Chapter Objectives

advertisement

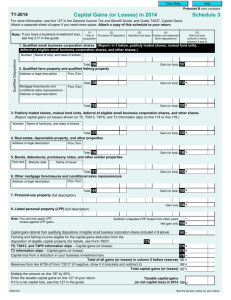

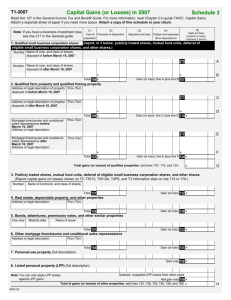

Chapter Objectives Be able to: ■ Explain the difference between capital income and business income. ■ Apply the general rules in determining capital gains and losses. ■ Identify and apply the special rules related to capital losses. ■ Identify the specific capital properties that have special rules and apply them in computing capital gains and losses. Capital Property Defined ■ ■ ■ ■ In order for a property to be classified as a capital property, it must have been acquired and used for the purpose of providing the owner with a long-term or enduring benefit. The key is establishing the intended purpose of the acquisition as the definition does not require that it be held for the long-term or that it must provide a benefit. The nature of the asset is not relevant since the same property may be capital property to one taxpayer and inventory, part of a business activity, to another. There are four factors which should be taken into account together in establishing the taxpayer’s original intention: period of ownership, nature of the transaction, number and frequency of the transactions, and relation of transaction to taxpayer’s business. When there is a change in use of the property, the CCRA has a policy that the gain can be allocated between capital and business income. Categories of Capital Property ■ ■ ■ ■ For the purpose of Canadian securities, an election can be made to treat all such transactions as capital income. However, the election is in force indefinitely. One of the implications is that losses will be capital losses and, thus, only deductible against capital gains. Personal use property is property that is used primarily for the personal use or enjoyment of the taxpayer and does not generate any financial returns. Listed personal property is personal use property that has some element of investment value such as: jewellery, stamps, coins, paintings, and sculptures. Financial property is property that was acquired primarily to generate a financial reward such as: shares, bonds, land, building, equipment, an vehicles. General Rules for Determining Capital Gains (Losses) ■ ■ ■ ■ The capital gain (loss) is calculated by deducting the adjusted cost base and expenses of disposition from the proceeds of disposition (POD). The taxable capital gain (loss) is one-half of the capital gain (loss). However, if capital losses exceed capital gains, the net result must be carried over to other periods as a net capital loss which is only deductible against capital gains in those other periods. Normally, a capital property is disposed on when sold and the POD is the fair market value of the property received in exchange. However, capital property may be disposed of under other circumstances and there are special rules to deal with them. The adjusted cost base (ACB) is the original purchase price plus related costs such as brokerage and installation costs. Expenses of disposition would be similar related costs. Deferred Proceeds ■ ■ ■ ■ ■ ■ When the vendor of a capital property accepts payment over a number of years, the related capital gain can also be allocated,within limits, over a number of years. The deferred recognition of capital gains is restricted to a maximum of five years and a minimum of 20% of the capital gain must be recognized, on a cumulative basis, for each of the five years. This method for recognizing capital gains is optional for each property sold. The five-year limit is extended to ten years when the sale is to a child and the property sold is small business shares or farm property. This is a permitted reserve and it is discretionary. If the buyer assumes a debt as part of the purchase, then the amount of equity in the property can be substituted for total proceeds in the calculation. Unique Aspects of Capital Losses ■ ■ ■ Loss on a loan to or shares in a small business corporation qualify as an allowable business investment loss (ABIL). Although this loss is a capital loss, it is treated as a non-capital loss and can be deducted against all sources of income. However, after the seven-year carry forward period, it converts back to a net capital loss carry forward. When an outstanding debt of a corporation is established to be a bad debt, the loan can be deemed to be disposed of and, thus, trigger a capital loss before the debt is actually disposed of. There is a similar provision for shares of a corporation but the deemed disposition can not be triggered until the corporation has become legally bankrupt or equivalent. Unique Aspects of Capital Losses (continued) ■ ■ ■ ■ ■ It is impossible to have a capital loss on the disposal of depreciable property. When a capital property is disposed of for a loss and then reacquired within 30 days before or after the date of disposition, the resulting loss is classified as a superficial loss, deemed to be nil for tax purposes, and added to the ACB of the reacquired asset. The same rule applies when the asset is sold to a related corporation or his/her RRSP. Losses on personal use property (PUP) are deemed to be nil and can not be used to offset gains on personal use property which is taxable. Losses on listed personal property (LPP) are recognized but they are only deductible against gains on listed personal property. Assets of PUP or LPP that cost less than $1,000 are deemed to have a cost of $1,000 and have POD of $1,000. Unique Aspects of Specific Capital Properties ■ ■ ■ ■ When identical properties are purchased over time, the weighted average should be used in computing ACB. An example is shares. When securities are converted or exchanged for shares of the same corporation, the ACB of the old security becomes the ACB for the new security. If the purchaser of an option exercises it, the cost of the option is added to the ACB of the property purchased. If the option is allowed to expire, the cost is treated as a capital loss in the year of expiry. When the seller of an option receives payment, it is immediately treated as a capital gain. If the option is exercised in the future, the option is added to the POD and the capital gain is determined and the tax return for the prior period would be revised to eliminate the capital gain. Unique Aspects of Specific Capital Properties (cont) ■ ■ ■ ■ For the purpose of commodities and commodities futures, an election can be made to allow taxpayers to choose between capital and business income. The election must be used consistently in future years. Gains or losses on the sale of eligible capital property, such as goodwill, is treated as business income. Although principal residences are personal use property and their gains are taxable, there is a special exemption to eliminate the gain on the disposition of a principal residence. If there is more than one principal residence, only one may be designated for the special exemption in any particular year. Mutual fund distributions retain the characteristics of the original source transactions. Real Estate Used to Carry on a Business ■ ■ ■ ■ There are special rules regarding the replacement of real estate used to carry on a business as long as the replacement property is used for a purpose similar to the original property. If the replacement is voluntary and the real estate is replaced by the end of the taxation year following the year of disposition, the gain will reduce the ACB of the replacement property. This exception does not apply to real estate used to earn property income from rentals. If the replacement is involuntary, such as expropriation, and the real estate is replaced by the end of the second taxation year following the year of disposition, the gain will reduce the ACB of the replacement property. Neither of the exceptions apply to personal use real estate.