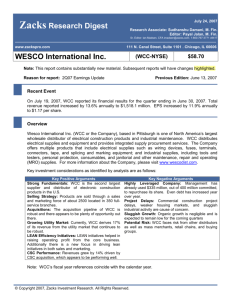

Slide sem título - Banco do Brasil

advertisement

Banco do Brasil 2Q07 Results 1 Recurring Net Income grows... 47.8 36.3 19.8 14.2 26.7 29.4 18.0 29.4 18.4 20.9 3,889 29.0 24.3 2,923 1,546 1,409 1,464 1,248 2,477 907 1,068 1,586 832 Δ Recurring Net Income - 126.2% 647 2Q06 3Q06 4Q06 1Q07 2Q07 Δ Recurring Net Income - 84.4% 1H06 1H07 Net Income – R$ million ROE (Annualized) - % Recurring Net Income – R$ million Recurring ROE (Annualized) - % ...and ROE goes into a positive trend. 2 Net Interest Income and less provisions... R$ million Net Income 1Q07 ( ) Higher Interest Income 355 Less Credit Risk Expenses 195 Other Administrative Expenses Growth 119 Provisions for Legal Risk Strengthening 152 Higher Taxes Expenses 195 Other Effects Recurring Net Income 2Q07 ( ) 1,409 Early Retirement Plan and Previ Effects Net Income 2Q07 29 1,464 396 1,068 ...compensated higher expenses, taxes and legal risk. 3 Net Interest Income grows... R$ billion 10.1 8.7 4.8 4.4 4.3 5.2 4.8 1.3 0.9 0.6 4.9 3.3 0.3 0.4 3.4 3.3 4.7 5.3 2Q06 3Q06 9.6 9.4 3.0 5.8 4Q06 3.2 4.8 4.8 4.6 5.4 0.8 0.5 6.1 1Q07 6.2 6.8 10.4 12.2 6.1 2Q07 Net Interest Income Loan Revenues Interest Expense Security Revenues 1H06 1H07 Other Interest Revenues ... on the back of loan revenues. 4 NIM kept stable... 15.7 14.6 13.6 8.1 2Q06 7.9 3Q06 8.4 4Q06 Average Selic Annualized - % 12.9 12.3 7.9 7.9 1Q07 2Q07 Annualized NIM by Loan Portfolio - % NIM Annualized¹ - % 33.0 (1) Net Interest Income over Earning Assets 31.4 31.8 28.9 28.8 8.9 8.5 8.0 7.3 7.0 5.7 5.2 6.4 7.0 6.6 2Q06 3Q06 Individuals 4Q06 Businesses 1Q07 2Q07 Agribusinesses ... despite the Selic easing cycle. 5 Growth in the long fixed rate exposure... Related to Selic - % 117.8 62.7 127.2 124.8 128.1 Investment Interest Rate 62.1 62.0 61.5 Funding Interest Rate 112.6 58.1 46.4 36.1 23.8 21.9 29.9 27.7 19.0 22.9 18.2 12.7 2Q06 3Q06 4Q06 1Q07 2Q07 Domestic Long Net Exposure - R$ billion Floating Rate Fixed Rate ...helps to protect the NIM. 6 Strong growth in the Loan Portfolio... R$ billion Δ % over 2Q06 1Q07 133.2 113.1 118.3 9.9 10.4 21.6 23.2 12.2 140.4 12.3 12.2 26.1 45.1 46.8 48.8 39.9 40.3 41.7 44.4 51.9 55.2 56.3 2Q06 3Q06 4Q06 1Q07 2Q07 Businesses Individuals Agribusinesses Abroad 3.5 23.5 (0.8) 29.0 6.8 22.2 4.3 35.3 2.1 145.2 27.9 24.0 28.4 ...explains the Net Interest Income performance. 7 Focus on Individuals Portfolio... R$ billion Δ % over 2Q06 1Q07 26.1 9.6 0.4 2.6 2.7 2Q06 0.6 9.3 8.3 7.4 6.0 6.8 9.9 (0.3) 2.8 10.2 68.4 8.9 8.2 (0.5) 28.9 7.9 320.4 33.7 9.5 10.1 9.9 29.0 24.0 23.2 21.6 27.9 2.3 2.8 0.9 3Q06 2.2 3.1 4Q06 2.7 2.6 3.2 3.4 1.3 1.7 1Q07 Cars Loan Overdraft Account Credit Card Payroll Loan 2Q07 Others ... highlighting cars and payroll loans. 