Chapter 16

Property Transactions:

Capital Gains and Losses

Individual Income Taxes

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

1

The Big Picture (slide 1 of 3)

• Maurice has come to you for tax advice regarding his

investments.

– He inherited $500,000 from his Uncle Joe and, following

the advice of a financial adviser, made the following

investments 9 months ago.

• $5,000 for 100 shares of Eagle Company stock.

• $50,000 for a 50% interest in a patent that Kevin, an

unemployed inventor, had obtained for a special

battery he had developed to power ‘‘green’’ cars.

– To date, Kevin has been unable to market the battery to an auto

manufacturer or supplier.

2

The Big Picture (slide 2 of 3)

• $95,000 to purchase a franchise from Orange, Inc.

• $200,000 in the stock of Purple, a publicly held bank

that does not pay dividends.

– At one time, the stock had appreciated to $300,000, but

now it is worth only $210,000.

• Maurice is considering unloading this stock.

• $50,000 in tax-exempt bonds.

– The interest rate is only 3%.

– Maurice is considering moving this money into taxable

bonds that pay 3.5%.

• $100,000 for a 10% limited partnership interest in a

real estate development.

– Lots in the development are selling well.

3

The Big Picture (slide 3 of 3)

• Maurice read an article that talked about the

beneficial tax rates for capital assets and dividends.

– He really liked the part about ‘‘costless’’ capital gains,

although he did not understand it.

• Maurice has retained his job as a toll booth operator

at the municipal airport.

– His annual compensation is $35,000.

• Respond to Maurice’s inquiries.

– Read the chapter and formulate your response.

4

Taxation of Capital

Gains and Losses

• Capital gains and losses must be separated

from other types of gains and losses for two

reasons:

– Long-term capital gains may be taxed at a lower

rate than ordinary gains

– A net capital loss is only deductible up to $3,000

per year

5

Taxation of Capital

Gains and Losses

• Capital gains and losses must be separated

from other types of gains and losses for two

reasons:

– Long-term capital gains may be taxed at a lower

rate than ordinary gains

– A net capital loss is only deductible up to $3,000

per year

6

Proper Classification of

Gains and Losses

• Depends on three characteristics:

– The tax status of the property

• Capital asset, §1231 asset, or ordinary asset

– The manner of the property’s disposition

• By sale, exchange, casualty, theft, or condemnation

– The holding period of the property

• Short term and long term

7

Capital Assets

(slide 1 of 6)

• §1221 defines capital assets as everything

except:

– Inventory (stock in trade)

– Notes and accounts receivables acquired from the

sale of inventory or performance of services

– Realty and depreciable property used in a trade or

business (§1231 assets)

8

Capital Assets

(slide 2 of 6)

• §1221 defines capital assets as everything except

(cont’d):

– Certain copyrights; literary, musical, or artistic

compositions; or letters, memoranda, or similar property

• Taxpayers may elect to treat a sale or exchange of certain musical

compositions or copyrights in musical works as the disposition of a

capital asset

– Certain publications of U.S. government

– Supplies of a type regularly used or consumed in the

ordinary course of a business

9

Capital Assets

(slide 3 of 6)

• Thus, capital assets usually include:

– Assets held for investment (e.g., stocks, bonds,

land)

– Personal use assets (e.g., residence, car)

– Miscellaneous assets selected by Congress

10

Capital Assets

(slide 3 of 6)

• Thus, capital assets usually include:

– Assets held for investment (e.g., stocks, bonds,

land)

– Personal use assets (e.g., residence, car)

– Miscellaneous assets selected by Congress

11

Capital Assets

(slide 3 of 6)

• Thus, capital assets usually include:

– Assets held for investment (e.g., stocks, bonds,

land)

– Personal use assets (e.g., residence, car)

– Miscellaneous assets selected by Congress

12

Capital Assets

(slide 4 of 6)

