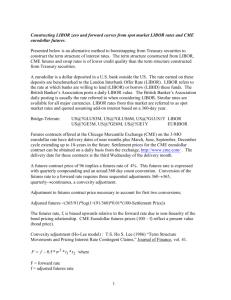

IFI_Ch09

advertisement

Chapter 9 Interest Rate and Currency Swaps The Goals of Chapter 9 • Define the interest rate risk for MNEs – It can be decomposed into the credit risk, reprising risk, and currency risk • For domestic interest rate risk, discuss the following management alternatives – – – – Refinancing Forward rate agreement Interest rate futures Interest rate swaps • Introduce various types currency swaps • Discuess the counterparty risk for swaps 9-2 Interest Rate Risk 9-3 Interest Rate Risk • All firms–domestic or multinational, small or large, leveraged, or unleveraged–are sensitive to interest rate movements – The changes of interest rates could introduce risk into the future cash flows of the firm • The largest interest rate risk of the nonfinancial firm, i.e., excluding financial institutions, is debt service – Particularly, the multicurrency dimension of interest rate risk for the MNE is of serious concern in this chapter • The second most prevalent source of interest rate risk for the MNE lies in its holdings of interest-sensitive securities – Unlike debt, which is recorded on the right-hand (liability) side of the firm’s balance sheet, the marketable securities portfolio of the firm appears on the left-hand (asset) side of the balance sheet – E.g., MNEs invest their excess funds in Treasury bonds 9-4 Interest Rate Risk • Before talking about the interest rate risk of debt service, different day-count convention for moneymarket instruments, e.g., short-term loans or bank deposits, in different nations are shown as follows ※ “International” indicates short-term loans in all Eurocurrencies except Eurosterling, which adopts actual/365 day-count basis for quotation ※ In practice, for different instruments, it is possible to have different day-count convention in a nation, e.g., in the U.S., actual/actual for Treasury bonds, 30/360 for corporate bonds, and actual/360 for money market instruments 9-5 Interest Rate Risk • The composition of the interest rate risk for MNE borrowers – Credit risk, sometimes termed roll-over risk, is the possibility that a borrower’s credit worthiness, at the time of renewing a credit, is reclassified by the bank (resulting in changes to fees, interest rates, credit line commitments or even denial of credit) – Repricing risk is the risk pertaining to floating rate debts, i.e., the risk of changes in interest rates charged at the time a financial contract’s rate is reset – Currency risk exits if MNEs borrow foreign debts • For the domestic environment, the comparison among the following strategies of borrowing $1 million for a threeyear period illustrates the credit risk and repricing risk 9-6 Interest Rate Risk – Strategy 1: Borrow $1 million for 3 years at a fixed interest rate • Since the future interest payments are fixed, there is no interest rate risk for the borrower – Strategy 2: Borrow $1 million for 3 years at a floating rate, LIBOR + 2%, to be reset annually • Since the interest rate is reset (repriced) annually, the borrower faces the repricing risk, which causes the uncertainty of future interest payments (the rate could be reset upward or downward) • The 2% is the credit premium to reflect the creditworthiness of the borrower at the beginning. Since the credit premium is a constant, there is no credit risk for the borrower – Strategy 3: Borrow $1 million for 1 years at a fixed rate, and then renew the loans annually • For the shorter time to maturity, the borrowers could borrow at a lower interest rate • For the annual renewal, the new interest rate may reflect both the prevailing 1-year interest rate (reprising risk) and the creditworthiness of the borrower at that time point (credit risk) 9-7 Management of Interest Rate Risk 9-8 Management of Interest Rate Risk • Both foreign exchange and interest rate risk management must focus on managing existing or anticipated cash flow exposures of the firm • Before treasurers and financial managers manage interest rate risk, they must resolve a basic management dilemma: the balance between risk and return – A higher expected return must accompany higher risk – In other words, eliminating all risks means eliminating the future expected return brought by the investment 9-9 Management of Interest Rate Risk • Treasury has traditionally been considered a service center (cost center) and is therefore not expected to take positions that incur risk in the expectation of profit – Treasury management practices are therefore predominantly conservative, i.e., to reduce the risk as could as possible – However, opportunities to reduce costs or actually earn profits from managing interest rate risk should not be ignored • Another issue is that whether stockholders want management to hedge interest rate risk or prefer to diversify the risk away by themselves – For both the interest rate and exchange rate risks, firms