payments are exempt from federal tax (usually from state tax in state of issue, too). • When comparing a muni with a similar taxable bond use iat ibt (1 t ) where t is marginal tax rate. • Typically sold as serial bond issues (see pp. 250-51) 11 Bearer Bonds (not many left) 12 Bond Indenture Specifies collateral • Mortgage bond - real assets pledged. • Equipment trust certificates - specific, titled, or identifiable equipment. • Collateral bonds - secured by financial assets. • Debentures - unsecured bonds. Specifies priority of claims on assets • Senior debt - first priority on general assets. • Subordinated (junior) debt - below senior. Debentures at bottom. Considerations concerning repayment of principal • Sinking fund provisions. The putting aside of sums for the repayment of principal when due, or the periodic retirement of a number of bonds selected randomly. • Call and/or put provisions 13 Junk Bonds • Junk bonds were not sellable in the primary market until late 1970s. • Junk bonds also known euphemistically as High Yield bonds, so don’t be misled. • Secondary market appeared in early 1980s. • “Low credit quality” firms now able to issue longterm fixed rate marketable debt, rather than be at mercy of commercial banks. • Many investors attracted to junk bonds because of high yield. 14 Foreign Bonds • Issued in a financial market of a nation by a foreign company in that country. • If a foreign firm issues a bond in the US, it is called a Yankee bond. • Bonds issues by foreign firms in Japan are called Samurai bonds. • Must conform to the regulations of country in which sold. 15