• Dealers in securities

– In general, securities are the inventory of securities

dealers, thus ordinary assets

– However, a dealer can identify securities as an

investment and receive capital gain treatment

• Clear identification must be made on the day of

acquisition

13

Capital Assets

(slide 4 of 6)

• Dealers in securities

– In general, securities are the inventory of securities

dealers, thus ordinary assets

– However, a dealer can identify securities as an

investment and receive capital gain treatment

• Clear identification must be made on the day of

acquisition

14

Capital Assets

(slide 5 of 6)

• Real property subdivided for sale

– Taxpayer may receive capital gain treatment on the

subdivision of real estate if the following requirements are

met:

•

•

•

•

Taxpayer is not a corporation

Taxpayer is not a real estate dealer

No substantial improvements made to the lots

Taxpayer held the lots for at least 5 years

– Capital gain treatment occurs until the year in which the 6th

lot is sold

• Then up to 5% of the revenue from lot sales is potential ordinary

income

• That potential ordinary income is offset by any selling expenses

from the lot sales

15

Capital Assets

(slide 5 of 6)

• Real property subdivided for sale

– Taxpayer may receive capital gain treatment on the

subdivision of real estate if the following requirements are

met:

•

•

•

•

Taxpayer is not a corporation

Taxpayer is not a real estate dealer

No substantial improvements made to the lots

Taxpayer held the lots for at least 5 years

– Capital gain treatment occurs until the year in which the 6th

lot is sold

• Then up to 5% of the revenue from lot sales is potential ordinary

income

• That potential ordinary income is offset by any selling expenses

from the lot sales

16

Capital Assets

(slide 6 of 6)

• Nonbusiness bad debts

– A nonbusiness bad debt is treated as a short-term

capital loss in the year it becomes completely

worthless

• Even if outstanding for more than one year

17

Sale or Exchange

• Recognition of capital gains and losses

generally requires a sale or exchange of assets

• Sale or exchange is not defined in the Code

• There are some exceptions to the sale or

exchange requirement

18

Sale or Exchange–Worthless Securities and

§ 1244 Stock (slide 1 of 2)

• A security that becomes worthless creates a

deductible capital loss without being sold or

exchanged

– The Code sets an artificial sale date for the securities on the

last day of the year in which worthlessness occurs

• Section 1244 allows an ordinary deduction on

disposition of stock at a loss

– The stock must be that of a small business company

– The ordinary deduction is limited to $50,000 ($100,000 for

married individuals filing jointly) per year

19

Sale or Exchange–Worthless Securities

(slide 2 of 2)

• Worthless securities example:

– Calendar year taxpayer purchased stock on

December 5, 2014

– The stock becomes worthless on April 5, 2015

– The loss is deemed to have occurred on December

31, 2015

• The result is a long-term capital loss

20

Sale or Exchange

Retirement of Corporate Obligations

• Collection of the redemption value of

corporate obligations (e.g., bonds payable) is

treated as a sale or exchange and may result in

a capital gain or loss

– OID amortization increases basis and reduces gain

on disposition or retirement

21

Sale or Exchange–Options

(slide 1 of 2)

• For the grantee of the option, if the property subject

to the option is (or would be) a capital asset in the

hands of the grantee

– Sale of an option results in capital gain or loss

– Lapse of an option is considered a sale or exchange

resulting in a capital loss

• For the grantor of an option, the lapse creates

– Short-term capital gain, if the option was on stocks,

securities, commodities or commodity futures

– Otherwise, ordinary income

22

Sale or Exchange–Options

(slide 2 of 2)

• Exercise of an option by a grantee

– Increases the gain (or reduces the loss) to the

grantor from the sale of the property

– Gain is ordinary or capital depending on the tax

status of the property

• Grantee adds the cost of the option to the basis

of the property acquired

23

The Big Picture - Example 13

Options (slide 1 of 4)

• Return to the facts of The Big Picture on p. 16-1.

• On February 1, 2015, Maurice purchases 100 shares

of Eagle Company stock for $5,000.

