Cardea Interest Rate Market Insight

advertisement

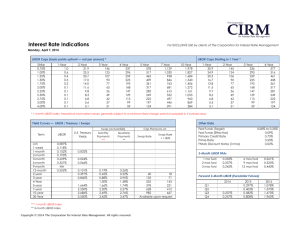

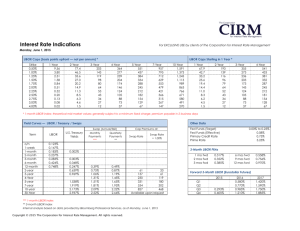

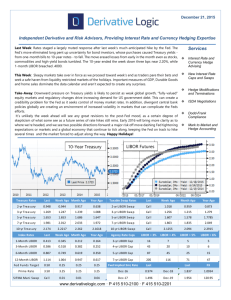

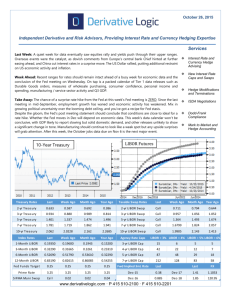

INTEREST RATE MARKET INSIGHT MAY 18, 2015 • Domestic equities and bonds ended the week relatively flat, with the S&P 500 up to • Spending on cars and at department stores just isn't happening yet, per the Census another record nominal high and the 10-year Treasury yield down one basis point to Bureau data, and consumers aren't buying furniture or eating out as much, either. The 2.14%. More meager data in the US helped the yield curve steepen as Chair Yellen will Empire State manufacturing survey ticked back into the positive for May, but only had no doubt be less likely to tighten given the soft numbers. With two weeks left until a a reading of 3. Business inventories grew a less than anticipated 0.1% MoM and potential 'hard stop' for Greece and its IMF life support, all eyes turn to negotiations industrial production fell 0.3% MoM, although revisions to March's numbers helped Thursday in Latvia to see if the ultimatums finally sink in for Greek leaders. With bank balance out the miss. Initial jobless claims continued to see their best levels in decades, deposits fleeing more rapidly, the collateral that Greek banks have with the ECB for with 264k new claims bringing the 4-week moving average down to nearly 271k. The loans has the potential to be haircut and that could trigger a fatal event. With June 5th Treasury auctions last week were better for the 3- and 10-year notes than the 30-year as the next IMF payment date and a June 3rd ECB meeting, expect some medium term bond, as the former two attracted buy-and-hold accounts after the recent selloff in likeresolution (or chaos) in the coming days. At home, retail sales managed to disappoint maturities. TIC data for March showed American buying of foreign equities over bonds once again, as the headline figure for April was flat and only up 0.2% ex autos and gas, and foreigners buying US bonds over stocks, leading to a net inflow of $17.6 billion, well below the positive consensus. Petrodollars not spent are being saved or applied even after Belgium sold some $100 billion in Treasury securities. UofM's consumer to debt--fiscal discipline, but it hurts GDP! Core and headline producer prices for final sentiment indicator fell sharply MoM to 88.6, even as the report's inflation demand also fell unexpectedly, -0.4% and -0.2% MoM, respectively. Gold has benefited expectations components rose to nearly 3% for 1- and 5-year forward inflation. as the dollar has declined against the euro in recent weeks, now above $1,230/oz. Current conditions and expectations were both down 7 points in the release. • With the upcoming Memorial holiday and a general pause in the data, the next two weeks could feature shallow and choppy waves for asset values until the first week of June brings a big week for data and the potential for 'Grexit.' There is an early close Friday in the bond market. We will get the FOMC minutes from May this week, along with some