July 24, 2007

Zacks Research Digest

Research Associate: Sudhanshu Damani, M. Fin.

Editor: Payal Jalan, M. Fin.

Sr. Editor: Ian Madsen, CFA imadsen@zacks.com; 1-800-767-3771 x9417

www.zackspro.com

111 N. Canal Street, Suite 1101 . Chicago, IL 60606

WESCO International Inc.

(WCC-NYSE)

$58.70

Note: This report contains substantially new material. Subsequent reports will have changes highlighted.

Reason for report: 2Q07 Earnings Update

Previous Edition: June 13, 2007

Recent Event

On July 19, 2007, WCC reported its financial results for the quarter ending in June 30, 2007. Total

revenue reported increased by 13.6% annually to $1,518.1 million. EPS increased by 11.9% annually

to $1.17 per share.

Overview

Wesco International Inc. (WCC or the Company), based in Pittsburgh is one of North America’s largest

wholesale distributor of electrical construction products and industrial maintenance. WCC distributes

electrical supplies and equipment and provides integrated supply procurement services. The Company

offers multiple products that include electrical supplies such as wiring devices, fuses, terminals,

connectors, tape, and splicing and marking equipment; and industrial supplies, including tools and

testers, personal protection, consumables, and janitorial and other maintenance, repair and operating

(MRO) supplies. For more information about the Company, please visit www.wescodist.com.

Key investment considerations as identified by analysts are as follows:

Key Positive Arguments

Strong Fundamentals: WCC is the second largest

supplier and distributor of electronic construction

products in the U.S.

Selling Strategy: Products are sold through a sales

and marketing force of about 2500 located in 350 fullservice branches.

Acquisitions: The acquisition pipeline of WCC is

robust and there appears to be plenty of opportunity out

there.

Growing Utility Market: Currently, WCC derives 17%

of its revenue from the utility market that continues to

be robust.

LEAN Efficiency Initiatives: LEAN initiatives helped in

raising operating profit from the core business.

Additionally there is a new focus in driving lean

initiatives in both sales and marketing.

CSC Performance: Revenues grew by 14% driven by

CSC acquisition, which appears to be performing well.

Key Negative Arguments

Highly Leveraged Company: Management has

already used $335 million, out of 400 million committed,

to repurchase its share. Even debt has increased year

over year.

Project Delays: Commercial construction project

delays, weaker housing markets, and sluggish

industrial activity are cause of concern.

Sluggish Growth: Organic growth is negligible and is

expected to remain low for the coming quarters

Potential Risk: WCC faces risk from other distributors

as well as mass merchants, retail chains, and buying

groups.

Note: WCC’s fiscal year references coincide with the calendar year.

© Copyright 2007, Zacks Investment Research. All Rights Reserved.

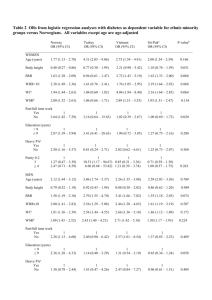

Revenue

Provided below is the summary of revenue as per Zacks Research Digest:

Total Revenue ($M)

2Q06A

1Q07A

2Q07A

Zacks Consensus

3Q07E

4Q07E

2007E

2008E

$1,595.0

$1,563.0

$6,176.0

$6,559.0

2009E

Digest Average

$1,336.0

$1,450.7

$1,518.1

$1,554.7↓

$1,519.6↓

$6,042.9↓

$6,370.8↓

$6,593.3↑

Digest Low

$1,336.0

$1,450.6

$1,518.0

$1,541.5

$1,486.1

$5,996.0

$6,296.2

$6,555.0

Digest High

$1,336.0

$1,451.0

$1,518.1

$1,563.6

$1,571.8

$6,104.2

$6,488.8

$6,625.7

14.6%

13.6%

15.8%

10.4%

13.6%

5.4%

3.5%

5.4%

4.6%

2.4%

-2.3%

Y/Y Growth

Q/Q Growth

5.6%

Zacks Digest average 2Q07 revenue stood at $1518.1 million versus $1336.0 million in 2Q06 and

$1450.7 million in 1Q07 showing an increase of 13.6% annually and 4.6% sequentially. The annual

increase was primarily due to revenue of approximately $181.0 million from Communications Supply

Corporation (CSC), which the Company acquired in 4Q06, representing roughly 13.5% of total growth

in revenue.

