Exam January 2000

advertisement

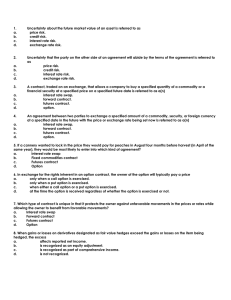

OMS 2000/1 FORM A Solvay Business School Options et Marchés Spéculatifs A. Farber FINAL EXAM January 20, 2000 Question 1 It is Jan. 1, 2000 (Happy New Year, by the way..). Suppose that your bank owns €250 million face value of OLO 262, a 8 percent coupon 12 years Belgian Government bond, currently priced at 120. You consider hedging this position with March 2000 Euro-BUND futures (assume that the maturity of this contract is at the end of March, in 3 months). The contract size is €100,000, the notional coupon is 6% and maturities for the underlying bonds are 8.5 to 10.5 years. The quoted futures price is 104. Your research department reports the following results from a regression of past price changes for the bond (S) regressed on the futures price changes (F) over the past year : S = 0.85 F + R² = 0.60 (1.1) How many futures contracts should you trade if you wanted to minimize the risk in your hedged position ? (1.2) Suppose you did trade 2,400 contracts. One month later, the quoted bond price is 115 and the quoted futures price is 98. What was the result (profit or loss in euros) on your cash position, your futures position and the hedged position ? (1.3) Would your hedge have been more effective had you trade the number of contracts found in question (1.1) ? Explain. (1.4) The quoted futures price puzzles M. Leaglet, your estimated colleague. He wishes to understand how it relates to the spot price of the underlying bond. The cheapest-to-deliver (CTD) bond is a 10-year 6% coupon bond (Maturity date 30.06.2010). The conversion factor for the March 2000 contract is 1. The riskfree interest rate (with continuous compounding) is 6%. Do you expect the quoted spot price of the CTD bond to greater than, equal to or less than the quoted futures price ? Check your intuition by calculating it. Explain. Question 2 Inventive Industry (2I) requires a fixed rate loan. It faces the following interest rates: Fixed borrowing rate: 5.60% Floating rate: 12-months Euribor + 0.30% 2I considers using a swap to reduce its cost borrowing. They request a quote from BBW (Banque du Brabant Wallon) on the following plain vanilla swap: Notional principal amount : € 20 mio Maturity : 3 years Floating index : 12-month Euribor Fixed coupon rate : ?% Payment frequency : Annual The Euribor yield curve prevailing at the origination of this swap is as follow: Maturity Yield (year) (With continuous compounding) 1 4.00% 2 4.60% 3 4.90% OMS 2000/1 FORM A (2.1) Consider first the swap as a pair of loan contracts. Find the values of these loans and calculate the minimum fixed rate to be offered at 2I by BBW. (2.2) Should 2I use this swap? Explain. (2.3) Explain why the swap as can viewed as a portfolio of FRAs. Show the relationship between the value of the swap and the value of the individual FRAs. (2.4) Could BBW hedge its swap position with interest futures contracts? How? Discuss. Question 3 Your firm has sold an option on the XYZ stock. You want to use the Black-Scholes-Merton model to create the option synthetically. In other words, you want to hold the replicating portfolio.You have gathered the following market data. Stock price : 101 Riskless interest rate (with continuous compounding) : 4% Type of option sold: European call Option maturity : 3 months Volatility : 0.30 (An option is for 1 share). Strike 100 Black-Scholes value 6.98 Option delta 0.58 Option gamma 0.0260 (3.1) What position should you take in XYZ stock ? Explain. (3.2) How much should you borrow or lend at the riskless interest rate ? (3.3) If you hold this replicating portfolio and tomorrow the stock price falls to 98, will you need to buy stock, sell stock or keep the same position to remain delta neutral ? (3.4) If the stock turns out to be more volatile than you expected, are you happy, unhappy or indifferent ? Question 4 This is your first day as a trader at the Imperial Corner Bank (ICB). You first task is to analyse the positions left by your predecessor. As a matter of fact, he left a clean desk except for a short put position on the Cetextra share. Quite surprisingly, he did not hedge this position and you wish to correct this omission before it is too late. Cetextra is a non dividend paying share with a market value of € 78 and a volatility of 30%. The (continuous) expected return on this stock is 12%. The risk free interest rate with continuous compounding is 6% per annum. The put sold by ICB is a European put option with 3-month to maturity (as of today) and a strike price of €75. To answer the following question use a binomial model with one step per month (4.1) Compute the current value of this put option using the binomial option pricing model. (4.2) Would the value of the option be identical if it were American instead of European? Explain. (4.3) Work out the transaction to do today in order to hedge this position. (4.4) Show how adjust the hedge in one month based on the 2 possible evolution of the stock price. OMS 2000/1 FORM A Question 5 In the figure below you are given the lattice of six-month Euribor (simple interest rates), which have been derived using the Ho and Lee model. The time interval used in this lattice is six months. The risk neutral probability of an up or down movement is 0.5. 0 In 6 months In 1 year 6.52% 5.17% 3.53% 5.06% 3.73% 2.18% Consider first a European put option on the 6-month BIBOR with 1 year to maturity, a fixed rate of 4.30% (a simple interest) and a nominal amount of € 10 millions. (5.1) Calculate the cash flows at maturity and the value today. (5.2) Show that this options can also be valued as a call on a zero-coupon. Consider now a 1-year floor with a floor rate equal to 4.30% (simple interest rate) and a nominal amount of € 10 millions. (5.3) Explain what a floor is and define the payoff on this floor at each date. (5.4) Explain how you would proceed to set the price for this floor (don’t do the calculation, unless, of course you still have a lot of time).