stand at a better position to estimate and hedge both risks, but stockholders can reduce both risks through diversification without any costs 9-10 Management of Interest Rate Risk • Similar to managing foreign exchange exposure, the firm cannot undertake management or hedging strategies without forming expectations–a direction–of interest rate movements – Comparing to the foreign exchange rate movements, interest rate movements have historically shown more stability • Once management has formed expectations about future interest rate levels, it must choose the appropriate implementation, including the selective use of various techniques and instruments – Several interest rate derivatives are considered for hedging, e.g., forward rate agreements, interest rate futures, interest rate swaps, or interest rate options 9-11 Management of Interest Rate Risk • As an example, Trident Corporation has taken out a three-year, floating-rate (LIBOR+1.5%) loan in the amount of US$10 million (annual interest payments) ※ The LIBOR will be reset each year on an agreed-upon date, which is assumed to be two days prior to payment ※ The AIC, defined as the IRR of total CFs, estimates the average cost of debt 9-12 Management of Interest Rate Risk • Note that even for fixed interest rate loan, it has the interest rate risk, which only influences the opportunity cost but does not put actual cash flows at risk – If interest rates decline, the firm still needs to pay a higher interest rate, which causes an opportunity loss for the firm – This course focuses only on the cash flow risk associated with the interest rate and exchange rate risks • Some alternatives available to management as a means to manage interest rate risk are as follows: – Refinancing • Trident restructures and refinances the entire agreement with the bank, which is not always possible and often expensive – Forward rate agreements (FRAs) – Interest rate futures – Interest rate swaps 9-13 Management of Interest Rate Risk • A forward rate agreement (FRA) is an over-thecounter contract to buy or sell interest rate payments on a notional principal • The buyer of an FRA obtains the right to lock in an interest rate for a desired period of time that begins at a future date • These contracts are settled in cash in either scenario 1. Interest rates rise above the agreed rate: the seller of the FRA will pay the buyer the increased interest expense on the notional principal 2. Interest rates fall below the agreed rate: the buyer will pay the seller the differential interest expense on the notional principal ※The example to illustrate the settlement of FRA is on the next slide 9-14 Management of Interest Rate Risk • Trident can buy a FRA to lock the LIBOR for the second-year interest payment to be 5% – If LIBOR rises to become 6% for the second year, Trident would receive a cash payment of $10 million×(6%–5%) from the FRA seller – If LIBOR declines to become 3% for the second year, Trident would pay a cash payment of $10 million×(5%–3%) to the FRA seller ※ In both cases, the effective interest rate that Trident pays is 5% plus the credit premium of 1.5% • Examples of the notation for FRAs Notation Effective Date from Now Termination Date from Now Underlying Rate 1×4 1 month 4 months 4–1 = 3-month LIBOR 1×7 1 month 7 months 7–1 = 6-month LIBOR 3×6 3 months 6 months 6–3 = 3-month LIBOR 3×9 3 months 9 months 9–3 = 6-month LIBOR 6 × 12 6 months 12 months 12–6 = 6-month LIBOR 12 × 18 12 months 18 months 18–12 = 6-month LIBOR 9-15 Management of Interest Rate Risk • Interest rate futures are futures contracts whose underlying security is a debt obligation, e.g., Treasury-bill futures, Treasury-bond futures, or Eurodollar futures • Unlike foreign currency futures, interest rate futures are relatively widely used by financial managers and treasurers of nonfinancial companies – Their popularity stems from the relatively high liquidity of the interest rate futures markets, their simplicity in use, and the rather standardized interest-rate exposures most firms possess • The two most widely used futures contracts are the Eurodollar futures traded on the Chicago Mercantile Exchange (CME) and the US Treasury Bond Futures on the Chicago Board of Trade (CBOT) 9-16 Exhibit 9.5 Eurodollar Futures Prices • Eurodollar futures are futures locking the 3-month Eurodollar deposit rate at the maturity of the futures ※ The quoted price of an Eurodollar futures contract is 100–100×3-month LIBOR rate (a per annum interest rate) on the maturity day, e.g., 100–100×5.24% = 94.76 ※ The notional principal of one contract of Eurodollar futures is $1 million ※ Given the quoted price Z, the value of one Eurodollar futures contract is $10,000[100 – (90/360)(100 – Z)], e.g., for Z = 94.76, value = $986,900 ※ LIBOR rate ↑ quoted price Z ↓ the value of Eurodollar futures ↓ (this quotation method is more intuitive than quoting LIBOR rate