However, revenue in the quarter was well below analysts’ expectation and the consensus outlook of

$1574.0 million due primarily to organic growth being essentially flat, up just 0.1% versus guidance of

about 6% and analysts’ expectations of 2%–3%. The Company said that the shortfall in core sales

growth resulted primarily from an unanticipated decline in utility expenditures for distribution material,

and lower commercial construction activity.

Outlook

The Company has reduced full year core growth expectations from 6%–8% to low to mid single digits, it

still believes that 2H will be more positive than 1H. It expects organic sales growth of approximately

2%–4% in 3Q07 with CSC adding between $180 and $190 million for overall sales of about $1.55

billion.

The Company maintained long-term operating margin target of 8.0% and even announced that it is

investing in multiple programs to increase organic topline revenues to achieve this.

Most analysts have reduced their revenue estimates due to slower-than-expected growth rates, pricing

pressure, and higher operating expenses.

One analyst (Morgan Keegan) states that inflationary pricing of products contributed approximately 1%

to internal revenue growth for the quarter. In addition the firm believes that though the Company has

operated in a mode wherein it is not gaining market share to the degree investors have become

accustomed to over the past five years, yet it continues to post growth rates in-line with the underlying

economic trends. It expects that the Company will regain its historical market share advantage in 2008.

Another analyst (R W. Baird) believes that given the current sales trends, coupled with increased

pricing pressure, WCC is losing some market share to competitors and significant sales and earnings

gain will be difficult to achieve.

For more details on individual analyst opinions please see the Consensus tab of the WCC spreadsheet.

Zacks Investment Research

Page 2

www.zackspro.com

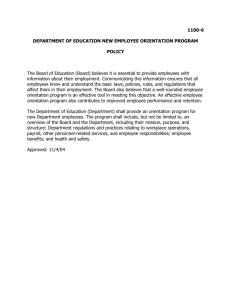

Margins

Provided below is the summary of margins as per Zacks Research Digest:

Margins

2Q06

1Q07A

2Q07A

3Q07E

4Q07E

2007E

2008E

2009E

Gross

Operating

Pre-Tax

Net

20.3%

7.1%

6.2%

4.1%

20.6%

6.1%

5.1%

3.5%

20.3%

6.6%

5.5%

3.8%

20.5%↓

6.8%↓

5.7%↓

3.9%↓

20.9%

6.9%↓

5.8%↓

3.9%↓

20.5%↓

6.6%↓

5.5%↓

3.8%↓

20.7%↓

7.0%↓

6.0%↓

4.1%↓

20.9%↓

7.4%↓

6.5%↓

4.4%↓

Gross margin for 2Q07 stood at 20.3%, flat annually, versus 20.6% in 1Q07 thereby showing a

sequential decline of 30 basis points attributable to significant pricing pressure in some product

categories and markets. Management commented that it is not inclined to relax pricing discipline and

trade-off profitability for volume.

One analyst (Morgan Keegan) believes that price volatility, a later-than-expected round of supplier price

increase, competitive market demand conditions, and the Company’s competitors holding lower cost

inventory than WCC likely created a 10 bps inventory loss on the gross margin line for the quarter.

SG&A expenses for 2Q07 stood at $199.3 million versus $170.2 million in 2Q06 and $202.6 million in

1Q07, thereby showing a y/y growth of 17.1% and a q/q decline of 1.7%. Depreciation and

amortization for 2Q07 stood at $9.2 million versus $6.3 million in 2Q06 and $8.9 million in 1Q07 thereby

showing a y/y growth of 45.8% and a q/q growth of 2.9%.

Operating margin for 2Q07 was 6.6% thereby falling by 50 bps on y/y basis.

Outlook

According to the management, gross margins for 3Q07 should expand modestly with SG&A expected

to improve by 10 bps and depreciation and amortization expense should come in at $9.5 million leading

to operating margin guidance between of 6.7%–6.9%. Management maintained 32% tax rate guidance

with share count between 48 million–49 million for 3Q07 and 49 million–50 million for 2007. The

Company maintained its 2008 target of 8% operating margin. However, one analyst (R.W. Baird)

believes that higher-than-expected revenue growth would be needed to reach this target.

One analyst (J.P. Morgan) believes that gross margin will see a headwind as the business moves

toward more direct ship for late-cycle project business but should still expand owing to productivity

improvements and some acquisition mix benefits.

For more details on individual analyst opinions please see the Consensus tab of the WCC spreadsheet.

