Document 10310710

advertisement

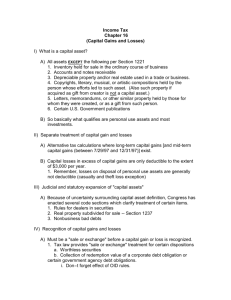

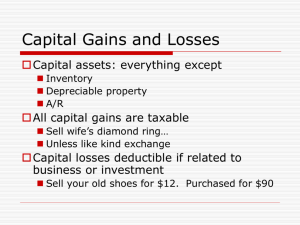

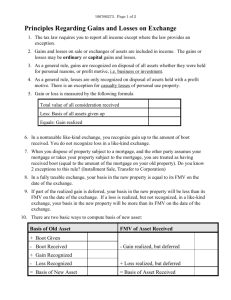

Presentation: Federal Income Taxation Chapter 8 Capital Gain and Losses Professor Wells November 15, 2012 1 Chapter 8 Capital Gains and Losses Issues in this Chapter: 1) Meshing capital gains and losses 2) Capital gains policy issues 3) Sale or exchange requirement 4) “Capital Asset” definition 5) Depreciation recapture 6) Code § 1231 property defined 7) Hedging transactions 2 Mechanics of the Treatment of Capital Gains & Losses §1001(a) – determine the amount of the gain realized; how determine tax basis? See §6045(g) re brokers to report basis re securities transactions. §1001(c) - gain to be “recognized” - unless otherwise provided 3 Tax Benefits and Planning Objectives re Capital Gains 1. Beneficial rate treatment - §1(h) provides for a 15% tax rate for long term capital gains, subject to certain exceptions (e.g., collectibles). 2. Capital losses cannot be used to offset ordinary income (except for individuals to the extent of $3,000 per year). How maximize the use of capital losses? 3. Definitional consideration: what is a capital asset? 4 When Capital Gains Exceed Capital Losses p.699 Capital gains - §1(h) - lower tax rates. Code §1222(11) - the excess of net long-term capital gain over net short-term capital loss is “net capital gain”. Meshing of (i) long term capital gains and losses and (ii) short term capital gains and losses is required to preclude arbitraging the tax rate structure. 5 Capital Losses Exceed Capital Gains 1) Deductible losses are available only to the extent of aggregate capital gains, but each year individuals can deduct $3,000 excess capital losses against ordinary income. Code §1211(b). 2) Code §1212(b) allows an indefinite carryover of capital losses for individuals. Code §1212(a) provides a five year carryover limit for corporations, but a carryback is available for three years. 6 Problem - Cathy & John Original Problem: W stock $10,000 LTCG X stock $3,000 LTCL Y stock $4,000 STCG Z stock $9,000 STCL Revised Problem W stock $10,000 LTCG X stock $3,000 LTCL Q stock $5,000 STCG Y stock $4,000 STCG Z stock $9,000 STCL $7,000 Net LTCG p.610 $2,000 Net Cap. Gain $5,000 Net STCL $7,000 Net LTCG $7,000 Net Cap. Gain $0 Net STCL 7 Planning considerations – “Harvesting losses” Sell gain and loss assets in the same year? No (except for those individuals regularly having significant capital gains and losses); stagger gains and losses so as to (a) first use capital losses against $3,000 of ordinary income, and (b) then have long term gains taxed at the preferable 15% tax rate (or in reverse chronological order). 8 Defining the Term “Capital Asset” – Code § 1221 p.615 Code §1221 provides a definition of “capital asset” as not Including: (i) inventory and property held primarily for sale to customers (ii) Real property or depreciable property used in a trade or business, but see §1231. (iii) Copyrights and similar property (iv) Accounts receivable (v) US government publications §1231 property– Losses ordinary. Gains capital. 9 Capital Gains Tax Rate Policy Issues p.616 1) Will lowering the capital gains tax rate increase tax revenues by unlocking gains and causing gain recognition for income tax purposes? 2) Relief for possible income bunching effect (because multiple years value accrual is taxed in one year)? Is the indexation of tax basis to reflect inflation a better option? 3) Relieve the impact of inflation (but cf., assets held (i) one year+ or (ii) 10 years); 4) Consider the “lock-in” effect of the impact of capital gains tax rates & Code §1014. Avoid by eliminating the realization concept? Some Code provisions do this, e.g., §475. 5) The “realization” concept itself does enable (i) tax deferral (cf., Haig-Simons) & (ii) income tax benefits 10 Capital Gains Tax Rate As Enabling Tax Regressivity? Who owns most capital assets which produce capital gains? The highest income individuals? Should capital gain income be subject to the same rate as wage income? Or, reward risk-taking? Does the lower rate represent implementation of a quasi consumption tax approach? 11 Why the Limit on Capital Loss Utilization? P.618 Taxpayer cannot realize losses to offset against ordinary income (while not realizing economically accrued gains). The limited $3,000 deduction for individuals does permit low level “cherry picking” for loss utilization. See §1211(b) re $3,000 capital loss allowance. 12 Differentiating: Capital Asset or Wages? Note the discussion concerning compensation paid to hedge fund & private equity fund managers: i.e., the “2 & 20” formula. The 2% of amount invested constitutes compensation. But, what about the 20% participation in the upside gains? Particularly, when no cash investment is made by the managers. Cf., growth of the value of a private company from “sweat equity.” 