directly) ※ Eurodollar futures contracts expire on the third Wednesday of the delivery month and are settled in cash (see the example on the next slide) 9-17 Management of Interest Rate Risk • Illustration for the use of Eurodollar futures: Date Quote Price Z February 10 94.76 February 11 94.23 February 12 94.98 ……. …… March 21 95.10 – On February 10, if you plan to invest $1 million to earn the threemonth interest rate on Mar. 21, you can take a long position of a Eurodollar futures matured on that day, which can lock in a rate of (100 – 94.76)% = 5.24% – On March 21, you can earn 100 – 95.10 = 4.90% on $1 million for the 3-month lending ($1,000,000×(90/360)×4.90% = $12,250) and a cash gain on the futures contract of $987,750 – $986,900 = $850 – The sum of $12,250 from the interest income of $1 million and $850 from the Eurodollar futures is $13,100, which is equal to the interest income if you lend $1 million at 5.24% for 3 months since March 21: $1,000,000×(90/360)×5.24% = $13,100 9-18 Management of Interest Rate Risk • Eurodollar futures strategies for IR exposures: – Buy a Eurodollar futures contract/long position (for the right of earning a fixed 3-month interest rate in the future) • If LIBOR rate ↑, the quoted price and the value of Eurodollar futures ↓ and investors adopting the long strategy suffers a loss (offsetting gains on interest income) • If LIBOR rate ↓, the quoted price and the value of Eurodollar futures ↑ and the long strategy earns a profit (offsetting losses on interest income) – Sell a Eurodollar futures contract/short position (for the obligation of paying a fixed 3-month interest rate in the future) • If LIBOR rate ↑, the quoted price and the value of Eurodollar futures ↓ and the investor adopting the short strategy earns a profit (offsetting the higher interest expense) • If LIBOR rate ↓, the quoted price and the value of Eurodollar futures ↑ and the short strategy generates a loss (offsetting the benefit of lower interest expense) 9-19 Exhibit 9.6 Eurodollar Futures Strategies for Common Exposures 9-20 Management of Interest Rate Risk • Swaps are contractual agreements to exchange or swap a series of cash flows • These cash flows are most commonly the interest payments associated with debt service, such as the floating-rate loan of Trident described above – If the agreement is for one party to swap its fixed interest rate payments for the floating interest rate payments of another, it is termed an Interest Rate Swap (IRS), or an Plain Vanilla Interest Rate Swap – If the agreement is to swap debt service obligation in different currencies, it is termed a Currency Swap (or Cross Currency Swap, CCS) (貨幣交換或換匯換利) • The swap itself is not a source of capital, but rather an alteration of the types of the cash flows associated with payment 9-21 Management of Interest Rate Risk • The interest rate swap forms the largest single financial derivatives market in the world ※ This table, which is surveyed by Bank for International Settlements (BIS), reports outstanding amounts of over-the-counter (OTC) derivatives from 2007 to 2009 ※ Interest rate contracts remained by far the largest component of the OTC market (about 72% of the total outstanding amount) ※ Note that Eurodollar futures (or Treasury-bill and Treasury-bond futures) are traded on exchanges rather that in the OTC market 9-22 Management of Interest Rate Risk • The two parties may have different expectations for entering into the IRS agreement: • Motivation 1: – A firm with fixed-rate debt that expects interest rates to fall can change fixed-rate debt to floating-rate debt – In this case, the firm would enter into a pay floating/receive fixed IRS • The firm will pay floating interest payments and receive fixed interest rate payments from the swap counterparty – The net interest burden of the firm will be a floating interest rate payment 9-23 Management of Interest Rate Risk • Motivation 2 – A firm has existing floating-rate debt service payments and it concludes that interest rates are about to rise – Through entering into a swap agreement to pay fixed/receive floating IRS, the net interest burden of the firm will be a fixed interest rate payment • Interest rate swaps are contractual commitment between a firm and a swap dealer (usually a bank) – The existence of swap dealers can provide the liquidity of the swap market because it is difficult to find immediately a counterparty with the different expectation of the change of interest rates but with the same demand of the principal and the timing – Swap dealer can earn the bid-ask spread of the swap rates 9-24 Management of Interest Rate Risk • Quotations for IRSs Years Bid Ask Swap Rate 1 5.24% 5.26% 5.250% 2 5.43% 5.46% 5.445% 3 5.56% 5.59% 5.575% 4 5.65% 5.68% 5.665% 5 5.73% 5.76% 5.745% – The Swap Rate is the fixed rate to let the value of a swap paying fixed (at that swap rate)/receiving float (at LIBOR) to