– On April 1, 2015, he writes a call option on the stock,

giving the grantee the right to buy the stock for $6,000

during the following six-month period.

– Maurice (the grantor) receives a call premium of $500 for

writing the call.

24

The Big Picture - Example 13

Options (slide 2 of 4)

• Return to the facts of The Big Picture on p. 16-1.

• If the call is exercised by the grantee on August 1,

2015, Maurice has $1,500 of short-term capital gain

from the sale of the stock.

– $6,000 + $500 − $5,000 = $1,500

• The grantee has a $6,500 basis for the stock.

– $500 option premium + $6,000 purchase price

25

The Big Picture - Example 13

Options (slide 3 of 4)

• Return to the facts of The Big Picture on p. 16-1.

• Assume that Maurice decides to sell his stock prior to exercise

for $6,000 and enters into a closing transaction by purchasing

a call on 100 shares of Eagle Company stock for $5,000.

– Because the Eagle stock is selling for $6,000, Maurice must pay a call

premium of $1,000.

• He recognizes a $500 short-term capital loss on the closing

transaction.

– $1,000 (call premium paid) − $500 (call premium received)

• On the actual sale of the Eagle stock, Maurice has a short-term

capital gain of $1,000

– $6,000 (selling price) − $5,000 (cost)

26

The Big Picture - Example 13

Options (slide 4 of 4)

• Return to the facts of The Big Picture on p. 16-1.

• Assume that the original option expired unexercised.

– Maurice has a $500 short-term capital gain equal

to the call premium received for writing the option.

• This gain is not recognized until the option expires.

– The grantee has a loss from expiration of the

option.

• The nature of the loss will depend upon whether the

option was a capital asset or an ordinary asset.

27

Sale or Exchange–Patents

• When all substantial rights to a patent are

transferred by a holder to another, the transfer

produces long-term capital gain or loss

– The holder of a patent must be an individual,

usually the creator, or an individual who purchases

the patent from the creator before the patented

invention is reduced to practice

28

The Big Picture - Example 14

Patents (slide 1 of 2)

• Return to the facts of The Big Picture on p. 16-1.

• Kevin transfers his 50% rights in the battery

patent to the Green Battery Co.

– In exchange, he receives $1 million plus $.50 for

each battery sold.

29

The Big Picture - Example 14

Patents (slide 2 of 2)

• Assuming Kevin has transferred all substantial rights,

Kevin automatically has a long-term capital gain.

– Both the $1 million lump-sum payment and the $.50 per

battery royalty qualify (less his basis in the patent).

– Kevin also had an automatic long-term capital gain when

he sold 50% of his rights in the patent to Maurice.

• Whether Maurice gets long-term capital gain

treatment on the transfer to Green Battery will depend

on whether he is a holder (see the discussion below

and Example 15).

30

The Big Picture - Example 15

Holder Of A Patent (slide 1 of 2)

• Return to the facts of The Big Picture on p. 16-1 and

continuing with the facts of Example 14

• Kevin is clearly a holder of the patent

– He is the inventor and was not an employee when

he invented the battery.

31

The Big Picture - Example 15

Holder Of A Patent (slide 2 of 2)

• When Maurice purchased a 50% interest in the patent, he

became a holder if the patent had not yet been reduced to

practice.

– Since the patent was not being manufactured at the time of the

purchase, it had not been reduced to practice.

• Consequently, Maurice is also a holder.

– He has an automatic long-term capital gain or loss if he transfers his

50% interest to Green Battery Co.

• Maurice’s basis for his share of the patent is $50,000, and his

share of the proceeds is $1 million plus $.50 for each battery

sold.

• Thus, Maurice has a long-term capital gain even though he has

not held his interest in the patent for more than one year.

