Corporation

advertisement

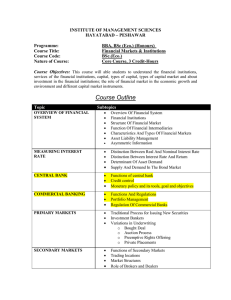

Overview of Bond Sector and Instruments Understanding Yield Spreads Government Agencies Municipal Corporation •US Treasury •Federally Related Institution •General Obligation •Secured Bonds Bank Obligations •Revenue •Unsecured Bonds •Government Sponsored Enterprises •Negotiabl e CDs •Special Bonds Structure •Medium Term Notes •Bankers Acceptances •Commercial Paper Sovereign Bonds •Bonds issued by a country’s central government •Issued in domestic market, another country”s foreign market, or in the Eurobonds market •Typically issued in the currency of the issuing country, but can be issued in other currencies as well Four Primary Methods of issuance Regular cycle auction – single price Regular cycle auction – multiple price An ad hoc auction system A tap system Under this method Refers to a method highest price (lowest where the central Refers to the issuance Under this method, yield) at which the government auctions and auctions of bonds winning bidders entire issue to be new securities when it identical to previously receive the bonds at issued bonds auctioned can be sold determines market the price that they bid is awarded to winning conditions are bidders advantageous US Treasury Treasury Bills Fixed-Principal Treasuries Inflation-Indexes Treasuries (TIPSs) Treasury Notes Treasury Bonds Treasury Strips (created by private sector) Coupon Strips Principal Strips On The Run and Off The Run • Treasury issues are divided into 2 categories based on their vintage : • On the run issues, the most recently auctined Treasury issues. • Off the run issues, older issues that have been replaced (as most traded issue) by a more recently auctioned issued. Issues replaced by several more recent issues are known as well off the run issues TIPSs • Coupon rate reflects real rate, net of inflation, change in inflation reflected in the principal • TIPS Coupon payment = inflation-adjusted par value x (stated coupon rate/2) • Cons: if consumer prices decline, so does the principal. Also, inflation adjustments are taxed • Example of TIPS : A TIPS has coupon rate of 3%, par value of $100,000. Annual inflation rate: 4%, compute the semi-annual coupon payment! • Answer: • Semi annual inflation = 4% x 0.5 = 2% • Inflation-adjusted principal = $100,000 x (1+0.02) = $102,000 • Semi annual coupon payment = $102,000 x 1.5% = $1530 Treasury Strips Principal strips Coupon strips Refers to strips created from coupon payments stripped from the original security, denoted as ci Refers to bond and note principal payments with the coupons stripped off. Those derived from stripped bonds are denoted bp and those from stripped notes np Federal Agency Debts • Debt securities issued by various agencies and organizations of the U.S Government • There are two types of federal agencies : • federal government agencies such as Ginnie Mae, TVA • government sponsored entities (privately owned) such as Fannie Mae, Freddie Mac, Sallie Mae Instrumen Types • Debentures, securities not backed by collateral • Mortgage and Asset backed securities Mortgage Backed Securities Mortgage pass through Pooling of several mortgages Sold in the form of participation certificates Collateralized Mortgage Obligations (CMOs) Derivative of pass-through Different tranches created Cash flows passed through to Prepayment risk distributed investors across tranches Issuer Types •Issued by local government •Tax-Backed Debt •In US issued by state, local government and entities that they create •Special Bonds Structure •Revenue Bonds Tax-Backed Debt General Obligation Debt (G.O. Debt) Unlimited Tax Lmited Tax Doule Barelled Issuer has unlimited taxing authority Issuer has a statutory limit on tax increase Backed also by additional revenues AppropriationBacked Obligation (Moral Obligation Bonds) Public Credit Enhanced Programs State Issue a nonbinding pledge to cover shortfalls State or Federal agency guarantees payment Corporate Debt Securities Secured Bonds Mortgage Debt Corporate Bonds Medium Term Notes (MTNs) Unsecured Bonds Credit Enhanced Bonds Collateral Trust Bonds Third-Party Structured Notes Bank Letter of Credit Commercial Paper Directlyplaced Dealer-placed Considered Factors for Rating Character, Capacity, Collateral and Covenant The Firm Specific Factors considered Past repayment history Quality of management, ability to adapt to changing conditions The industry outlook and firm strategy Overall debt level of the firm Operating cash flow, ability to service debt Other sources of liquidity (cash, salable assets) Competitive position, regulatory enviroment and union contracts/history Financial management and controls Susceptibility to event risk and political risk Factor specific to particular debt issue Priority of the claim being rated Value/quality of any collateral pledged to secure the debt The