C16-1 Individual Income Taxes Individual Income Taxes

advertisement

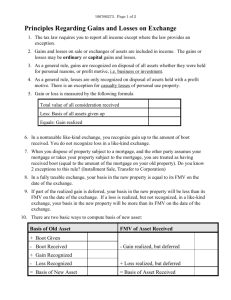

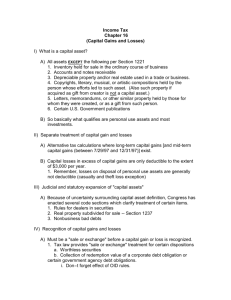

Chapter 16 Property Transactions: Capital Gains and Losses Individual Income Taxes Copyright ©2009 Cengage Learning Individual Income Taxes C16-1 Taxation of Capital Gains and Losses • Capital gains and losses must be separated from other types of gains and losses for two reasons: – Long-term capital gains may be taxed at a lower rate than ordinary gains – A net capital loss is only deductible up to $3,000 per year Individual Income Taxes C16-2 Proper Classification of Gains and Losses • Depends on three characteristics: – The tax status of the property • Capital asset, §1231 asset, or ordinary asset – The manner of the property’s disposition • By sale, exchange, casualty, theft, or condemnation – The holding period of the property • Short term and long term Individual Income Taxes C16-3 Capital Assets (slide 1 of 6) • §1221 defines capital assets as everything except: – Inventory (stock in trade) – Notes and accounts receivables acquired from the sale of inventory or performance of services – Realty and depreciable property used in a trade or business (§1231 assets) Individual Income Taxes C16-4 Capital Assets (slide 2 of 6) • §1221 defines capital assets as everything except (cont’d): – Certain copyrights; literary, musical, or artistic compositions; or letters, memoranda, or similar property when created by taxpayer (or for which taxpayer takes a carryover basis from the creator) • Taxpayers may elect to treat a sale or exchange of musical compositions or copyrights in musical works as the disposition of a capital asset – Certain publications of U.S. government – Supplies of a type regularly used or consumed in the ordinary course of a business Individual Income Taxes C16-5 Capital Assets (slide 3 of 6) • Thus, capital assets are: – Assets held for investment (e.g., stocks, bonds, land) – Personal use assets (e.g., residence, car) – Miscellaneous assets selected by Congress Individual Income Taxes C16-6 Capital Assets (slide 4 of 6) • Dealers in securities – In general, securities are the inventory of securities dealers, thus ordinary assets – However, a dealer can identify securities as an investment and receive capital gain treatment • Clear identification must be made on the day of acquisition Individual Income Taxes C16-7 Capital Assets (slide 5 of 6) • Real property subdivided for sale – Taxpayer may receive capital gain treatment on the subdivision of real estate if the following requirements are met: • • • • • Taxpayer is not a corporation Taxpayer is not a real estate dealer No substantial improvements made to the lots Taxpayer held the lots for at least 5 years Capital gain treatment occurs until the year in which the 6th lot is sold – Then up to 5% of the revenue from lot sales is potential ordinary income – That potential ordinary income is offset by any selling expenses from the lot sales Individual Income Taxes C16-8 Capital Assets (slide 6 of 6) • Nonbusiness bad debts – A nonbusiness bad debt is treated as a shortterm capital loss in the year it becomes completely worthless • Even if outstanding for more than one year Individual Income Taxes C16-9 Sale or Exchange (slide 1 of 11) • Recognition of capital gains and losses generally requires a sale or exchange of assets • Sale or exchange is not defined in the Code • There are some exceptions to the sale or exchange requirement Individual Income Taxes C16-10 Sale or Exchange–Worthless Securities and § 1244 Stock (slide 2 of 11) • A security that becomes worthless creates a deductible capital loss without being sold or exchanged – The Code sets an artificial sale date for the securities on the last day of the year in which worthlessness occurs • Section 1244 allows an ordinary deduction on disposition of stock at a loss – The stock must be that of a small business company – The ordinary deduction is limited to $50,000 ($100,000 for married individuals filing jointly) per year Individual Income Taxes C16-11 Sale or Exchange (slide 3 of 11) • Worthless securities example: – Calendar year taxpayer purchased stock on December 5, 2007 – The stock becomes worthless on April 5, 2008 – The loss is deemed to