32

Sale or Exchange–Franchises, Trademarks, and

Trade Names (slide 1 of 3)

• The licensing of franchises, trade names,

trademarks, and other intangibles is generally

not considered a sale or exchange of a capital

asset

– Therefore, ordinary income results to transferor

• Exception: Capital gain (loss) may result if the

transferor does not retain any significant power, right, or

continuing interest

33

Sale or Exchange–Franchises, Trademarks, and

Trade Names (slide 2 of 3)

• Significant powers, rights, or continuing

interests include:

–

–

–

–

Control over assignment

Quality of products and services

Sale or advertising of other products or services

The right to require that substantially all supplies

and equipment be purchased from the transferor

– The right to terminate the franchise at will, and

– The right to substantial contingent payments

34

Sale or Exchange–Franchises, Trademarks, and

Trade Names (slide 3 of 3)

• When the transferor retains a significant power, right,

or continuing interest, the transferee’s noncontingent

payments are ordinary income to the transferor

– The franchisee capitalizes the payments and amortizes

them over 15 years

• Whether the transferor retains a significant power,

right, or continuing interest, contingent payments are

ordinary income for the franchisor and an ordinary

deduction for the franchisee

35

Sale or Exchange–Franchises, Trademarks, and

Trade Names (slide 3 of 3)

• When the transferor retains a significant power, right,

or continuing interest, the transferee’s noncontingent

payments are ordinary income to the transferor

– The franchisee capitalizes the payments and amortizes

them over 15 years

• Whether the transferor retains a significant power,

right, or continuing interest, contingent payments are

ordinary income for the franchisor and an ordinary

deduction for the franchisee

36

Sale or Exchange–Franchises, Trademarks, and

Trade Names (slide 3 of 3)

• When the transferor retains a significant power, right,

or continuing interest, the transferee’s noncontingent

payments are ordinary income to the transferor

– The franchisee capitalizes the payments and amortizes

them over 15 years

• Whether the transferor retains a significant power,

right, or continuing interest, contingent payments are

ordinary income for the franchisor and an ordinary

deduction for the franchisee

37

The Big Picture - Example 16

Sale of Franchise

• Return to the facts of The Big Picture on p. 16-1

• Maurice sells for $210,000 to Mauve, Inc., the

franchise purchased from Orange, Inc., nine months

ago.

– The $210,000 received by Maurice is not contingent, and

all significant powers, rights, and continuing interests are

transferred.

– The $115,000 gain ($210,000 proceeds − $95,000 adjusted

basis) is a short-term capital gain because Maurice has held

the franchise for only nine months.

38

Sale or Exchange

Lease Cancellation Payments

• Lessee treatment

– Treated as received in exchange for underlying leased

property

• Capital gain results if asset leased was a capital asset (e.g., personal

use )

• Ordinary income results if asset leased was an ordinary asset (e.g.,

used in lessee’s business and lease has existed for one year or less

when canceled)

• Lease could be a § 1231 asset if the property is used in lessee’s

trade or business and the lease has existed for > a year when it is

canceled

• Lessor treatment

– Payments received are ordinary income

• Considered to be in lieu of rental payments

39

Holding Period

(slide 1 of 3)

• Short-term

– Asset held for 1 year or less

• Long-term

– Asset held for more than 1 year

• Holding period starts on the day after the

property is acquired and includes the day of

disposition

40

Holding Period

(slide 2 of 3)

• Nontaxable Exchanges

– Holding period of property received includes holding period of former

asset if a capital or §1231 asset

• Transactions involving a carryover basis

– Former owner’s holding period tacks on to present owner’s holding

period if a nontaxable transaction and basis carries over

• Certain disallowed loss transactions

– Under several Code provisions, realized losses are disallowed.

– When a loss is disallowed, there is no carryover of holding period.