be zero, i.e., the present values of the floating rate cash flows and fixed rate cash flows are equal based on the current LIBOR yield curve – For a different time to maturity, there is a corresponding swap rate – Swap dealers quote the bid and ask prices for the swap rate: • The bid price is the fixed interest rate the dealer will pay for a series of floating cash inflows at the LIBOR rate, e.g., the dealer would pay 5.56% to exchange for receiving LIBOR rates for three years • The ask price is the fixed interest rate the dealer needs for a series of floating cash outflows at the LIBOR rate, e.g., the dealer needs to 9-25 receive 5.59% to exchange for paying LIBOR rate for three years Exhibit 9.8 Comparative Advantage and Structuring a Swap Agreement • Comparative advantage argument: another reason for the existence of IRSs ※ For Unilever, its comparative advantage over Xerox is 1% (7% vs. 8%) for fixedrate debts and only 0.5% (LIBOR+0.25% vs. LIBOR+0.75%) for floating-rate debts 1. This is because banks usually charge a lower-credit firm a more expensive rate for fixed rate debts in order to cover its uncertainty in the future 2. For lower-credit firms (like Xerox in this example), they usually prefer fixed-rate debts because a certain series of cash payments in the future could reduce their financial risk ※ As long as there is a higher-credit firm (like Unilever in this example) preferring a floating-rate debt, it is possible to share comparative advantages with lower-credit firms (like Xerox in this example) through IRSs 9-26 Management of Interest Rate Risk • Interest rate swaps can benefit both counterparties – Unilever borrows at the fixed rate of 7% • It prefers a floating-rate debt • Unilever enters into a receive fixed (7%)/pay floating (LIBOR) interest rate swap with Citibank • The net interest rate for Unilever is LIBOR, which is float and smaller than the original LIBOR+0.25% for floating-rate debts – Xerox borrows at the floating rate of LIBOR+0.75% • It prefers a fixed-rate debt • Xerox enters into a pay fixed (7.875%)/receive floating (LIBOR+0.75%) interest rate swap with Citibank • The net interest rate for Xerox is 7.875%, which is fixed and a lower cost of funds than it could have acquired on its own, i.e., 8% ※ For Citibank, the net interest rate is 0.125% (=7.875%–7% + LIBOR–(LIBOR+0.75%)) 9-27 Management of Interest Rate Risk • The swap can be a tool not only for hedge but also for speculation – As long as the investor has a expectation of the change of interest rates, he can trade interest rate swaps, although he does not have any interest rate exposure – Expect LIBOR rate ↑, pay fixed/receive floating; Expect LIBOR rate ↓, pay floating/receive fixed • The cash flows of an IRS are interest rates applied to a set amount of capital, which is called notional principal (名義本金) because it is not exchanged physically, so IRSs are also known as coupon swaps 9-28 Carlton Corporation: Swapping to Fixed Rates • Trident Corporation’s existing floating-rate loan is now the source of some concern • Recent events have led management to believe that interest rates, specifically LIBOR, may be rising in the three years ahead • As the loan is relatively new, refinancing is considered too expensive, but management believes that a pay fixed/receive floating IRS may be the better alternative for fixing future interest rates now • Note that this swap agreement does not replace but supplement the existing loan agreement • After considering this IRS, the scheduled interest rates of the following three year are in Exhibit 9.9 9-29 Exhibit 9.9 Trident Corporation’s Interest Rate Swap to Pay Fixed/Receive Floating ※ Note that the original floating interest payments (at LIBOR) will be canceled out with the receipt of floating interest income from the IRS (at LIBOR) ※ If the current fixed borrowing rate quoted to Trident by its lenders is above 7.25%, then it is cheaper to adopt this IRS to change the floating-rate debt obligation to a fixed-rate debt obligation 9-30 Currency Swap 9-31 Currency Swap • The usual motivation for the use of a currency swap is to replace cash flows scheduled in an undesired currency with cash flows in a desired currency – Firms often raise capital in currencies in which they do not possess significant revenues or other natural cash flows (due to the cheaper cost of fund or lower tax in that currency) – The desired currency is probably the currency in which the firm’s future operating revenues (inflows) will be generated ※To swap an undesired currency with a cheaper cost of fund or lower tax for a desired currency with future operating cash inflows is a possible solution 9-32 Trident Corporation: Swapping Floating Dollars into Fixed-Rate Swiss Francs • After raising US$10 million in floating-rate debt, and subsequently swapping into fixed-rate payments, Trident decides it would prefer to make its payments in