INTEREST RATE MARKET INSIGHT JUNE 9, 2014

advertisement

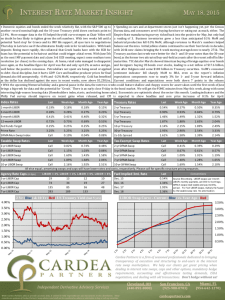

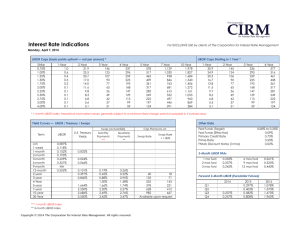

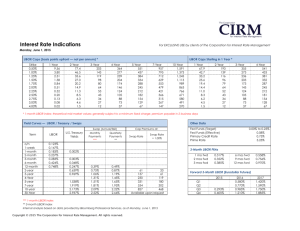

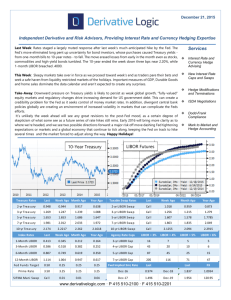

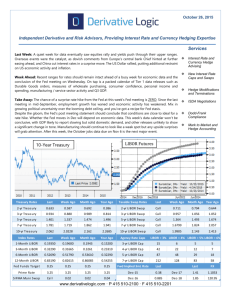

INTEREST RATE MARKET INSIGHT JUNE 9, 2014 • So equities continued to rocket higher last week (S&P 500, Dow, and Dow Transports all at all-time closing highs) on news of ECB easing and a jobs report in the US that failed to overturn the applecart trend of 200k/month net new nonfarm payrolls. However, the trading in domestic bond markets shifted and sellers were afoot, leading the longer-dated paper to surge in yield, and pushing the benchmark 10-year maturity from its lows in the 2.40%s all the way to 2.59% to close the week, and the trend continues in early action this morning. Meanwhile at the short end, 3-month LIBOR remains at all-time lows near 23 bps, with current market expectations that it will reach only 0.94% by the end of next year. European Central Bank head Mario Draghi let loose with some widely anticipated policy accommodation on Thursday in an effort to stave off Eurozone deflation, including lowering the benchmark borrowing rate by 10 bps to 0.15%, initiating some €400 million in roughly 4 year term borrowing facilities to banks that will allow them to lend to the real economy, and moving the ECB deposit rate to -0.10%, or in other words, forcing depositors to pay interest to have the bank hold money for them. When these provisions kick in later this week, money will certainly be moving, but in this recovery, it seems that funds don't necessarily flow to the central bank's preferred stimulative investments. Domestically, the jobs report met the consensus at 217k new jobs MoM for May and revisions to March and April only fell 6k, the unemployment rate stood still at 6.3%, and hourly earnings rose 0.2% MoM. The labor force participation rate was again 62.8%, near generational lows, and the ADP private payrolls data (+179k) was weak relative to the big release Friday. Again, economic activity seems to remain relatively robust, with ISM Manufacturing and services both staying above 55 readings, rising factory orders and construction spending, and a decent Markit PMI Manufacturing flash at 56.4. The trade deficit widened to -$47.2 billion for April, a miss, and jobless claims were slightly higher than expected (312k new initial). With improving weather, a lighter data calendar, easing Ukrainian tensions, and the World Cup in Brazil only weeks away, the low volume, low volatility trade is likely to take us through the month of June. • Wednesday's retail sales report will be the most anticipated release of the week, and market makers look for a 0.6% MoM gain on the headline and core readings around +0.4% MoM. Import prices should rise MoM after declining in April, and we also get to see long term capital flows to and from the US, jobless claims should stay flat WoW, and April business inventories likely rose 0.4% in the release to come this week. Most