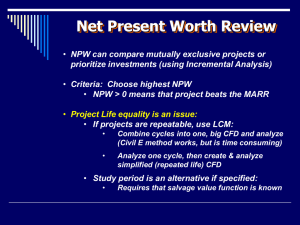

Chapter 5 Present Worth Analysis

advertisement

1 Chapter Outline Incremental Analysis Graphical Technique in Solving problems with Mutually Exclusive Alternatives Using Spreadsheets in Incremental Analysis 2 Learning Objectives Define Incremental Analysis Apply Graphical Technique in Solving Problems with Mutually Exclusive Alternatives Use Spreadsheets in Incremental Analysis 3 Internal Rate of Return (IRR) By definition in Chapter 7: Given a cash flow stream, IRR is the interest rate i at which the benefits are equivalent to the costs. This can be expressed mathematically in five different ways. NPW=0 PW of benefits - PW of costs =0 PW of benefits = PW of costs PW of benefits / PW of costs=1 EUAB-EUAC=0 4 Example Cash flows for an investment are shown in the following figure. What is the IRR to obtain these cash flows? YEAR CASH FLOW 0 ($500) 1 $100 2 $150 3 $200 4 $250 5 YEAR CASH FLOW 0 ($500) 1 $100 2 $150 3 $200 4 $250 QUESTION CONTINUES EUAW EUAB EUAC 0 100 50( A / G , i %, 4) 500( A / P, i %, 4) 0 Try i 5% 100 50( A / G ,5%, 4) 500( A / P,5%, 4) 100 50(1.439) 500(0.2820) 30.95 Try i 15% 100 50( A / G ,15%, 4) 500( A / P,15%, 4) 100 50(1.326) 500(0.3503) -8.85 10.20 6 YEAR CASH FLOW 0 ($500) 1 $100 2 $150 3 $200 4 $250 QUESTION CONTINUES EUAW EUAB EUAC 0 100 50( A / G , i %, 4) 500( A / P, i %, 4) 0 Try i 5% 100 50( A / G ,5%, 4) 500( A / P,5%, 4) 100 50(1.439) 500(0.2820) 30.95 Try i 15% 100 50( A / G ,15%, 4) 500( A / P,15%, 4) 100 50(1.326) 500(0.3503) -8.85 10.20 7 INTERPOLATION 5% 30.95 30.95 5-X 10 X% 0 15% -8.85 39.80 5 X 30.95 0 30.95 5 15 30.95 (8.85) 39.80 X 12.78 13% 8 INTERPOLATION 5% 30.95 30.95 5-X 10 X% 0 15% -8.85 39.80 5 X 30.95 0 30.95 5 15 30.95 (8.85) 39.80 X 12.78 13% 9 EXCEL solution IRR = irr(a1:a5) = 12.83% 10 Mutually Exclusive Alternatives Only one alternative may be implemented All alternatives serve the same purpose Objective of incremental analysis is to select the best of these mutually exclusive alternatives 11 Incremental Analysis When there are two alternatives, rate of return analysis is performed by computing the incremental rate of return, ΔIRR, on the difference between the two alternatives, as discussed in Chapter 7. 12 Incremental Analysis The cash flow for the difference between alternatives is calculated by taking the higher initial-cost alternative minus the lower initial-cost alternative. The below decision path is made for incremental rate of return (ΔIRR) on difference between alternatives: Two -Alternative Situations Decision ΔIRR≥MARR Choose the higher-cost alternative ΔIRR<MARR Choose the lower-cost alternative 13 Example The cash flows for four different alternatives are given in table below. If MARR 10%, which is the best alternative? Using the incremental analysis, we need to repeat 3 times, by comparing 2 alternatives at a time. 14 MARR = 10% EUAB =EUAC (Increment) ΔIRR≥MARR ΔIRR<MARR Choose the higher-cost alternative 15 Choose the lower-cost alternative Incremental Analysis Could be applied to rate of return (IRR), present worth (PW), equivalent uniform annual cost (EUAC), or equivalent uniform annual worth (EUAW) approaches. [Higher-cost alternative] = [Lower-cost alternative] + [Increment between them] The “defender” is the best alternative identified so far in the process, and “challenger” is the next higher-cost alternative to be evaluated. For a set of N mutually exclusive alternatives, (N - 1) “challenger/defender” comparisons must be made. Copyright Oxford University Press 2009 16 Example Given the alternatives below: Select the one best alternative if MARR = 8%. Use incremental rate of return analysis. 