Swiss francs – Since the company has a natural cash inflow in Swiss francs due to sales contract, it may decide to match the currency of its debt denomination to its cash flows with a currency swap • Trident now enters into a three-year pay Swiss francs (at 2.01%) and receive US dollars (at 5.56%) fixed-for-fixed currency swap • The cash payments associated with this fixed-forfixed currency swap are shown in Exhibit 9.11 9-33 Exhibit 9.11 Trident’s Currency Swap: Pay Swiss Francs and Receive U.S. Dollars pay receive receive receive receive pay pay pay ※ Different from IRSs, the principal are exchanged physically in currency swaps – The spot exchange rate on the date of the agreement establishes what the principal is in the target currency, i.e., the initial exchange rate is SF1.5/US$ and US$10 million is exchanged for SF$15 million initially – The principal itself is part of the swap agreement because the principals are exchanged on the initial day and exchanged back on the maturity day ※ For the illustrative purpose, this text book focuses on nonamortizing swaps which repay the entire principal at maturity, rather than over the life of the swap agreement 9-34 Interest Rate and Currency Swap Quotes • Quotations of the interest rate swaps for different currencies • In fact, above quotations are also the quotations for currency swaps 9-35 Interest Rate and Currency Swap Quotes ※ In theory, a floating-for-floating currency swap involves exchanging CFs at LIBOR of one currency for CFs at LIBOR of another currency, e.g., paying annual LIBOR of US$ and receiving annual LIBOR of SF for three years (LIBOR of $ LIBOR of SF) ※ Since a swap rate of IRS can exchange for a series of LIBOR rates in each currency (swap rate LIBOR for each currency), it allows the fixed-forfixed currency swap to exchange the swap rates in any pair of currencies (swap rate of $ swap rate of SF), e.g., the 3-year pay Swiss francs/receive US dollars fixed-for-fixed currency swap is to pay Swiss swap rate 1.97% and receive US swap rate 5.575% ※ In practice, the swap dealer should charge some fees through the bid and ask rates in different currencies, and the typical rule of the swap dealer to decide the bid and ask rates for each currency is to maximize its profit ※ To trade the 3-year pay Swiss francs/receive US dollars currency swap with Trident, the swap dealer will offer receiving Swiss francs at the ask rate of 2.01% and paying US dollars at the bid rate of 5.56% (those rates are the figures in the currency swap contract in the case of Trident discussed above) ※ In addition to floating-for-floating and fixed-for-fixed currency swaps, the third type is a cross-currency interest rate swap where a floating rate (the LIBOR) in one currency is exchanged for a fixed rate (the swap rate) in another currency 9-36 Mark-to-Market and Unwinding Swaps • Financial accounting practices require Trident to track and value its position regularly with the mark-tomarket (or mark-to-model) method on the basis of current exchange and interest rates • After one year, if the two-year fixed rate of interest for francs (dollars) is now 2% (5.5%) and the spot exchange rate is now SF1.4650/US$, the market-tomarket value of the fixed-for-fixed currency swap for Trident is a loss of US$229,818 SF301,500 SF15,301,500 SF15, 002,912 1 2 (1.02) (1.02) US$556, 000 US$10,556, 000 PV($ income) US$10, 011, 078 1 2 (1.055) (1.055) SF15, 002,912 mark-to-market value US$10, 011, 078 US$229,818 SF1.4650 / US$ 9-37 PV(SF payment) Mark-to-Market and Unwinding Swaps • It may happen that at some future date one side of a swap may wish to terminate or unwind the agreement before it matures • Unwinding a currency swap requires to close positions of both counterparties by settling the markto-market gains or losses between them – For example, if Trident wants to unwind the currency swap after one year, it needs to pay US$229,818 to the counterparty – In practice, the party which wants to unwind the swap will be charged an additional penalty fee 9-38 Counterparty Risk • Counterparty risk is the potential exposure any individual firm bears that the second party to any financial contract will be unable to fulfill its obligations under the contract’s specifications • The real exposure of an interest rate or currency swap is not the total notional principal, but the “positive” mark-to-market value of the swap contract – If the mark-to-market value of the swap contract is negative for your position, i.e., your counterparty has some gains, it is not necessary for you to worry about the counterparty risk • Counterparty risk has been one of the major factors that favor the use of exchange-traded rather than overthe-counter derivatives – Exchanges themselves are counterparties to all derivatives transactions, and together with the margin requirement, there is nearly no counterparty risk for exchange-traded derivatives 9-39