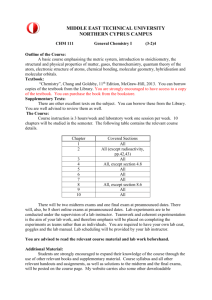

785

advertisement

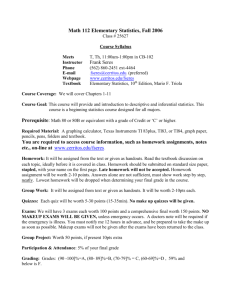

Financial Management (FIN350) Administrative Issues and Course Overview TIP If you do not understand something, ask me! Today’s plan Administrative issues: syllabus Course overview Chapter 1 2 The instructor My name is Donglin Li. Email: donglinli2006@yahoo.com ) Office hours: Mon 14:00-17:00, Tu 13:00-14:00, Bus 315 You can also email me questions. http://online.sfsu.edu/~donglin/courses.html Research interests: Corporate finance: Agency cost, overinvestment Accounting: Financial Statement Analysis, Market Anomalies Default Prediction; Reg FD 3 My expectation in this course I want everyone in the room to be familiar with finance to be familiar with key concepts / issues to feel more comfortable talking about finance and answering finance questions. 4 My expectation in this course students who come to class, listen, review the problems, and think a lot , typically do well. students who seldom show up in class usually perform poorly. 5 Textbook Fundamentals of Financial Management, concise 5th Edition, by Thomson and Southwestern. This is a very popular textbook, which has been used in many programs for the intro course in finance. Maybe tougher than other textbooks. You will like it. 6 Prerequisites You are required to take (ACCT 101, ECON 101, DS 110, 212; ISYS 263 or pass computer information systems proficiency test. ) 7 Homework Homework will not be graded. The solution will be posted on my web. Try to do the Self-test problems at the end of each chapter in the textbook. The best way to learn new concepts is to do a lot of problems. I will also put lecture slides, HW solution and some multiple choice exercises on my web. 8 In-Class-Work There will be 4 in-class projects. 9 4 quizzes and final exam The exams are closed-book. There are no makeup or in-advance exams. The exams are based on material covered in lectures, homework, and textbook. Mostly multiple choice questions. 10 Quizzes and Final Please bring your SFSU ID or a driver license to class, as well as scantrons. 11 Grading Your total points will be based on the following: Class performance 10 Quizzes (drop 1 lowest) 51 Final 39 12 The curve grade The grade that will appear on your transcript is based on the ranking of your total scores in class: Top 10% of class A to AAbove 65% of class B+ to BAbove 30% of class C+ to CBottom 30% of class D+ to F 13 Academic integrity The instructor has zero tolerance for cheating or looking at each other during the exams In the exams, please sit as far as possible between each other. 14 Communicate with the instructor Teaching Style: Lectures and problem solving I APPRECIATE any constructive suggestions (in person or email) that would improve the course. 15 Course organization This course is broken-down into three parts 1: valuation of financial assets (Bonds, stocks) 2: valuation of real assets (capital budgeting) 3: capital structure theory (financing with debt or issuing stocks) 16 Course Overview Finance: what is it? Corporate Finance Corporations Money and capital markets Financial Markets: Banks, Stock Exchanges Investments Investors 17