Zacks Investment Research

Page 3

www.zackspro.com

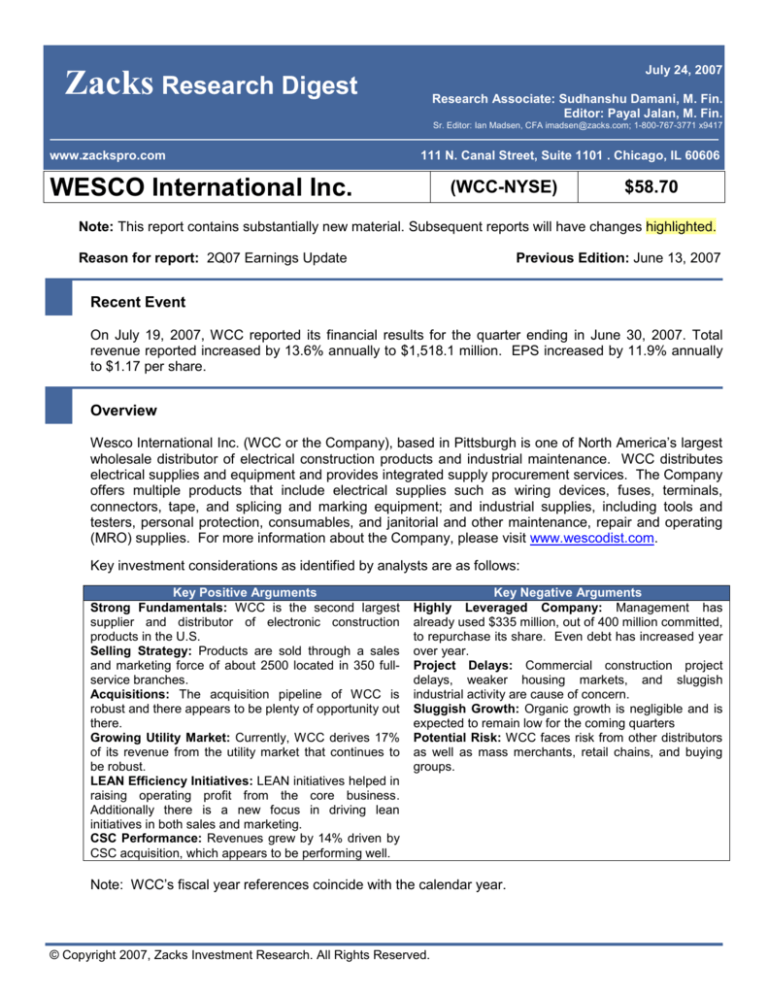

Earnings per Share

Provided below is the summary of EPS as per Zacks Research Digest:

EPS

Zacks Consensus

Digest Average

Digest Low

Digest High

Y/Y Growth

Qtrly. Seq. Growth

2Q06

1Q07A

2Q07A

3Q07E

4Q07E

2007E

2008E

2009E

$1.05

$0.98

$1.06

$0.99

$0.92

$1.08

15.3%

-10.3%

$1.17

$1.17

$1.17

11.9%

18.0%

$1.35

$1.25 ↓

$1.20

$1.30

12.0%

7.1%

$1.29

$1.24↓

$1.09

$1.38

12.0%

-1.2%

$4.89

$4.64↓

$4.45

$4.80

12.1%

$5.62

$5.41↓

$5.17

$5.65

16.7%

$6.14↓

$5.92

$6.40

13.5%

21.6%

Zacks Digest average 2Q07 pro forma EPS was $1.17 versus $1.05 in 2Q06 and $0.99 in 1Q07, a y/y

growth of 11.9% and a q/q growth of 18.0%. GAAP EPS in 2Q07 stood at $1.17 versus $1.01 in 2Q06,

a y/y growth rate of 15.8%.

Outlook

Highlights from the EPS table are as follows:

2007 forecasts (total 10) range from $4.45 (Morgan Keegan) to $4.80 (Wachovia), the average is $4.64.

2008 forecasts (total 10) range from $5.17 (William Blair) to $5.65 (UnionBankSwitz.; Wachovia), the average

is $5.41.

2009 forecasts (total 3) range from $5.92 (Raymond James) to $6.40 (J.P. Morgan); the average is $6.14.

All analyst providing EPS estimates have lowered it for both 2007 and 2008 mainly to reflect the weak

2Q07 and to account for lower organic growth and higher operating expenses.

