DOL and DFL math

advertisement

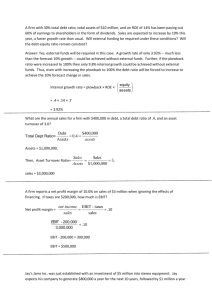

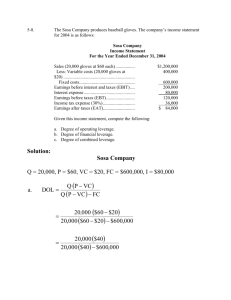

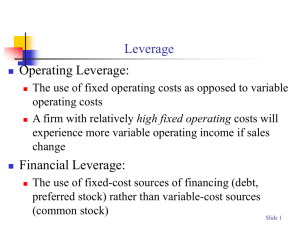

The Mathematics of DOL and DFL The degree of operating leverage and degree of financial leverage are elasticities. Perhaps, you recall the concept of elasticity from prior courses in the context of price elasticity of demand or supply. Some variable definitions and accounting equations are needed as follows to derive the DOL formula. Gross Profit = Q (P - V), where Q is the quantity sold; P is the price per unit; Fc is fixed cost; and V is the variable cost per unit. We assume that the price per unit does not depend on the quantity sold. EBIT = Gross Profit – fixed costs = Q (P - V) – Fc. Degree of Operating Leverage (DOL) DOL is the percentage change in EBIT caused by a one-percent change in sales (Q). As such, the DOL is the elasticity of EBIT with respect to the quantity of sales (Q) as follows1: DOL d EBIT dQ Q d [Q( P V ) Fc ] Q . Thus, dQ EBIT EBIT Q Q( P V ) gross profit DOL ( P V ) . EBIT EBIT EBIT Degree of Financial Leverage DFL is the percentage change in earnings per share caused by a onepercent change in EBIT. Thus, DFL is the elasticity of EPS with respect to EBIT. Earnings per share is EBIT minus interest (I), times one minus the tax rate (t), divided by the number of shares outstanding (shares). In symbolic form: EPS = [(EBIT – I)(1 – t)] / shares DFL 1 dEPS EBIT (1 t ) EBIT (1 t ) EBIT EBIT DFL dEBIT EPS shares EPS ( EBIT I )(1 t ) EBIT I An elasticity of q with respect to p is in general: dq p . dp q 1 Degree of Total Leverage (DTL) Degree of total leverage is the product of DOL and DFL. It is the percentage change in EPS caused by a one-percent change in sales. For example, if DOL is 3 and DFL 4, then: o A 5% increase in sales increases EBIT 15% o A 15% increase in EBIT increases EPS 60% o Therefore, a 5% increase in sales increases EPS 60%. 2