The timing of cash flows for a plain-vanilla swap: the realization at

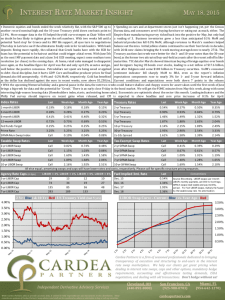

advertisement

Constructing LIBOR zero and forward curves from spot market LIBOR rates and CME eurodollar futures. Presented below is an alternative method to bootstrapping from Treasury securities to construct the term structure of interest rates. The term structure constructed from LIBOR, CME futures and swap rates is of lower credit quality than the term structure constructed from Treasury securities. A eurodollar is a dollar deposited in a U.S. bank outside the US. The rate earned on these deposits are benchmarked to the London Interbank Offer Rate (LIBOR). LIBOR refers to the rate at which banks are willing to lend (LIBOR) or borrow (LIBID) these funds. The British Banker’s Association posts a daily LIBOR value. The British Banker’s Association daily posting is usually the rate referred to when considering LIBOR. Similar rates are available for all major currencies. LIBOR rates from this market are referred to as spot market rates and quoted assuming add-on interest based on a 360-day year. Bridge-Telerate: US@?GLUS3M, US@?GLUS6M, US@?GLUS1Y LIBOR US@?GE3M, US@?GE6M, US@?GE1Y EURIBOR Futures contracts offered at the Chicago Mercantile Exchange (CME) on the 3-MO eurodollar rate have delivery dates of near months plus March, June, September, December cycle extending up to 10-years in the future. Settlement prices for the CME eurodollar contract can be obtained on a daily basis from the exchange, http://www.cme.com/ . The delivery date for these contracts is the third Wednesday of the delivery month. A futures contract price of 96 implies a futures rate of 4%. This futures rate is expressed with quarterly compounding and an actual/360 day count convention. Conversion of the futures rate to a forward rate requires three sequential adjustments 360365, quarterlycontinuous, a convexity adjustment. Adjustment to futures contract price necessary to account for first two conversions; Adjusted futures =(365/91)*log(1+(91/360)*0.01*(100-Settlement Price)) The futures rate, f, is biased upwards relative to the forward rate due to non-linearity of the bond pricing relationship. CME Eurodollar futures prices (100 – f) reflect a present value (bond price). Convexity adjustment (Ho-Lee model) : T.S. Ho S. Lee (1986) “Term Structure Movements and Pricing Interest Rate Contingent Claims,” Journal of Finance, vol. 41. F f 0.5 * 2 * t1 * t 2 where F = forward rate f = adjusted futures rate 1 = volatility of annual changes in L t1 = time in years till futures contract delivery date t2 = time in years till maturity of the rate underlying the futures contract. F = Adjusted futures – Convexity adjustment Estimating volatility of annual changes in 3-MO LIBOR http://www.federalreserve.gov/releases/ euro dollar 3m year end 1971 6.58 1987 7.07 0.0037 1972 5.41 1973 9.26 -0.0117 1988 7.85 0.0078 0.0385 1989 9.16 0.0131 1974 1975 11.04 0.0178 1990 8.16 -0.01 7.03 -0.0401 1991 5.86 -0.023 1976 5.58 -0.0145 1992 3.7 -0.0216 1977 6.03 0.0045 1993 3.18 -0.0052 1978 8.73 0.027 1994 4.63 0.0145 1979 11.96 0.0323 1995 5.93 0.013 1980 14 0.0204 1996 5.38 -0.0055 1981 16.79 0.0279 1997 5.61 0.0023 1982 13.08 -0.0371 1998 5.45 -0.0016 1983 9.57 -0.0351 1999 5.31 -0.0014 1984 10.75 0.0118 2000 6.45 0.0114 1985 8.27 -0.0248 2001 3.7 -0.0275 1986 6.7 -0.0157 2002 1.73 -0.0197 2001 3.7 0.0197 2002 1.73 -0.0197 2003 1.07 -0.0066 stdev 0.021004 The LIBOR zero curve (term structure) is