Project Finance

advertisement

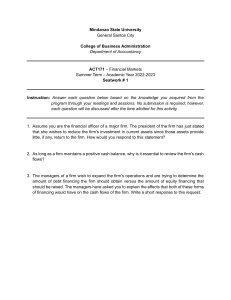

Course Code Course Title Project Finance FIN XXX Credits 3 Course Objectives This course is designed to impart a basic introduction to the principles and practice of project finance andappraisal. The learning’s from the course will come handy even for those who plan to be entrepreneurs in the future. Course Description Course Outline Introduction to Project Finance - Description of Project Finance Transaction, difference between corporate finance and project finance, Structuring the Project, Limited Resource Structures- BOT, BOO, Leasing Techniques Risks in project Financing-Risk Identification, Risk management, Risk Assessment, Sensitivity Analysis, Scenario Analysis Valuing Projects- NPV, IRR, MIRR, Real Options, Decision Trees and Monte Carlo Simulations Financing Projects- Raising Capital In international Markets, Project financing structures Social Cost Benefit Analysis- Shadow Prices and Economic rate of return Environment Appraisal of the project and Detailed Project Report Course Delivery Lectures, Case Discussions, Simulations and Practitioners sessions Textbook Prasanna Chandra, Projects, Planning Analysis, Selection, Financing, Implementation and Review, Tata Mcgrah Hill, 7th edition Reference Books & Additional Reading Material Benjamin C. Esty, Modern Project Finance: A Casebook Frederik Pretorius ,Project Finance for Construction and Infrastructure: Principles and Case Studies Esteban C. Buljevich, Yoon S. Park, Project Financing and the International Finance E.R. Yescombe ,Principles of Project Finance