• e.g., Related party losses, sale or exchange of personal use assets

• Inherited property is always treated as long term no matter

how long it is held by the heir

41

Holding Period

(slide 3 of 3)

• Short sales

– Taxpayer sells borrowed securities and then repays the

lender with substantially identical securities

– Gain or loss is not recognized until the short sale is closed

– Generally, the holding period for a short sale is determined

by how long the property used for repayment is held

• If substantially identical property (e.g., other shares of the same

stock) is held by the taxpayer, the short-term or long-term character

of the short sale gain or loss may be affected

42

Holding Period

(slide 3 of 3)

• Short sales

– Taxpayer sells borrowed securities and then repays the

lender with substantially identical securities

– Gain or loss is not recognized until the short sale is closed

– Generally, the holding period for a short sale is determined

by how long the property used for repayment is held

• If substantially identical property (e.g., other shares of the same

stock) is held by the taxpayer, the short-term or long-term character

of the short sale gain or loss may be affected

43

The Big Picture - Example 21

Holding Period

• Return to the facts of The Big Picture on p. 16-1

• Assume that Maurice purchased the Purple

stock on January 15, 2014.

– If he sells it on January 16, 2015, Maurice’s

holding period is more than one year.

– If instead Maurice sells the stock on January 15,

2015, the holding period is exactly one year, and

the gain or loss is short term.

44

Tax Treatment of Capital

Gains and Losses (slide 1 of 7)

• Noncorporate taxpayers

– Capital gains and losses must be netted by holding

period

• Short-term capital gains and losses are netted

• Long-term capital gains and losses are netted

• If possible, long-term gains or losses are then netted

with short-term gains or losses

– If the result is a loss:

– The capital loss deduction is limited to a maximum deduction

of $3,000

– Unused amounts retain their character and carryforward

indefinitely

45

Tax Treatment of Capital

Gains and Losses (slide 2 of 7)

• Noncorporate taxpayers (cont’d)

– If net from capital transactions is a gain, tax

treatment depends on holding period

• Short-term (assets held 12 months or less)

– Taxed at ordinary income tax rates

• Long-term (assets held more than 12 months)

– An alternative tax calculation is available using preferential tax

rates

46

Tax Treatment of Capital

Gains and Losses (slide 3 of 7)

• Noncorporate taxpayers (cont’d)

– Net long-term capital gain is eligible for one or

more of five alternative tax rates: 0%, 15%, 20%,

25%, and 28%

• The 25% rate applies to unrecaptured §1250 gain and is

related to gain from disposition of §1231 assets

• The 28% rate applies to collectibles

• The 0%/15%/20% rates apply to any remaining net

long-term capital gain

– Under the American Taxpayer Relief Act of 2012, the 20%

rate applies beginning in 2013 when the taxpayer’s regular tax

bracket is 39.6%

47

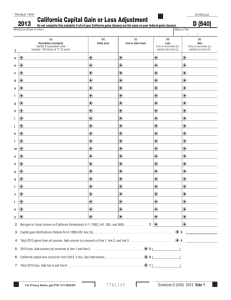

Tax Treatment of Capital

Gains and Losses (slide 4 of 7)

Income Layers for Alternative Tax on Capital Gain Computation

48

Tax Treatment of Capital

Gains and Losses (slide 5 of 7)

• Collectibles, even though they are held long term, are

subject to a 28% alternative tax rate

• Collectibles include any:

–

–

–

–

–

–

–

Work of art

Rug or antique

Metal or gem

Stamp

Alcoholic beverage

Historical objects (documents, clothes, etc.)

Most coins

49

Tax Treatment of Capital

Gains and Losses (slide 6 of 7)

• Qualified dividend income paid from current or acc.

E & P is eligible for the 0%/15%/20% long-term

capital gain rates

– After determining net capital gain or loss, qualified

dividend income is added to the net long-term capital gain

portion of the net capital gain and is taxed as 0%/15%/20%

gain

– If there is a net capital loss, it is still deductible for AGI

• Limited to $3,000 per year with the remainder of the loss carrying

over

• In this case, the qualified dividend income is still eligible to be

treated as 0%/15%/20% gain in the alternative tax calculation

– It is not offset by the net capital loss

50

Tax Treatment of Capital

Gains and Losses (slide 7 of 7)

• The alternative tax on net capital gain applies only if

taxable income includes some net long-term capital

gain

– Net capital gain may be made up of various rate layers

• For each layer, compare the regular tax rate with the alternative tax

rate on that portion of the net capital gain

– The layers are taxed in the following order:

• 25% gain, 28% gain, the 0% portion of the 0%/15%/20% gain, the

15% portion of the 0%/15%/20% gain, and then the 20% portion of

the 0%/15%/20% gain.