8 Stable Credit Risk... Average Risk - % 6.9 6.8 6.8 6.7 6.2 6.2 6.0 BB Banking Industry 5.4 5.4 5.4 Required Provision / Past Due Loan + 90 days - % 213.9 211.1 179.6 222.7 214.0 175.1 170.1 221.9 173.1 166.2 BB Banking Industry 2Q06 3Q06 4Q06 1Q07 2Q07 ... better than the industry... 9 ...allows provisions to recede... 5.5 5.6 5.0 4.8 4.1 1,757 1,385 1,431 1,257 1,236 7.4 2Q06 3Q06 4Q06 1Q07 Provision Expenses - R$ million 2Q07 5.0 7.4 6.5 6.5 6.5 4.1 4.2 4.1 2.9 2.8 2.8 4Q06 1Q07 2Q07 5.2 Provision Expenses / Loan Portfolio¹ - % 3.6 2Q06 3.8 3Q06 Provision / Loan Portfolio - % Past Over Due Loans + 15 days / Loan Portfolio - % (1) Average Portfolio and Expenses of the past 12 months Past Over Due Loans + 60 days / Loan Portfolio - % ...with delinquency under control. 10 Provisions... R$ million 8,414 752 7,662 Jun/06 8,757 8,635 548 Sep/06 9,441 1,582 1,655 7,238 7,551 7,786 Dec/06 Mar/07 1,397 8,209 9,133 Jun/07 Total Provision Required Provision Additional Provision ... denoting conservative approach. 11 Funding still growing.... R$ billion Δ % over 2Q06 1Q07 139.9 6.0 144.9 5.7 2.4 158.8 5.2 160.7 5.3 164.5 5.4 (9.0) 3.3 76.9 80.9 81.4 17.4 0.7 40.1 35.6 36.8 17.5 3.5 22.9 4.9 69.4 72.3 31.4 32.4 33.2 34.4 36.7 38.9 40.8 Jun/06 Sep/06 Dec/06 Mar/07 Jun/07 Saving Deposits Time Deposits 17.6 Demand Deposits Others ... highlighting saving and demand deposits. 12 Fees from products and customers... R$ million Δ % over 2Q06 1Q07 2,252 2,287 2,377 322 349 316 715 713 722 742 1,211 1,217 1,216 1,319 2,246 320 2Q06 3Q06 Products 4Q06 Customers 2,437 285 772 8.5 2.5 (10.9) (9.8) 8.0 4.0 14.0 4.6 1,381 1Q07 2Q07 Others ... still growing. 13 Assets under Management surpass R$ 200 billion... 19.7 171.2 19.7 180.6 19.1 182.7 19.1 193.1 19.1 208.9 Δ= 8.2% Δ= 22.0% Customers - million 2Q06 3Q06 4Q06 1Q07 Market Share - % Assets under Management - R$ billion 2Q07 23.7 24.1 24.4 24.6 24.9 1.5 1.5 1.6 1.6 1.6 22.2 22.6 22.8 23.0 23.3 2Q06 3Q06 4Q06 1Q07 2Q07 Individuals Companies ...and the customer basis reach 25 million. 14 Insurance reaches a new level of performance... Value Added¹ - R$ million 300 245 315 316 250 Δ= 0.5% Δ= 28.9% 2Q06 3Q06 4Q06 1Q07 2Q07 (1) Includes equity income, fee income, brokage and asset management income 15 ...so does credit card business. Value Added¹ - R$ million 558 454 559 508 486 Δ= 10.1% Δ= 23.1% 2Q06 3Q06 4Q06 1Q07 2Q07 (1) Includes fee income, financing income, equity income and others 16 Great expansion in the credit card basis... 14.1 9.9 15.7 11.4 10.9 8.9 14.4 11.2 11.5 9.4 Δ= 3.4% Δ= 29.9% 2Q06 3Q06 4Q06 1Q07 2Q07 Credit Cards - million (1) Includes Credit Cards and Debit Cards Revenue¹ - R$ billion ...6 million new cards in 12 months. 