have occurred on December 31, 2008 • The result is a long-term capital loss Individual Income Taxes C16-12 Sale or Exchange–Retirement of Corporate Obligations (slide 4 of 11) • Collection of the redemption value of corporate obligations (e.g., bonds payable) is treated as a sale or exchange and may result in a capital gain or loss – OID amortization increases basis and reduces gain on disposition or retirement Individual Income Taxes C16-13 Sale or Exchange–Options (slide 5 of 11) • For the grantee of the option – Sale of an option results in capital gain or loss if the option property is a capital asset to the grantee – Lapse of an option on a capital asset is considered a sale or exchange resulting in a capital loss • For the grantor of an option, the lapse creates – Short-term capital gain, if the option was on stocks, securities, commodities or commodity futures – Otherwise, ordinary income Individual Income Taxes C16-14 Sale or Exchange–Options (slide 6 of 11) • Exercise of an option by a grantee – Increases the gain (or reduces the loss) to the grantor from the sale of the property – Gain is ordinary or capital depending on the tax status of the property • Grantee adds the cost of the option to the basis of the property acquired Individual Income Taxes C16-15 Sale or Exchange–Patents (slide 7 of 11) • When all substantial rights to a patent are transferred by a holder to another, the transfer produces long-term capital gain or loss – The holder of a patent must be an individual, usually the creator, or an individual who purchases the patent from the creator before the patented invention is reduced to practice Individual Income Taxes C16-16 Sale or Exchange–Franchises, Trademarks, and Trade Names (slide 8 of 11) • The licensing of franchises, trade names, trademarks, and other intangibles is generally not considered a sale or exchange of a capital asset – Therefore, ordinary income results to transferor • Exception: Capital gain (loss) may result if the transferor does not retain any significant power, right, or continuing interest Individual Income Taxes C16-17 Sale or Exchange–Franchises, Trademarks, and Trade Names (slide 9 of 11) • Significant powers, rights, or continuing interests include: – Control over assignment, quality of products and services – Sale or advertising of other products or services – The right to require that substantially all supplies and equipment be purchased from the transferor – The right to terminate the franchise at will, and – The right to substantial contingent payments Individual Income Taxes C16-18 Sale or Exchange–Franchises, Trademarks, and Trade Names (slide 10 of 11) • Noncontingent payments are ordinary income to the transferor – The franchisee capitalizes the payments and amortizes them over 15 years • Contingent payments are ordinary income for the franchisor and an ordinary deduction for the franchisee Individual Income Taxes C16-19 Sale or Exchange–Lease Cancellation Payments (slide 11 of 11) • Lessee treatment – Treated as received in exchange for underlying leased property • Capital gain results if asset leased was a capital asset (e.g., personal use ) • Ordinary income results if asset leased was an ordinary asset (e.g., used in lessee’s business and lease has existed for one year or less when canceled) • Lease could be a § 1231 asset if the property is used in lessee’s trade or business and the lease has existed for > a year when it is canceled • Lessor treatment – Payments received are ordinary income (rents) Individual Income Taxes C16-20 Holding Period (slide 1 of 3) • Short-term – Asset held for 1 year or less • Long-term – Asset held for more than 1 year • Holding period starts on the day after the property is acquired and includes the day of disposition Individual Income Taxes C16-21 Holding Period (slide 2 of 3) • Nontaxable Exchanges – Holding period of property received includes holding period of former asset if a capital or §1231 asset • Transactions involving a carryover basis – Former owner’s holding period tacks on to present owner’s holding period if a nontaxable transaction and basis carries over • Inherited property is always treated as long term no matter how long it is held by the heir Individual Income Taxes C16-22 Holding Period (slide 3 of 