17 MARR = 8% Since the MARR is 8%, Alt. D may be eliminated, as the ROR is less than 8% Among the remaining alternatives A, B, and C, the two lower cost alternatives are A and B. (A - B) increment: PW of benefit = PW of cost (623 - 531)(P/A, i, 10) = (4,000 - 3,000) (P/A, i, 10) = 1,000/92 = 10.86 (C - B) increment: PW of benefit = PW of cost (1,020 - 531)(P/A, i, 10) = (6,000 - 3,000) (P/A, i, 10) = 3,000/489 = 6.13 ∆ROR is greater than 8%. Therefore, choose the higher-cost alternative, Alt. C 18 Example 8-1 High Capacity $13,400 $4000/year 5 years Cost Benefit Life Low Capacity $10,310 $3300/year 5 years Increment $3090 $700/year 5 years PW LOW= -$10,310 + $3300(P/A,i,5) PW HIGH= -$13,400 + $4000(P/A,i,5) $8,000.00 IRRIncrement= 4.3% $6,000.00 IRRHigh PW $4,000.00 IRRLow $2,000.00 $0.00 0% 5% 10% 15% 20% 25% ($2,000.00) ($4,000.00) i 19 Example 8-1 – Continued In column B, input formula: PW LOW = –$10,300 + $3300(P/A,i,5) = –$10300 + pv(A3, 5, –3300) In column C, input formula: PW HIGH = –$13,400 + $4000(P/A,i,5) = –$13400 + pv(A3, 5, –4000) From a3 to a24, input interest from 0 to 0.21 In column D, input formula for incremental cost PW HIGH–LOW: = C3 – B3 Then draw a line chart! Or use EXCEL function npv(i, value range) -10300+npv(A3, $A$28:$A$32) -13400+npv(A3, $A$36:$A$40) Example 8-1 – Continued Interest Rate PW LOW= -$10,300 + $3300(P/A,i,5) 0% ≤ i ≤ 4.3% 4.3 % ≤ i ≤ 18% 18% ≤ i PW HIGH= -$13,400 + $40000(P/A,i,5) PWhigh-low = -$3090 + $700(P/A, i, 5) Best Choice High Capacity Low Capacity Do Nothing IRRIncrement= %4.3 $8,000 $6,000 IRRIncrement= %4.3 IRR $40 High $4,000 $20 $2,000 ($4,000) Diff IRRLow 5.0% 10.0% ($20)3.5% 15.0% ($40) High Low $0 $0 0.0% ($2,000) Diff Diff 20.0% 4.5% 25.0% 5.5% 30.0% ($60) ($80) 21 Net Present Worth Example 8-2 Rate MARR = 10% Machine X $200 Machine Y $700 Uniform Annual Benefit $95 $120 End-of-Useful-Life Salvage Value $50 $150 Initial Cost Useful Life, in Years 6 In column C, –700 + pv(A3, 12, –120, –150) 12 Machine X Machine Y 0% $840.00 $890.00 1.322 752.24 752.24 2 710.89 687.31 4 604.26 519.90 6 515.57 380.61 8 441.26 263.90 10 378.56 165.44 12 325.30 81.83 14 279.77 10.37 16 240.58 -51.08 18 206.65 -104.23 20 177.10 -150.47 In column B, –200 + pv(A2, 6, -95, -50) + pv(A2,6, 0, 200 – pv(A2, 6, -95, -50)) 22 Net Present Worth Rate Example 8-2 $1,000.00 NPW $600.00 IRRY $400.00 $200.00 $840.00 $890.00 1.322 752.24 752.24 2 710.89 687.31 4 604.26 519.90 6 515.57 380.61 8 441.26 263.90 10 378.56 165.44 12 325.30 81.83 14 279.77 10.37 16 240.58 -51.08 18 206.65 -104.23 20 177.10 -150.47 Machine X Machine Y $0.00 0% 5% 10% 15% ($200.00) ($400.00) i For MARR ≤ 1.3%, Machine Y is the right choice 20% Machine Y 0% ∆ IRRIncrement =1.3% $800.00 Machine X 25% For MARR ≥1.3%, Machine X is the right choice 23 Example 8-3 Consider the three mutually exclusive alternatives: Initial Cost Uniform Annual Benefit A $2000 B $4000 C $5000 410 639 700 Each alternative has a 20 year life and no salvage value. If the MARR is 6%, which alternative should be selected? 