17 Costs under control... R$ million Δ % over 2Q06 1Q07 3,396 3,268 1,401 1,519 9.9 8.5 1,846 1,748 1,713 (6.9) (2.0) 4Q06 1Q07 2Q07 3,216 1,383 1,378 1,516 1,839 1,804 2Q06 3Q06 (1) Legal risk and extraordinary items are not included. 2.6 3,186 3,253 Personnel Expenses¹ 0.5 Other Administrative Expenses¹ ...in line with the business pace. 18 Early Retirement Plan and Previ... Early Retirement Plan Eligible Employees: those above 50 years old or able to receive INSS pension and over 15 year contribution to Previ 6.9 thousand people joined Impacts in the 2Q07: R$ 445.9 million, after taxes Forecasted saving for 2008: R$ 158 million, after taxes Suspension of the Contributions to Previ Suspension of the contributions to the Benefit Plan #1 Impacts in the 2Q07: R$ 50 million, after taxes Forecasted saving for 2008: R$ 200 million, after taxes (subject of revaluation every 12 months) ...bring future cost savings and... 19 ...reduction in the workforce. Workforce - thousand 10.5 10.2 9.9 10.1 9.8 82.9 82.6 82.7 82.5 79.3 Points of Service - thousand 2Q06 3Q06 Employees 4Q06 1Q07 2Q07 15.0 15.0 15.1 15.1 15.2 3.9 4.0 4.0 4.0 4.0 11.0 11.1 11.1 11.2 11.2 2Q06 3Q06 4Q06 1Q07 2Q07 Interns Branches Others 20 Fee Income... R$ billion 112.2 113.4 127.9 112.9 130.2 110.1 2.2 2.0 2Q06 (1) Year to Date 2.3 2.2 1.9 3Q06 2.4 2.4 2.5 2.0 1.9 4Q06 1Q07 Recurring Coverage Ratio¹ - % Fee Income Coverage Ratio¹ - % Personnel Expenses 2Q07 ...covers more than 130% of personnel expenses. 21 Expenses control allows... R$ billion 45.5 49.1 47.5 46.5 44.1 44.7 8.0 7.1 3.4 3.4 2Q06 (1) Year to Date 3Q06 3.6 4Q06 7.7 7.5 7.1 4.2 3.3 1Q07 2Q07 Recurring Efficiency Ratio¹ - % Administrative Expenses Efficiency Ratio¹ - % Operating Income ...to keep efficiency on the track. 22 BIS Ratio allows... % 17.3 17.7 17.3 17.2 15.9 5.7 5.8 5.6 5.5 5.3 11.6 11.9 Jun/06 Sep/06 11.6 Dec/06 Tier I 11.6 Mar/07 10.6 Jun/07 Tier II ...a R$ 88 billion leverage margin. 23 Investor Relations Unit SBS - Quadra 1 - Bloco C - Ed. Sede III - 5° floor 70073-901 - Brasília (DF) Phone: 55 (61) 3310.3980 Fax: 55 (61) 3310.3735 www.bb.com.br ri@bb.com.br Disclaimer - This presentation contains references and statements, planned synergies, increasing estimates, projections of results and future strategy for Banco do Brasil, it’s Associated and Affiliated Companies and Subsidiaries. Although these references and statements reflect the management’s belief, it also involves imprecision and high difficult risks to be foreseen, consequently, it may conduct to a different result than the one anticipated here. These expectations are highly depended on market conditions, on the Brazilian economic performance, on the sector and the international market. Banco do Brasil is not responsible for bringing up to date any estimate in this presentation. For further information access www.bb.com.br/ri 24