13 Bielfeldt v. Commissioner Sale to “Customers” p.620 §1221(a)(1) provides for exclusion from capital asset status of property held for sale. Here: Taxpayer held property for as a “trader” but not a dealer Note §475(f) would have given ordinary treatment. Why? 14 Biedenharn Realty Co. v. United States p.624 Property held for investment or held for sale? Dual use. Court held that property held for sale. Factors considered: 1) Frequency and substantiality of sales 2) Development and improvement activities for the land 3) Seller’s solicitation and advertising efforts in sales 4) Relative earnings – property sales vs. earned income 5) Bulk sales 6) Liquidation of investments? 15 Corn Products Case p.635 Were purchases and sales of corn futures contracts capital asset transactions? Taxpayer says futures trading was separate from its manufacturing operations. And, therefore, capital gains (and losses) from the futures contracts. Sup. Ct. says futures contracts are equivalent to inventory and, therefore, ordinary income (and loss) realized on disposition. CBOT CBOT 1 2 Grain Elevator Farmer 16 “Corn Products” Doctrine Arkansas Best Case p.638 Issue: Was corporate stock a capital asset? Facts: Taxpayer acquired stock in a Dallas bank. The stock was sold at a loss after the bank became a problem bank (& ordinary loss?). Tax Court held the stock purchases during bank's “problem phase” were made exclusively for business purposes. Reversed by 8th Cir. and Supreme Court affirmed. Acquisition purpose not deemed relevant. 17 Sequels to Arkansas Best p. 641-642 No tax “common law” definition of a capital asset (assumed after Corn Products case). But, a broad construction of §1221(a)(1). Regulatory response: Reg. §1.1221-2 which limits non capital asset treatment to hedging transactions/ “risk reduction.” 18 Changes to IRC §1221 (1999) Exceptions to capital gains definition: §1221(a)(6) – commodities derivative financial instruments §1221(a)(7) – hedging transactions (timely identification required) §1221(a)(8) – supplies of a type consumed by the taxpayer in ordinary course of business (e.g., airlines purchase of fuel). 19 Common Law: Substitute for Rent Hort v. Commissioner p.642 Lump sum payment received by owner upon cancellation of lease as a substitute for future rent. “Substitute for Ordinary Income” proves too much. 20 McAllister v. Commissioner p.647 Facts: Richard McAllister (Richard I) by will created a trust fund of $100,000. The income was to go to his son John for life, then to John’s widow for life, then to John’s brother, Richard II. When John died, his estate needed cash, so his widow, the taxpayer in this case, sold her life estate to Richard II for $55,000. She reported a capital loss of $8,790. Held: The taxpayer’s position is sustained. She sold a property interest or right. This was not an assignment of income. Consideration received characterized as capital gain. What is the life tenant’s tax basis? See §1001(e). Cf., Blair case re assignment of income. 21 Lottery Winner Womack v. Commissioner p.651 The Womacks won the right to twenty annual payments of $150,000 from the Florida State Lottery. After they received annual payments for four years, the total remaining amount of payments was $2,400,000. They sold the right to those remaining payments for $1,328,000, which they claimed was capital gain and the Commissioner treated as ordinary income. Held: The Third Circuit affirmed the ruling of the Tax Court that Lottery Rights are not capital asset under the judicially established substitute for ordinary income doctrine. Rationale:: a substitute for the regular receipt of ordinary income and, therefore, ordinary income. Equivalent to earned income. 22 Oil Payments Commissioner v. P.G. Lake p.656 Corporation transferred a 600x oil payment to officer to pay loan. Treatment of assignment as a capital asset transfer. Held taxable as ordinary income since a substitute for ordinary income. Response is Code §636 – treat the transaction as a loan. 23 Bootstrap Sale to Charity Commissioner v. Brown p.659 Insert Facts: Clay Brown and family owned all the shares of Clay Brown & Co. (CB Co.). Clay Brown sold their shares to the California Institute for Cancer Research for $1,300,000, payable $5,000 cash at the outset and the rest in deferred payments over not more than 10 years. The agreement called for the Charity to lease the assets to a Fortuna Sawmills, Inc. which was in turn owned by Clay Brown. Fortuna paid rent equal to 80 percent of its operating profits (before depreciation). Fortuna deducted the lease payments and the Charity was nontaxable on its receipt. The Charity used the proceeds to pay Clay Brown the purchase price, and Clay Brown claimed Long-Term Capital Gain Treatment on the gain from the contingent sales price. Held: Clay Brown wins 24 Lattera Synthesis “Family Resemblence Test” p.653 . Judge Ambro Posits this synthesis: Step One: Look to Type of Carve-Out First. Horizontal carve-out leads to ordinary income. Vertical carve-outs lead to step #2. Step Two: Because a vertical carve-out could signal either capital gains or ordinary income, we then look to the character of the underlying asset and apply the “family resemblance test.” A. Assets gives a right to Earned Income create ordinary income when sold (examples: landlord’s leasehold rights in rental, annuity rights, right to interest income return, contractual payment rights). All of these resemble a right to already earned income. If the sale is of property that has a “family resemblance” to an asset that represents a right to earned income, then ordinary income treatment. B. Assets that represent a right to Earn Income create capital gain (stocks, land, tangible personal property). If the sale is of a vertical interest in an asset that has a “family resemblance” to an asset that earns income, then capital gain treatment. 25 Abandonment or Terminating Rights Baker v. Commissioner p.670 Abandonment of property can constitute a “sale or exchange.” Termination of a contract can constitute a sale or exchange but not where merely terminating a right to ordinary employment income. Note Code §1241 re capital gain to lessee for payment to terminate a lease. 26 Theatrical Production Rights Commissioner v. Ferrer p.679 1) Surrender of the lease of the play is not excluded from capital gains treatment. 2) Negative power to prevent disposition or motion picture rights until after play production – capital gain proceeds. 3) Right to receive portion of motion picture proceeds – not capital. 27 Right of Privacy Miller v. Commissioner p.687 Facts: The widow of famous bandleader Glenn Miller entered into a contract with Universal Studios granting it the exclusive right to make a movie based on Glenn Miller’s life. At the time the case arose it was unclear what, if any, rights Mrs. Miller might have had in respect of her deceased husband’s story (or her own). The movie was a hit and Mrs. Miller collected $409,336, which she claims was from the sale of property and therefore was capital gain. Held: Ordinary income. Whatever it was that she had that resulted in the payment, it was not “property.” 28 Patents §1235 p.690 §1235 provides capital gain treatment on the sale of a patent by an individual inventor. Even where consideration is based on royalties. All substantial rights in the patent to be transferred to enable capital gains treatment. §§1221 and 1231 apply to other patent transfers (But see 1221(b)(3) for musical copyrights). 29 Prior Related Transaction p.697 Merchant National Bank v. Commissioner Facts: The taxpayer bank held promissory notes for loans that turned sour and wrote them off completely as ordinary losses in 1941 and 1943. It 1944 it sold the notes for $18,460. Held: Ordinary income. 30 Prior Related Transaction Arrowsmith v. Commissioner p.698 Taxpayer liquidated a corporation. Gain reported on stock redemption as capital gain. Later taxpayer required to pay a judgment against the corporation. Payment treated as a capital loss, not as an ordinary and necessary business expense. Skelly Oil (page 700) in Note 31 Hypothetical: Sale of Business FACTS: Seller sales a business for $5 million in cash and has a basis of $4 million. Assume only asset is a §1231 asset that has $300,000 of depreciation recapture. 1 Sell of Asset for $5 million $5 million of cash Seller Buyer QUESTION #1: What is the tax consequence on the sale? QUESTION #2: Now assume that there was a defect in the equipment and Seller must reimburse Buyer $1.2 million for this undisclosed by reason of the indemnity clause of the purchase & sale agreement. What result? §1231 Asset 2 Reimbursement of $1.2 million $1.2 million of cash Seller Buyer 32 U.S. v. Skelly Oil FACTS: Skelly sold natural gas at regulated price and claimed percentage depletion on those sales of 27.5%. Skelly Oil had to repay a portion of these proceeds ($505,536.54). Only $366,513.99 had been subject to tax in the earlier year (i.e., $505,536.54 * 72.5%). Taxpayer claims a 100% deduction on the $505,536.54 repayment while IRS claims that the repayment should only give rise to a $366,513.99. Holding: Deduction limited to only 72.5% of amount of repayment under tax benefit rule principles, citing Arrowsmith. 33