One analyst (UnionBankSwitz.) believes that the Company’s sales and marketing initiatives, combined

with a pick-up in customer spending, a discipline on pricing, a lagged benefit from copper prices, and

help from share buybacks could drive earnings growth over the next 12 months.

For more details on individual analyst opinions please see the EPS tab of the WCC spreadsheet.

Target Price/Valuation

Of 11 analysts covering the stock, 8 gave positive ratings and 3 gave neutral ratings. There was no

negative rating on the stock. The Zacks Digest average target price was $74.11 (↓ from the previous

Digest report; 26.3% upside from the current price). The price targets range from $66.00 (FTN Midwest

Res.) (12.4% upside from the current price) to $81.00 (J.P. Morgan) (38.0% upside from the current

price). The firm (J.P. Morgan) with the highest target price of $81.00 rated the stock Overweight. The

firm (FTN Midwest Res.) with the lowest target price of $66.00 rated the stock Neutral.

Zacks Investment Research

Page 4

www.zackspro.com

Provided below is the summary of rating and valuation as per Zacks Research Digest:

Rating Distribution

Positive

72.7%

Neutral

27.3%

Negative

0.0%

Digest High

$81.00

Digest Low

$66.00

$74.11 ↓

Avg. Target Price

Analysts with Target Price/Total No.

9/11

According to analysts, risks to the target price include sensitivity of revenue to foreign exchange

fluctuations, various risks associated with the Company’s acquisition strategy, commercial construction

project delays, intense competition in the electrical distribution industry, and risks associated with the

Company’s high financial leverage/debt burden.

Metrics detailing current management effectiveness are as follows:

Metric (TTM)

WCC

Industry

S&P 500

Return on Assets (ROA)

9.88%

7.00%

8.36%

Return on Investments (ROI)

17.47%

9.49%

12.36%

Return on Equity (ROE)

37.75%

18.28%

20.84%

ROA, ROI, and ROE are higher than the overall market averages (as measured by the S&P 500) of

8.36%, 12.36%, and 20.84%, respectively.

For more details on individual analyst opinions please see the Valuation tab of the WCC spreadsheet.

Capital Structure/Solvency/Cash Flow/Governance/Others

Balance Sheet

Cash and cash equivalent in 2Q07 stood at $65.0 million versus $55.3 million in 1Q07, trade accounts

receivable for 2Q07 was $892.2 million versus $865.7 million in 1Q07, inventories for the quarter stood

at $634.8 million versus $606.1 million in 1Q07. On the liability side accounts payable for 2Q07 was

$664.6 million versus $646.7 million in 1Q07, long-term debt for 2Q07 stood at $838.4 million versus

$777.2 million in 1Q07, total stockholder’s equity for the quarter stood at $556.5 million versus $623.2

million in 1Q07.

Share Repurchase

WCC maintained its commitment to the $400 million share repurchase program announced in February

of 2007, repurchasing a total of 5.2 million shares thus far, out of which 2.2 million shares were

purchased in 2Q07, leaving approximately $65 million in authorization.

Zacks Investment Research

Page 5

www.zackspro.com

Acquisition of Cascade Contols Corporation

At the end of June, WCC closed on the acquisition of Cascade Controls Corporation. Cascade has

annual sales of $11 million and is a well-established automation and controls distributor in the

Northwest region of the U.S. Cascade provides WCC with additional capabilities to serve its growing

customer base of original equipment manufacturers.

Potentially Severe Problem

There are none other than those discussed in other sections of this report.

Long-Term Growth

Long-term growth rates vary from 10.0% (FTN Midwest Res.) to 15.0% (Wachovia, William Blair) with

an average of 13.0%.

One analyst (UnionBankSwitz.) estimates that WCC’s business is currently 95%+ domestic. It believes

some of the growth opportunities that could result from exposure to engineering and construction

companies are more international.

Another analyst (Stephens), though cautious in the near term, believes that the Company’s long-term

term business trends remain solid across all of its key markets. In addition, the firm continues to expect

the industrial economy to rebound in 2H07 and into 2008, utilities are expected to continue to build out

the electrical infrastructure across the U.S., and the outlook for large construction projects remains

generally strong – all of which should give WCC a boost.

