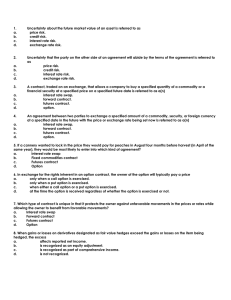

REVIEW QUESTIONS

advertisement

REVIEW HINTS MANAGING FINANCIAL RISK (FMR) AND THE FASB’S SUMMARY OF DERIVATIVES TYPES (Both Readings Cover the Same Topics) CHAPTER 1 1. Financial risk is: 2. Interest-rate risk refers to: 3. Short-term interest rates: 4. The prices of long-term bonds: 5. Duration is: 6. The term structure of interest rates describes the relationship between the: 7. According to the expectations theory of the yield curve, a downward sloping yield curve means that market participants expect: 8. The term structure theory which predicts long-term interest rates will, on average, be higher than short-term interest rates is called: 9. The goal of financial engineering is to: 10. A major purpose of financial risk management is to: CHAPTER 2 1. The forward exchange rate locked in with a forward exchange-rate contract: 2. The Eurocurrency market is: 3. The U.S. dollar forward exchange rate premium or discount on the British pound sterling is most likely to be equal to: 4. A forward exchange contract to buy German marks in 60 days can be replicated by: 5. A forward rate agreement is: 6. The contractual rate on a Norwegian FRA can be derived from: 7. With a forward exchange-rate contract, payment must be made: CHAPTER 3 1. The settlement price of a futures contract is: 2. The process of marking futures contracts to market has the effect of: 3. Marking to market is generally thought to: 4. Price limits are most likely to be associated with: 5. Foreign-currency contracts are likely to be used to: 6. A person wanting to lock in an exchange rate for the payment of a foreign-currency obligation to someone else would: 7. Basis in futures-contract trading refers to: 8. A basic relationship in financial futures pricing is that: CHAPTER 4 1. An option contract gives the option holder: 2. An option to sell an asset is called: 3. An option to by an asset is called: 4. A European option: 5. A call option can be replicated by: CHAPTER 5 1. A major advantage of options over futures contracts for hedging purposes is: 2. Foreign-currency options are available: 3. An expected receipt of German marks by an American exporter can be hedged best by: 4. Using foreign-currency futures options instead of underlying foreign-currency futures contracts: 5. The writers of currency call options: 6. To set a cap on the interest rate that a company must pay for a future loan, the treasurer can: 7. The interest-rate cap that a corporate treasurer can set on a future loan is equal to the rate implied by the strike price of an interest-rate: 8. The value of an interest-rate call option will increase if: 9. The option delta is: CHAPTER 6 1. An interest rate swap usually involves: 2. Usually, interest rate swaps are: 3. In an interest rate swap, the firm wishing floating-rate debt: 4. In an interest rate swap: 5. An interest rate swap is: 6. Swaptions are: 7. One reason interest rate swaps exist is that: 8. A currency swap is: 9. Circus swaps are: 10. In efficient markets, the value of an outstanding interest rate swap: CHAPTER 7 1. An expected receipt of British pounds in ninety days can be fully hedged: 2. If a company uses a forward contract to fully hedge a required payment of yen in ninety days: 3. A risk management product which is similar to a cylinder is: 4. A corporate treasurer could set a cap and a floor on the interest rate for a future loan by: 5. A bank could set a cap and a floor on the interest rate it receives from a commercial loan by: 6. A corporate treasurer could convert a floating-rate loan to a synthetic fixed-rate loan by: 7. If interest rates are expected to rise: From the FASB document entitled Summary of Derivative Types at J:\courses\acct5341\fasb\sfas133\derivsum.doc Be prepared for essay questions about the following: 1. 2. 3. 4. 5. 6. Determination of Fair Value pp. 4-7 What is duration and why is it important? pp. 11-17 How are forward rates derived? pp. 19-20 How are yield curves derived? pp. 19-27 What are the types of risks in derivatives? pp. 75-76 Glossary terms pp. 77-81 Sometimes I ask students to provide the FAS 133 journal entries for examples given in he FASB document entitled Summary of Derivative Types at J:\courses\acct5341\fasb\sfas133\derivsum.doc All Possible Quiz Questions for each week are topics for examination questions.