interesting high-season housing data (Homebuilders index, starts, and existing home sales). Economists are optimistic about the sector this month. Leading indicators and the Philly Fed survey should improve on recent gains when released, and CPI is expected to show headline and core price increases of 0.1% for April. Index Rates Last Week Ago Month Ago Year Ago 1-month LIBOR 0.19% 0.18% 0.18% 0.15% 3-month LIBOR 0.28% 0.28% 0.27% 0.23% 6-month LIBOR 0.41% 0.41% 0.40% 12-month LIBOR 0.72% 0.73% Fed Funds Target 0.25% Prime Rate Treasury Rates Last Week Ago Month Ago Year Ago 2-yr Treasury 0.54% 0.57% 0.50% 0.35% 3-yr Treasury 0.90% 0.93% 0.84% 0.79% 0.32% 5-yr Treasury 1.46% 1.49% 1.32% 1.52% 0.69% 0.53% 7-yr Treasury 1.87% 1.88% 1.65% 2.04% 0.25% 0.25% 0.25% 10-yr Treasury 2.14% 2.15% 1.89% 2.49% 3.25% 3.25% 3.25% 3.25% 30-yr Treasury 2.93% 2.90% 2.54% 3.33% SIFMA Muni Swap Index Call 0.10% 0.04% 0.08% 2s-10s Spread 1.61% 1.58% 1.39% 2.14% Taxable Swap Rates Last Week Ago Month Ago Year Ago Tax-Exempt Swap Rates Last Week Ago Month Ago Year Ago 2-yr LIBOR Swap Call 0.82% 0.74% 0.48% 2-yr SIFMA Swap Call 0.41% 0.39% 0.29% 3-yr LIBOR Swap Call 1.15% 1.03% 0.88% 3-yr SIFMA Swap Call 0.67% 0.61% 0.57% 5-yr LIBOR Swap Call 1.60% 1.43% 1.58% 5-yr SIFMA Swap Call 1.09% 1.01% 1.19% 7-yr LIBOR Swap Call 1.89% 1.68% 2.06% 7-yr SIFMA Swap Call 1.40% 1.28% 1.65% Call 2.16% 1.92% 2.51% 10-yr SIFMA Swap Call 1.69% 1.54% All else equal, amortizing swaps and caps will have lower rates and costs, respectively. Please call for specific structure pricing requests. 2.10% 10-yr LIBOR Swap Agency Rate Caps (in bps) 3-yr LIBOR Cap 4-yr LIBOR Cap 5-yr LIBOR Cap 7-yr LIBOR Cap LIB O R = 3 % LIB O R = 4 % LIB O R = 5 % LIB O R = 6 % 29 74 135 293 13 34 85 189 12 19 36 133 10 27 48 102 Fwd Implied 3mL Rate Dec. 15 Dec. 16 Dec. 17 Dec. 18 2 Yr (Blue) & 10 Yr (Red) US Treasury Yield (last 5 yrs) Last Conventions 0.54% 1.34% 1.95% 2.36% Source: Bloomberg. LIBOR swaps use 1-month LIBOR, monthly payments, act/360 for both legs. SIFM A swaps reset weekly and pay monthly, act/act. For %of LIBOR swaps, multiply the %used by the taxable swap rate. No amortization. LIBOR Swap Curve - Current (Blue) vs. Year Ago (Red) 4.00% 3.50% 3.50% 3.00% 3.00% 2.50% 2.50% 2.00% 2.00% 1.50% 1.50% 1.00% 1.00% 0.50% 0.50% 0.00% 0.00% Cardea Partners is a firm of seasoned professionals dedicated to bringing transparency of execution and structuring to end-users in the interest rate swap marketplace. We help our clients get great pricing when dealing in interest rate swaps, caps and other options, mandatory hedge requirements, accounting and effectiveness testing demands, ISDA negotiation, and dealing with old transactions. Don’t hedge without us! Independent Derivative Advisory Services While Cardea Partners aims to provide accurate data, it cannot be held responsible for any inaccuracies in this distribution. These remarks are opinions of Cardea Partners’ swap advisors and shall not be considered as advice or solicitation to buy or sell any securities. Cleveland, OH San Francisco, CA (440-892-8000) (925-988-0703) cardeapartners.com Miami, FL (954-642-1270)