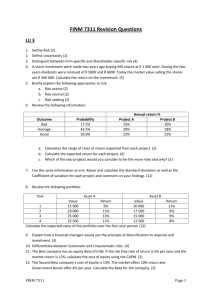

File Unit 3 Bonds Intro

advertisement

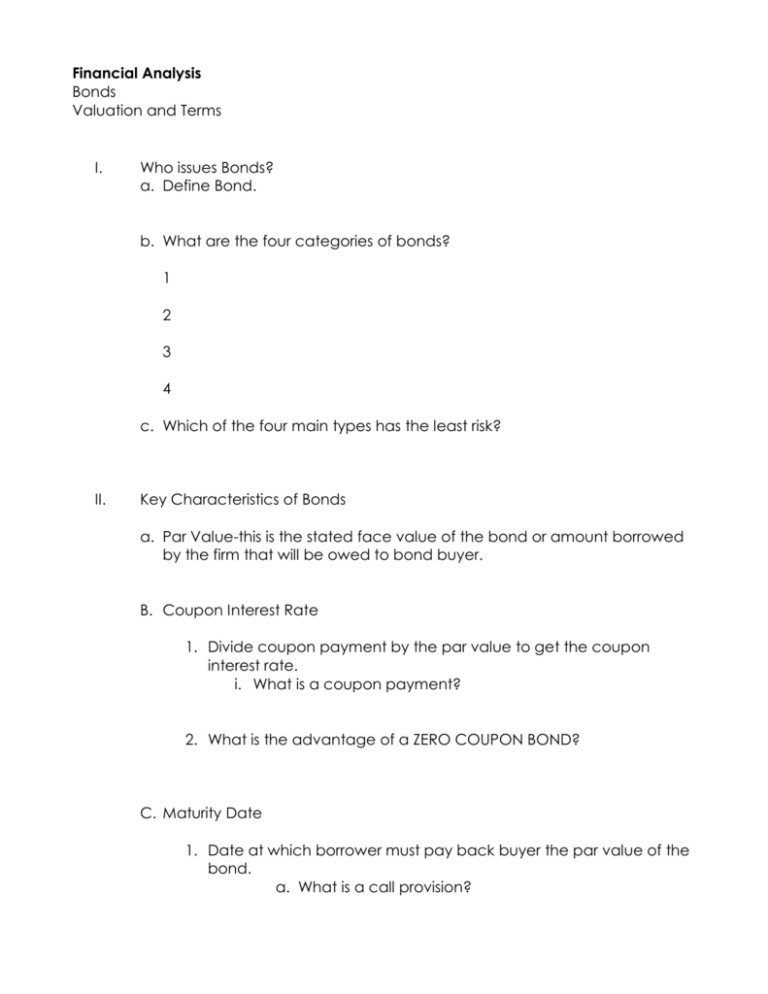

Financial Analysis Bonds Valuation and Terms I. Who issues Bonds? a. Define Bond. b. What are the four categories of bonds? 1 2 3 4 c. Which of the four main types has the least risk? II. Key Characteristics of Bonds a. Par Value-this is the stated face value of the bond or amount borrowed by the firm that will be owed to bond buyer. B. Coupon Interest Rate 1. Divide coupon payment by the par value to get the coupon interest rate. i. What is a coupon payment? 2. What is the advantage of a ZERO COUPON BOND? C. Maturity Date 1. Date at which borrower must pay back buyer the par value of the bond. a. What is a call provision? 2. What would be a logical reason for a bond to be called earlier than it’s mature date? ASSIGNMENT: RESEARCH TO FIND BOND RATINGS AND CREATE A CHART WITH THE DIFFERENT LEVELS. WHEN ARE BONDS WORTH IT? IF AT ALL! http://monevator.com/2009/01/10/what-are-the-benefits-of-corporate-bonds/ 1. 2. 3. 4. READ ARTICLE USE YOUR KNOWLEDGE OF INVESTMENTS DECIDE WHETHER YOU WANT TO BUY A BOND EXPLAIN UTILIZING SOME WRITINGS AND QUOTES FROM ARTICLE IN YOUR DECISION.