24 Initial Cost Uniform Annual Benefit A $2000 B $4000 C $5000 410 639 700 $10,000.00 ∆ IRRC-B= 2% $8,000.00 If MARR ≥ 9.6%, Choose Alt. A NPW $6,000.00 ∆ IRRB-A=9.6% $4,000.00 $2,000.00 Alt. B If 9.6% ≥ MARR≥2%, Choose Alt. B Alt. A $0.00 ($2,000.00) 0% 5% 10% 15% Alt. C ($4,000.00) 20% 25% If 2% ≥ MARR ≥ 0%, Choose Alt. C i Net Present Worth Graph of Alternatives A, B, and C. 25 $10,000.00 ∆ IRRC-B= 2% $8,000.00 If MARR ≥ 9.6%, Choose Alt. A NPW $6,000.00 ∆ IRRB-A=9.6% $4,000.00 $2,000.00 Alt. B If 9.6% ≥ MARR≥2%, Choose Alt. B Alt. A $0.00 ($2,000.00) 0% 5% 10% 15% Alt. C 20% ($4,000.00) 25% If 2% ≥ MARR ≥ 0%, Choose Alt. C i How to find the intersection points: NPW(C-B) = -$5000+$4000+($700-$639)(P/A,i,20) = 0 ∆IRR(C-B) = 2% NPW(B-A) = -$4000+$2000+($639- $410)(P/A,i,20) = 0 ∆IRR(B-A) = 9.6% 26 Example 8-4 Brass $100,000 4 Cost Life Stainless $175,000 10 Titanium $300,000 25 $80,000 $70,000 If 6.3% ≥ MARR ≥ 0%, Choose Titanium EUAC $60,000 IRRTitanium - Stainless= 6.3% $50,000 $40,000 If 15.3% ≥ MARR≥ 6.3%, Choose Stainless $30,000 $20,000 IRRStainless - Brass=15.3% $10,000 If MARR ≥ 15.3%, Choose Brass $0 0% 5% 10% 15% 20% 25% i 27 Example 8-5 Incremental Analysis (with Do-Nothing option) Machine X $200 65 6 Initial Cost Uniform Annual Benefit Useful Life, in years $60 IRRY-Z=3.5% $40 IRRZ-X=11% If MARR≥23%, IRRX=23% Choose “Do-Nothing” $0 ($20) 0% Machine Z $425 100 8 X $20 EUAW Machine Y $700 110 12 5% 10% 15% 20% 25% If 23%≥MARR≥11%, Choose X Z ($40) Y ($60) If 11%≥MARR≥3.5%, Choose Z ($80) ($100) i If 3.5%≥MARR≥0%, Choose Y 28 Example 8-5 Incremental Analysis (without Do-Nothing option) Machine X $200 65 6 Initial Cost Uniform Annual Benefit Useful Life, in years $60 IRRY-Z=3.5% $40 IRRZ-X=11% X EUAW $20 Machine Y $700 110 12 If MARR≥11%, IRRX=23% Choose X $0 ($20) 0% 5% 10% 15% 20% 25% Z ($40) Y ($60) Machine Z $425 100 8 If 11%≥MARR≥3.5%, Choose Z If 3.5%≥MARR≥0%, Choose Y ($80) ($100) i 29 Example 8-6 Incremental Analysis using Graphical Comparison A $4000 639 Initial Cost Uniform Annual Benefit B $2000 410 C $6000 761 D $1000 117 E $9000 785 10,000 8,000 IRRC-A=2% 6,000 IRRA-B=9.6% 4,000 NPW Life = 20 yrs IRRB=20% 2,000 0 (2,000) 0% 5% 10% 15% 20% 25% (4,000) (6,000) (8,000) i 30 Example 8-6 Incremental Analysis using Graphical Comparison Initial Cost Uniform Annual Benefit A $4000 639 B $2000 410 C $6000 761 D $1000 117 E $9000 785 Calculating Incremental Interest ∆IRR(C-A) = $6000-$4000 = ($761 - $639)(P/A, i, 20) = 2% ∆IRR(A-B) = $4000-$2000 = ($ 639 - $410)(P/A, i, 20) = 9.6% And to find where the NPW of B crosses the 0 axis IRR (B) = $2000 = $410(P/A, i, 20) = 20% 31 Example 8-6 Incremental Analysis using Graphical Comparison A $4000 639 Initial Cost Uniform Annual Benefit B $2000 410 C $6000 761 10,000 8,000 IRRA-B=9.6% NPW 4,000 IRRB=20% If 20%≥MARR≥9.6%, Choose B 2,000 0 (2,000) 0% E $9000 785 If MARR≥20%, Choose Do-Nothing IRRC-A=2% 6,000 D $1000 117 5% 10% 15% (4,000) 20% 25% If 9.6%≥MARR≥2%, Choose A (6,000) (8,000) i If 2%≥MARR≥0%, Choose C 32 Spreadsheet and Incremental Analysis Excel Functions Purpose Rate (n, A, -P, [F], [Type], [guess]) To find rate of return or incremental rate of return given n, P, and A IRR (range, [guess]) To find internal rate of return (or incremental rate of return) of a series of cash flow (or incremental cash flow) Excel Tools Purpose Goal Seek It varies the value in one specific cell until a formula that's dependent on that cell returns the wanted result. Solver adjusts the values in the changing cells to produce the result from the target cell formula. Constraints are applied to restrict the values Solver can use in the model. Solver 33 End of Chapter 8 34