constructed from observations of spot LIBOR and forward rates calculated from CME eurodollar futures contract prices. Conversion to continuous compounding simplifies this process (however may not be in accordance with day count conventions). t0---------- z1 -------------------t1 t0---------------------------------t1-------- F1,2---------t2 t0-------------------------- z2 ----------------------------t2 Definition of forward rate: The forward rate for a specified forward period is the rate earned during the forward period making total return of a sequential investment equivalent to the total return of a long term investment. 2 z1 * t1t0 365 F12 * t2 t1 365 z 2 * t2 t0 365 e * e e Given z1 (spot market rate) and F1,2 (forward rate) derived from futures contract; z2 F1,2 * (t 2 t1 ) z1 (t1 t 0 ) . (t 2 t 0 ) The set of LIBOR zero rates is calculated by extending this computation to successive periods corresponding to the March, June, September, December eurodollar futures cycle. After constructing the LIBOR zero curve from spot rates and forward rates, linear interpolation between zero rates can be used to find zero rates corresponding to the payment dates of financial contracts (interest rate swap). Utilizing zero rates for a swap contract’s payment dates the relationship above can be inverted to determine the relevant forward rates for determining the equilibrium swap rate. For example if t1 is a reset date and t2 the corresponding payment date, the forward rate F1,2 , determines the variable rate payment for purposes of calculating the equilibrium swap rate is z * (t 2 t 0 ) z1 * (t1 t 0 ) F1,2 2 (t 2 t1 ) . 3 3/08/04 91 182 3MO-Spot 1.04% 6MO-Spot 1.08% eurodollar futures settlement prices as of 03/08/04 07:00 pm (cst) Term Structure Delivery DDLV Settle Adj. Futures Convexity Forward Maturity DTM Zero Forward 4-Sep 9/15/2004 191 282 98.7 1.3159% 0.0089% 1.3070% 6/7/2004 91 1.04% 4-Dec 12/15/2004 282 373 98.465 1.5533% 0.0174% 1.5359% 9/6/2004 182 1.08% 1.12% 5-Mar 3/16/2005 373 464 98.175 1.8461% 0.0286% 1.8174% 12/15/2004 282 1.16% 1.31% 5-Jun 6/15/2005 464 555 97.825 2.1992% 0.0426% 2.1565% 3/16/2005 373 1.25% 1.54% 5-Sep 9/21/2005 562 653 97.47 2.5570% 0.0607% 2.4962% 6/15/2005 464 1.36% 1.82% 5-Dec 12/21/2005 653 744 97.15 2.8792% 0.0804% 2.7988% 9/14/2005 555 1.49% 2.16% 6-Mar 3/22/2006 744 835 96.9 3.1308% 0.1028% 3.0280% 12/21/2005 653 1.62% 2.32% 6-Jun 6/21/2006 835 926 96.665 3.3671% 0.1280% 3.2392% 3/22/2006 744 1.76% 2.80% 6-Sep 9/20/2006 926 1017 96.445 3.5883% 0.1559% 3.4324% 6/21/2006 835 1.90% 3.03% 6-Dec 12/20/2006 1017 1108 96.235 3.7992% 0.1865% 3.6127% 9/20/2006 926 2.03% 3.24% 7-Mar 3/21/2007 1108 1199 96.055 3.9800% 0.2199% 3.7601% 12/20/2006 1017 2.16% 3.43% 7-Jun 6/20/2007 1199 1290 95.88 4.1556% 0.2560% 3.8996% 3/21/2007 1108 2.28% 3.61% 7-Sep 9/19/2007 1290 1381 95.715 4.3212% 0.2949% 4.0263% 6/20/2007 1199 2.39% 3.76% 7-Dec 12/19/2007 1381 1472 95.555 4.4816% 0.3365% 4.1452% 9/19/2007 1290 2.50% 3.90% 8-Mar 3/19/2008 1472 1563 95.42 4.6169% 0.3808% 4.2361% 12/19/2007 1381 2.60% 4.03% 8-Jun 6/18/2008 1563 1654 95.29 4.7472% 0.4279% 4.3193% 3/19/2008 1472 2.69% 4.15% 8-Sep 9/17/2008 1654 1745 95.165 4.8724% 0.4777% 4.3947% 6/18/2008 1563 2.78% 4.24% 8-Dec 12/17/2008 1745 1836 95.04 4.9976% 0.5303% 4.4674% 9/17/2008 1654 2.87% 4.32% 9-Mar 3/18/2009 1836 1927 94.94 5.0977% 0.5856% 4.5122% 12/17/2008 1745 2.95% 4.39% 9-Jun 6/17/2009 1927 2018 94.845 5.1928% 0.6436% 4.5492% 3/18/2009 1836 3.02% 4.47% 9-Sep 9/16/2009 2018 