3) • Short sales – Taxpayer sells borrowed securities and then repays the lender with substantially identical securities – Gain or loss is not recognized until the short sale is closed – Generally, the holding period for a short sale is determined by how long the property used for repayment is held • If substantially identical property (e.g., other shares of the same stock) is held by the taxpayer, the short-term or long-term character of the short sale gain or loss may be affected Individual Income Taxes C16-23 Tax Treatment of Capital Gains and Losses (slide 1 of 7) • Noncorporate taxpayers – Capital gains and losses must be netted by holding period • Short-term capital gains and losses are netted • Long-term capital gains and losses are netted • If possible, long-term gains or losses are then netted with short-term gains or losses – If the result is a loss: – The capital loss deduction is limited to a maximum deduction of $3,000 – Unused amounts retain their character and carryforward indefinitely Individual Income Taxes C16-24 Tax Treatment of Capital Gains and Losses (slide 2 of 7) • Noncorporate taxpayers (cont’d) – If net from capital transactions is a gain, tax treatment depends on holding period • Short-term (assets held 12 months or less) – Taxed at ordinary income tax rates • Long-term (assets held more than 12 months) – An alternative tax calculation is available using preferential tax rates Individual Income Taxes C16-25 Tax Treatment of Capital Gains and Losses (slide 3 of 7) • Noncorporate taxpayers (cont’d) – Net long-term capital gain is eligible for one or more of four alternative tax rates: 0%, 15%, 25%, and 28% • The 25% rate applies to unrecaptured §1250 gain and is related to gain from disposition of §1231 assets • The 28% rate applies to collectibles • The 0%/15% rates apply to any remaining net longterm capital gain Individual Income Taxes C16-26 Tax Treatment of Capital Gains and Losses (slide 4 of 7) • Collectibles, even though they are held long term, are subject to a 28% alternative tax rate • Collectibles include any: – – – – – – – Work of art Rug or antique Metal or gem Stamp Alcoholic beverage Historical objects (documents, clothes, etc.) Most coins Individual Income Taxes C16-27 Tax Treatment of Capital Gains and Losses (slide 5 of 7) • Qualified dividend income paid from current or acc. E & P is eligible for the 0%/15% long-term capital gain rates – After determining net capital gain or loss, qualified dividend income is added to the net long-term capital gain portion of the net capital gain and is taxed as 0%/15% gain • If there is a net capital loss, it is still deductible for AGI – Limited to $3,000 per year with the remainder of the loss carrying over • In this case, the qualified dividend income is still eligible to be treated as 0%/15% gain in the alternative tax calculation – It is not offset by the net capital loss Individual Income Taxes C16-28 Tax Treatment of Capital Gains and Losses (slide 6 of 7) • The alternative tax on net capital gain applies only if taxable income includes some net long-term capital gain – Net capital gain may be made up of various rate layers • For each layer, compare the regular tax rate with the alternative tax rate on that portion of the net capital gain • The layers are taxed in the following order: 25% gain, 28% gain, the 0% portion of the 0%/15% gain, and then the 15% portion of the 0%/15% gain • This allows the taxpayer to receive the lower of the regular tax or the alternative tax on each layer of net capital gain Individual Income Taxes C16-29 Tax Treatment of Capital Gains and Losses (slide 7 of 7) • Corporate taxpayers – Differences in corporate capital treatment • There is a NCG alternative tax rate of 35 % – Since the max corporate tax rate is 35 %, the alternative tax is not beneficial • Net capital losses can only offset capital gains (i.e., no $3,000 deduction in excess of capital gains) • Net capital losses are carried back 3 years and carried forward 5 years as short-term losses Individual Income Taxes C16-30 If you have any comments or suggestions concerning this PowerPoint Presentation for South-Western Federal Taxation, please contact: Dr. Donald R. Trippeer, CPA trippedr@oneonta.edu SUNY Oneonta Individual Income Taxes C16-31