a project report on - ManagementParadise.com

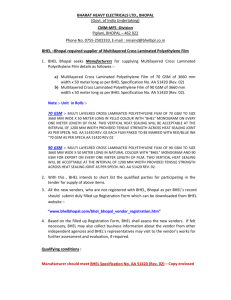

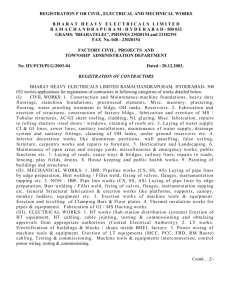

advertisement