covenants of the debt issue Any guarantees or obligations for parent company support Corporate Bonds Issues •Corporate bond issues typically are : •Sold all at once •Sold on a firm commitment basis whereby an understanding syndicate guarantees the sale of the whole issue •Consist of bonds with a single coupon rate and maturity Medium term Notes •Medium term notes (MTNs) differ from a regular corporate bond offering in all of these characteristics Structured Notes •A debt security created when the issuer combines a typical bond or note with derivative. •Types of structured notes include : •Step up notes, coupon rate increases over time on a preset schedule. •Inverse Floaters, coupon rate increases when the reference rate decreases and decreases when the reference rate increases. •Deleveraged Floaters, coupon rate equals a fraction of the reference rate plus a constant margin. •Dual Indexed Floaters, coupon rate is based on the difference between two reference rates. •Range Notes, coupon rate equals the reference rate if the reference rate falls within a specified range, or zero if the reference rate falls outside that range. •Index amortizing Notes, coupon rate is fixed but some principal is repaid before maturity with the amount of principal prepaid based on the level of the reference rate. Commercial paper •A short term unsecured debt instrument used by corporations to borrow money at rates lower than bank rates. •Directly placed paper , commercial paper that is sold to large investors without going through an agent or broker dealer. Large issuers will deal with a select group of regular commercial paper buyers who customarily buy very large amounts. •Dealer placed paper, sold to purchasers through a commercial paper dealer. Most large investment firms have commercial paper desk to serve their customers’ needs for short term cash management products. Negotiable Certificate of deposit • Certificate of deposit, promise by the bank to repay a certain amount plus interest with specific and for specific periods of time, that can be trade on the secondary market Bankers Acceptances • Guarantees by a bank that a loan will be rapaid. Created as part of commercial transaction, especially international trade Special Purpose Vehicle/Corporation • a separate legal entity to which a corporation transfers the financial assets for an ABS issue. • The Motivation for a corporation to issue asset backed securities to reduce borrowing costs. By transferring the assets into a separate entity, the entity can issue the bonds and receive a higher rating than the unsecured debt of the corporation. • External Credit Enhancements : • Corporate guarantees, which may be provided by the corporation creating the ABS or its parent. • Letters of credit, which may be obtained from a bank for a fee • Bond Insurance, which may be obtained from an insurance company or a provider specializing in underwriting such structures. This is also referred to as an insurance wrap Collateralized Debt Obligation (CDO) •A debt instrument where the collateral for the promise to pay is an underlying pool of other debt obligations and even other CDOs •Tranches of CDO are created based on the seniority of the claim to the cash flows of underlying assets, and given different credit rating based on seniority Primary Market • The Primary Market for debt typically used an investment banker to involved in advising the debt issuer and in distributing (selling) the debt securities to investors. • Two type of underwriting : firm commitment and best effort. Secondary Market • The Secondary Market for debt securities includes exchanges, an over the counter dealer market and electronic trading networks Exercise 1 • A treasury note (T-note) principal strip has six months remaining to maturity. How is its price likely to compare to a 6 month treasury bill (T-bill) that has just been issued ? The T-note price should be : • A. lower • B. higher • C. the same Exercise 2 • Which of the following statements about treasury securities is most accurate? • A. Treasury principal strips are usually created from treasury bills • B. Treasury bonds may be used to create treasury coupon strips • C. Treasury coupon strip make lower coupon payments than treasury principal strips Exercise 3 • Which of the following municipal bonds typically has the greater risk and is issued with higher yields ? • A. Revenue bonds • B. Limited tax general obligation bonds • C. Unlimited tax general obligation bonds Exercise 4 • A debt security that is collateralized by a pool of the sovereign debt of several developing countries is most likely a (n) : • A. CMO • B. CDO • C. ABS Exercise 5 •Activities in the primary market for debt securities would least likely include : •A. market making •B. a best efforts offering •C. a firm commitment Thank You and Success Agus Salim CFA 0811990573 agussalim09@gmail.com