• This allows the taxpayer to receive the lower of the

regular tax or the alternative tax on each layer of net

capital gain

51

Tax Treatment of Capital

Gains and Losses (slide 7 of 7)

• The alternative tax on net capital gain applies only if

taxable income includes some net long-term capital

gain

– Net capital gain may be made up of various rate layers

• For each layer, compare the regular tax rate with the alternative tax

rate on that portion of the net capital gain

– The layers are taxed in the following order:

• 25% gain, 28% gain, the 0% portion of the 0%/15%/20% gain, the

15% portion of the 0%/15%/20% gain, and then the 20% portion of

the 0%/15%/20% gain.

• This allows the taxpayer to receive the lower of the

regular tax or the alternative tax on each layer of net

capital gain

52

The Big Picture - Example 37

Qualified Dividend Income

• Return to the facts of The Big Picture on p. 16-1

• After holding the Purple stock for 10 months,

Maurice receives $350 of dividends.

– If Purple is a domestic or qualifying foreign

corporation, these are qualified dividends eligible

for the 0%/15%/20% tax rate.

53

Tax Treatment of Capital

Gains and Losses - Corporate Taxpayers

• Differences in corporate capital treatment

– There is a NCG alternative tax rate of 35 %

• Since the max corporate tax rate is 35 %, the alternative

tax is not beneficial

– Net capital losses can only offset capital gains (i.e.,

no $3,000 deduction in excess of capital gains)

– Net capital losses are carried back 3 years and

carried forward 5 years as short-term losses

54

Refocus On The Big Picture (slide 1 of 3)

• Maurice is correct that certain capital gains and

dividends are eligible for preferential tax treatment

– Tax rates of 0%, 15%, or 20% may apply rather than

regular tax rates.

• You then discuss the potential tax consequences of

each of his investments.

– Purple stock and Eagle stock- To qualify for the beneficial

tax rate, the holding period for the stock must be longer

than one year.

• From a tax perspective, Maurice should retain his stock investments

for at least an additional three months and a day.

• To be eligible for the ‘‘costless’’ capital gains, his taxable income

should not exceed $37,450 for 2015

.

• The dividends received on the Purple stock are “qualified

dividends” eligible for the 0%/15%/20% alternative tax rate.

55

Refocus On The Big Picture (slide 2 of 3)

• Patent - Since he is a ‘‘holder’’ of the patent, it will

qualify for the beneficial capital gain rate regardless

of the holding period if the patent should produce

income in excess of his $50,000 investment.

– However, if he loses money on the investment, he will be

able to deduct only $3,000 of the loss per year (assuming

no other capital gains).

• Tax-exempt bonds.

– The after-tax return on the taxable bonds would be less

than the 3% on the tax-exempt bonds.

– In addition, the interest on the taxable bonds would

increase his taxable income, possibly moving it out of the

desired 15% marginal tax rate into the 25% marginal tax

rate.

56

Refocus On The Big Picture (slide 3 of 3)

• Franchise rights.

– The franchise rights purchased from Orange, Inc., probably require the

payment of a franchise fee based upon sales in the franchise business.

– Maurice should either start such a business or sell the franchise rights.

• Partnership interest.

– The tax treatment related to his partnership interest depends on whether

he is reporting

• His share of profits or losses

– Ordinary income or ordinary loss, or

• Recognized gain or loss from the sale of his partnership interest

– Capital gain or capital loss.

• You conclude your tax advice to Maurice by telling him that

his investments should make economic sense.

– There are no 100% tax rates.

– For example, disposing of the bank stock in the current market could be

the wise thing to do.

57

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr@oneonta.edu

SUNY Oneonta

© 2015 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

58