2109 94.755 5.2829% 0.7044% 4.5785% 6/17/2009 1927 3.09% 4.51% 9-Dec 12/16/2009 2109 2200 94.665 5.3729% 0.7679% 4.6050% 9/16/2009 2018 3.16% 4.55% 10-Mar 3/17/2010 2200 2291 94.58 5.4580% 0.8342% 4.6238% 12/16/2009 2109 3.22% 4.58% 10-Jun 6/16/2010 2291 2382 94.5 5.5380% 0.9032% 4.6348% 3/17/2010 2200 3.28% 4.61% 10-Sep 9/15/2010 2382 2473 94.42 5.6180% 0.9750% 4.6430% 6/16/2010 2291 3.33% 4.62% 10-Dec 12/15/2010 2473 2564 94.35 5.6880% 1.0495% 4.6385% 9/15/2010 2382 3.38% 4.63% 11-Mar 3/16/2011 2564 2655 94.285 5.7529% 1.1267% 4.6262% 12/15/2010 2473 3.43% 4.64% 11-Jun 6/15/2011 2655 2746 94.215 5.8229% 1.2067% 4.6162% 3/16/2011 2564 3.47% 4.64% 11-Sep 9/21/2011 2753 2844 94.155 5.8828% 1.2959% 4.5870% 6/15/2011 2655 3.51% 4.63% 11-Dec 12/21/2011 2844 2935 94.09 5.9478% 1.3815% 4.5662% 9/14/2011 2746 3.55% 4.62% 12-Mar 3/21/2012 2935 3026 94.035 6.0027% 1.4699% 4.5328% 12/21/2011 2844 3.57% 4.26% 12-Jun 6/20/2012 3026 3117 93.97 6.0676% 1.5611% 4.5065% 3/21/2012 2935 3.60% 4.57% 12-Sep 9/19/2012 3117 3208 93.91 6.1275% 1.6550% 4.4726% 6/20/2012 3026 3.63% 4.53% 12-Dec 12/19/2012 3208 3299 93.85 6.1874% 1.7516% 4.4358% 9/19/2012 3117 3.65% 4.51% 13-Mar 3/20/2013 3299 3390 93.805 6.2324% 1.8510% 4.3814% 12/19/2012 3208 3.68% 4.47% 4 13-Jun 6/19/2013 3390 3481 93.745 6.2923% 1.9531% 4.3392% 3/20/2013 3299 3.70% 4.44% 13-Sep 9/18/2013 3481 3572 6.3372% 2.0580% 4.2792% 6/19/2013 3390 3.72% 4.38% 13-Dec 12/18/2013 3572 6.4020% 2.1656% 4.2365% 9/18/2013 3481 3.73% 4.34% 999 999 93.7 3663 93.635 999 999 999 999 12/18/2013 3572 3.75% 4.28% 3/19/2014 3663 3.76% 4.24% Maturity DTM Zero Forward Fixed for floating interest rate swap valuation The timing of cash flows for a plain-vanilla swap: the realization at time ti (reset time) of the spot rate Li spanning the period [ti ti+1] determines a floating payment per unit of notional principal at time ti+1 (payment date) of magnitude Li*i per dollar of notional principal. The distance i is given by the number of days in the period [ti ti+1] divided by 360 or 365, as dictated by the appropriate conventions. For a plain-vanilla swap, the fixed payment per unit of notional principal, X*i ,also occurs at time ti+1. Li i x -----------------------------------|---------------| t0 ti ti+1 Li is the spot 3-MO or 6-MO LIBOR (reference rate for swap contract) rate prevailing at time ti . Absence of arbitrage swap pricing: Given both LIBOR forward and spot rate curves, the unknown cash flows in the floating leg of the swap must be set equal to the forward rates to prevent arbitrage opportunities. Define P(0,t) = the price of a discount bond maturing at time t. Using continuous compounding the P(0,t) are functions of the LIBOR zero rates, zt . P(0, t ) exp( zt * (t / 365)) Define Ft = the LIBOR forward rate for the period [t t +1] The equilibrium swap rate (coupon rate) is defined as the fixed rate X such that today’s present value of the fixed and floating rate payments over the swap’s tenor (legs) are equal. 