Management expects the industrial market to remain stable supported by capital spending and

sustained manufacturing. According to analysts, management has been aggressive in using

acquisitions to boost growth, and will likely continue to do so in the future. Analysts expect topline

growth to receive equal contributions from both organic initiatives and acquisitions. The bottomline

growth will likely be driven by further improvements in operating leverage as benefits from the

Company’s Lean initiative, a cost reduction program implemented in 2005, roll out for another 2–3

years.

Upcoming Events

On October 18, 2007, WCC expects to release its 3Q07 earnings.

Individual Analyst Opinions

POSITIVE RATINGS (72.7%)

Goldman – Buy ($75.00) – 07/19/07: The firm maintains a Buy rating with a price target of $75.00.

INVESTMENT SUMMARY: The firm expects improvement in organic growth rate, with better utility endmarkets. It also believes that the investors should capitalize on the attractive relative valuation of the

Company.

Zacks Investment Research

Page 6

www.zackspro.com

J.P. Morgan – Overweight ($81.00) – 07/23/07: The firm reiterates a price target of $81.00 and an

Overweight rating. INVESTMENT SUMMARY: The firm believes that WCC has fairly low business risk

given a very diverse customer, industry, and regional base, as well as variant growth drivers in

integrated supply, national accounts, and the local branch-based operations.

Lehman – Overweight ($77.00) – 07/20/07: The firm maintains an Overweight rating but reduced its

price target from $77.00 to $75.00. INVESTMENT SUMMARY: The firm believes that the Company’s

refocus on investing in sales and service capabilities in combination with positive end market conditions

could generate improved organic sales growth and leverage.

Morgan Keegan – Outperform – 07/20/07: The firm maintains an Outperform rating. INVESTMENT

SUMMARY: The firm believes that despite a weak 2Q07 and the core revenues remaining almost flat,

annually, the most important factor is that the Company is not losing market share.

Raymond James – Outperform ($75.00) – 07/19/07: The firm, though positive on the stock, has

downgraded its rating from Strong Buy to Outperform and decreased the target price from $80.00 to

$75.00. INVESTMENT SUMMARY: The firm believes that the downside on the stock is limited, and

that a reacceleration in organic sales growth is possible, and not imminent, by the end of the year,

following 2Q07’s weak results and particularly weak organic growth guidance for 3Q07.

Stephens – Overweight ($75.00) – 07/20/07: The firm maintains an Overweight rating and a price

target of $75.00. INVESTMENT SUMMARY: The firm believes that the stock is undervalued. In

addition, it also expects 2H07 to be better than the first half of the year, which should result in multiple

expansion over time.

UnionBankSwitz. – Buy ($75.00) – 07/20/07: The firm maintains a Buy rating on the stock but

decreased the target price from $77.00 to $75.00.

Wachovia – Outperform ($73.00) – 07/19/07: The firm maintains an Outperform rating but decreased

the price target from $75.00 to $73.00. INVESTMENT SUMMARY: The firm believes that the

Company’s long-term earnings remain favorable and that current valuation levels represent a buying

opportunity.

NEUTRAL RATINGS (27.3%)

FTN Midwest Res. – Neutral ($66.00) – 07/20/07: The firm maintains a neutral rating but decreased

the price target from $67.00 to $66.00 based on reduced expectation for EVA improvement through

2008.

R W. Baird – Neutral ($72.00) – 07/20/07: The firm maintains a Neutral rating, with a price target of

$72.00. INVESTMENT SUMMARY: The firm believes that low organic growth rates, weakness in the

utility and non-residential end-markets and weak pricing are indicative of near-term market share loss,

which may make sales and profit growth more difficult.

William Blair – Market Perform – 07/20/07: The firm maintains a Market Perform rating.

INVESTMENT SUMMARY: The firm is of the opinion that the Company represents strong growth

prospects, high operating leverage, room for margin expansion, and improving ROIC. Although these

positives are in place, the firm is yet not confident that in the near future these factors will be able to

overcome slowing sales growth, significant pricing pressure, and declining incremental operating

margin.

Zacks Investment Research

Page 7

www.zackspro.com

NEGATIVE RATINGS (0%)

None

DROPPED COVERAGE

Prudential – 06/11/07 – The firm dropped its coverage of WESCO International due to departure of the

covering analyst.

Research Associate: Sudhanshu Damani

Copy Editor: Salma Islam

Content Ed.: Payal Jalan

Zacks Investment Research

Page 8

www.zackspro.com

Zacks Investment Research

Page 9

www.zackspro.com