active traders will be positioning themselves ahead of next week's FOMC meeting on the 18th, which should feature continued tapering and also the second press conference for newly minted Chair Yellen and the economic forecasts of the sitting governors as well. Index Rates Last Week Ago Month Ago Year Ago Last Week Ago Month Ago Year Ago 1-month LIBOR 0.15% 0.15% 0.15% 0.19% 2-yr Treasury 0.40% 0.38% 0.43% 0.29% 3-month LIBOR 0.23% 0.23% 0.22% 0.27% 3-yr Treasury 0.83% 0.77% 0.88% 0.47% 6-month LIBOR 0.32% 0.32% 0.32% 0.41% 5-yr Treasury 1.64% 1.54% 1.68% 1.01% 12-month LIBOR 0.53% 0.53% 0.54% 0.69% 7-yr Treasury 2.18% 2.06% 2.20% 1.49% Fed Funds Target 0.25% 0.25% 0.25% 0.25% 10-yr Treasury 2.59% 2.48% 2.59% 2.08% Prime Rate 3.25% 3.25% 3.25% 3.25% 30-yr Treasury 3.43% 3.33% 3.38% 3.25% SIFMA Muni Swap Index Call 0.06% 0.08% 0.08% 2s-10s Spread 2.19% 2.10% 2.17% 1.79% Taxable Swap Rates Last Week Ago Month Ago Year Ago Tax-Exempt Swap Rates Last Week Ago Month Ago Year Ago 2-yr LIBOR Swap Call 0.50% 0.55% 0.45% 2-yr SIFMA Swap Call 0.30% 0.33% 0.30% 3-yr LIBOR Swap Call 0.89% 0.98% 0.65% 3-yr SIFMA Swap Call 0.57% 0.64% 0.45% 5-yr LIBOR Swap Call 1.58% 1.72% 1.17% 5-yr SIFMA Swap Call 1.18% 1.28% 0.88% 7-yr LIBOR Swap Call 2.06% 2.20% 1.67% 7-yr SIFMA Swap Call 1.65% 1.74% 1.34% Call 2.51% 2.63% 2.21% 10-yr SIFMA Swap Call 2.11% 2.18% All else equal, amortizing swaps and caps will have lower rates and costs, respectively. Please call for specific structure pricing requests. 1.84% 10-yr LIBOR Swap Rate Caps (co st in bps) 3-yr LIBOR Cap 5-yr LIBOR Cap 7-yr LIBOR Cap 10-yr LIBOR Cap Strike = 4.00% Strike = 5.00% 20 110 267 544 15 68 170 363 Treasury Rates Fwd Implied 3mL Rate Dec. 14 Dec. 15 Dec. 16 Dec. 17 2 Yr (Blue) & 10 Yr (Red) US Treasury Yield (last 5 yrs) Last 0.26% 0.94% 2.04% 2.87% Conventions Source: Bloomberg. LIBOR swaps use 1-month LIBOR, monthly payments, act/360 for both legs. SIFM A swaps reset weekly and pay monthly, act/act. For %of LIBOR swaps, multiply the %used by the taxable swap rate. No amortization. LIBOR Swap Curve - Current (Blue) vs. Year Ago (Red) 4.50% 4.00% 4.00% 3.50% 3.50% 3.00% 3.00% 2.50% 2.50% 2.00% 2.00% 1.50% 1.50% 1.00% 1.00% 0.50% 0.50% 0.00% 0.00% Cardea Partners is a firm of seasoned professionals dedicated to bringing transparency of execution and structuring to end-users in the interest rate swap marketplace. We help our clients get great pricing and clarity when dealing with interest rate swaps, caps and other options, mandatory hedge requirements, accounting and effectiveness testing demands, ISDA negotiation, and dealing with old transactions. Don’t hedge without us! Independent Derivative Advisory Services While Cardea Partners aims to provide accurate data, it cannot be held responsible for any inaccuracies in this distribution. These remarks are opinions of Cardea Partners’ swap advisors and shall not be considered as advice or solicitation to buy or sell any securities. Cleveland, OH San Francisco, CA (440-892-8000) (925-988-0703) cardeapartners.com Miami, FL (954-642-1270)