5 n n NP * X * i * P(0, t i 1 ) NP * Fi * i * P(0, t i 1 ) i 1 i 1 n NP * Fi * i * P(0, t i 1 ) X i 1 n NP * i * P(0, t i 1 ) i 1 n Fi * P(0, t i 1 ) i 1 n P (0, t i 1 ) i 1 X is the equilibrium swap rate that makes today’s value of the swap equal for both counterparties. X is a weighted average of the projected forward rates analogous to the calculation of Macaulay’s duration. After an equilibrium swap has been entered, the swap will in general no longer have zero value, since interest rates will in general not have followed the implied forward curve. The swap will maintain zero value only if the realized values Li are the projected forward rates on the date the equilibrium (zero value) swap was struck. Deviations of realized Li from time 0 projected forward rates will cause the swap value to deviate from zero. Replacement value of a swap after the initial date can be found from the initial equilibrium swap rate and the forward rate curve on the valuation date. The fixed rate payor’s replacement value at date t, where n- is the number of remaining cash flows at (t); n Vt Fi * P(t , t i 1 ) X 0 * P(t , t i 1 )* NP * i i 1 n Vt ( X t X 0 ) * P(t , t i 1 ) * NP * i i 1 6 Swap pricing date 3/08/04 Tenor 10-year, 39 reset 40 cash flow NP 1000000 Swap Pricing fixed for 3MO LIBOR Reset DTRorDTC Zero 6/7/2004 91 1.04% 9/6/2004 182 1.08% 12/6/2004 273 3/7/2005 Expected Cash Flow Forward PV PV*F FR-payor PV*CF VR-payor PV*CF 0.9974 1.0373% -6518 -6501 6518 6501 1.12% 0.9946 1.1140% -6319 -6285 6319 6285 1.15% 1.30% 0.9914 1.2886% -5870 -5820 5870 5820 364 1.24% 1.51% 0.9877 1.4937% -5340 -5275 5340 5275 6/6/2005 455 1.35% 1.79% 0.9833 1.7580% -4653 -4576 4653 4576 9/5/2005 546 1.48% 2.12% 0.9781 2.0748% -3822 -3738 3822 3738 12/5/2005 637 1.60% 2.30% 0.9725 2.2323% -3388 -3295 3388 3295 3/6/2006 728 1.74% 2.71% 0.9660 2.6192% -2351 -2271 2351 2271 6/5/2006 819 1.88% 2.99% 0.9588 2.8655% -1660 -1591 1660 1591 9/4/2006 910 2.01% 3.20% 0.9512 3.0466% -1125 -1070 1125 1070 12/4/2006 1001 2.13% 3.40% 0.9431 3.2061% -636 -600 636 600 3/5/2007 1092 2.26% 3.58% 0.9348 3.3482% -181 -169 181 169 6/4/2007 1183 2.37% 3.74% 0.9261 3.4591% 202 187 -202 -187 9/3/2007 1274 2.48% 3.88% 0.9172 3.5550% 553 507 -553 -507 12/3/2007 1365 2.58% 4.00% 0.9081 3.6367% 874 794 -874 -794 3/3/2008 1456 2.68% 4.12% 0.8988 3.7075% 1173 1055 -1173 -1055 6/2/2008 1547 2.77% 4.22% 0.8894 3.7540% 1413 1256 -1413 -1256 9/1/2008 1638 2.85% 4.31% 0.8799 3.7883% 1623 1428 -1623 -1428 12/1/2008 1729 2.93% 4.38% 0.8703 3.8139% 1815 1579 -1815 -1579 3/2/2009 1820 3.01% 4.46% 0.8607 3.8346% 1997 1719 -1997 -1719 6/1/2009 1911 3.08% 4.51% 0.8511 3.8342% 2121 1805 -2121 -1805 8/31/2009 2002 3.15% 4.54% 0.8415 3.8233% 2216 1865 -2216 -1865 11/30/2009 2093 3.21% 4.57% 0.8320 3.8054% 2293 1908 -2293 -1908 3/1/2010 2184 3.27% 4.60% 0.8225 3.7842% 2360 1941 -2360 -1941 5/31/2010 2275 3.32% 4.62% 0.8131 3.7571% 2410 1960 -2410 -1960 8/30/2010 2366 3.37% 4.63% 0.8037 3.7239% 2441 1962 -2441 -1962 11/29/2010 2457 3.42% 4.64% 0.7945 3.6880% 2462 1956 -2462 -1956 2/28/2011 2548 3.46% 4.64% 0.7853 3.6438% 2457 1929 -2457 -1929 5/30/2011 2639 3.50% 4.63% 0.7763 3.5935% 2430 1886 -2430 -1886 8/29/2011 2730 3.54% 4.62% 0.7674 3.5443% 2404 1845 -2404 -1845 11/28/2011 2821 3.56% 4.32% 0.7592 3.2818% 1666 1265 -1666 -1265 2/27/2012 2912 3.59% 4.49% 0.7508 3.3691% 2077 1560 -2077 -1560 5/28/2012 3003 3.62% 4.54% 0.7423 3.3714% 2212 1642 -2212 -1642 8/27/2012 3094 3.65% 4.51% 0.7340 3.3130% 2142 1572 -2142 -1572 11/26/2012 3185 3.67% 4.48% 0.7258 3.2529% 2062 1497 -2062 -1497 2/25/2013 3276 3.69% 4.45% 0.7178 3.1912% 1973 1416 -1973 -1416 7 5/27/2013 3367 3.71% 4.40% 0.7100 3.1210% 1848 1312 -1848 -1312 8/26/2013 3458 3.73% 4.35% 0.7024 3.0554% 1735 1219 -1735 -1219 last reset 11/25/2013 3549 3.74% 4.29% 0.6949 2.9844% 1597 1110 -1597 -1110 last payment 2/24/2014 3640 3.76% 4.25% 0.6876 2.9205% 1479 1017 -1479 -1017 DTRorDTC Zero Forward PV PV*F Sum(PV*F) 124.69% Sum(PV) 34.1214 X 8 3.65% FR-payor Sum(PV*CF) PV*CF VR-payor PV*CF 0 0 9