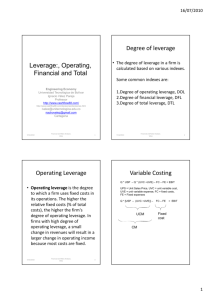

Operating Leverage

advertisement

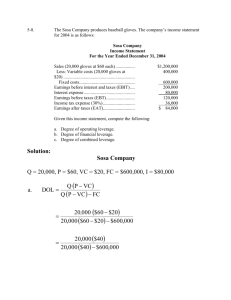

CHAPTER 9 Capital Structure and Leverage Optimal capital structure Business vs. financial risk Leverage The Target Capital Structure Capital Structure The combination of debt and equity used to finance a firm Target Capital Structure The mix of debt, preferred stock, and common equity with which the firm plans to finance its investments The Target Capital Structure Four factors that influence capital structure decisions: 1. The firm’s business risk 2. The firm’s tax position 3. Financial flexibility 4. Managerial attitude risk In a company, it has two types of risk: Business risk Financial risk In this chapter, we will learn: What is business risk & financial risk? How to measure business risk? How to measure financial risk? Business Risk Business risk: the riskiness inherent in the firm’s operations if it uses no debt. 经营风险:是公司经营中的内在风险,即在不 采用债务的情况下经营所面临的风险。 Business Risk Two ways to analyze the business risk: Breakeven analysis Operating leverage Breakeven analysis Breakeven analysis: A technique for studying the relationship among fixed costs, variable costs, sales volume, and profits. 盈亏平衡分析(保本分析):一种研究固定成 本、变动成本、销售量和利润之间关系的技术 方法。 Breakeven analysis Breakeven occurs when EBIT = 0 Total revenue – Total cost = 0 PQ - VQ - FC = 0 Q(P - V) = FC QBE (保本销售量)= FC / (P - V) P = Price per unit (单价) V = Variable costs per unit (单位变动成本) FC = Fixed costs (固定成本) Q = Quantity sold (销售量) Breakeven analysis Breakeven occurs when EBIT = 0 Total revenue – Total cost = 0 Total revenue = Total cost Sales revenue = Fixed cost + Variable cost Sales revenue = FC + V×Q SBE (保本销售收入)= FC + V×QBE Example e.g.: A firm that produces a child’s bicycle: Sells for $50 a unit Annual fixed operating costs---$100,000 Variable operating costs---$25 a unit QBE=$100,000/($50-$25)=4,000 units SBE=$100,000+$25×4,000=$200,000 Breakeven Chart REVENUES AND COSTS Total Revenues Profits 250000 Breakeven Point 保本点 Total Costs 200000 100000 Losses FC 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 QUANTITY PRODUCED AND SOLD Case study Price Variable costs Fixed costs Plan A $2.00 $1.50 $20,000 Plan B $2.00 $1.00 $60,000 What is the break point for plan A? (QBE, SBE) What is the break point for plan B? (QBE, SBE) For plan A: Case study QBE=40,000 units SBE=$80,000 For plan B: QBE=60,000 units SBE=$120,000 Which one’s breakeven point is lower? (plan A or plan B) Plan A Which plan is easier to make profits? Plan A Operating leverage Operating leverage: the extent to which fixed costs are used in a firm’s operations. 经营杠杆:是在公司的经营过程中固定成本使 用的比重。 Operating leverage Operating leverage is the ratio of percentage change in EBIT divided by percentage change in quantity sold. 经营杠杆是息税前利润变动百分比与销售量变 动百分比之间的比率。 EBIT DOL EBIT Q Q DOL (degree of operating leverage, 经营杠杆 系数) Computing the DOL DOLQ units Q (P - V) = Q (P - V) - FC Q = Q - QBE Q QBE This equation is mainly for a single-product firm. 这个公式主要适用于单一产品公司。 Computing the DOL DOLS dollars of sales S - VC = S - VC - FC = EBIT + FC EBIT EBIT FC This equation is mainly for a multi-product firm. 这个公式主要适用于多产品公司。 Case study Company Fox is a single-product firm. It has two plans. Plan A Plan B Price $2.00 $2.00 Variable costs $1.50 $1.00 Fixed costs $20,000 $60,000 Units sold 100,000 100,000 What is the DOL for plan A and plan B? Case study DOL DOL A B 100,000 100,000 1.67 - 40,000 100,000 2.5 100,000 - 60,000 Plan B has a higher DOL, which means plan B is riskier than plan A. A high degree of operating leverage implies a high business risk. 高经营杠杆系数意味着高 经营风险。 Financial risk Financial risk: an increase in stockholders’ risk, over and above the firm’s basic business risk, resulting from the use of financial leverage. 财务风险:是在公司基本经营风险的基础上股 东所面临的增加的风险,它源于公司对财务杠 杆的作用。 Business risk is the risk without the debt. Financial risk is the risk with the debt. Financial risk Financial risk can also be measured by financial leverage. Financial leverage: the degree to which a firm is utilizing borrowed money. 财务杠杆: 公司利用债务筹资的程度(比例)。 Financial leverage Financial leverage is the ratio of percentage change in EPS divided by percentage change in EBIT. 经营杠杆是每股收益变动百分比与息税前利润 变动百分比之间的比率。 EPS DFL EPS EBIT EBIT DFL (degree of financial leverage, 财务杠杆 系数) Computing the DFL DFL EBIT EBIT - I EBIT = Earnings before interest and taxes I = Interest Case study Option 1: Zero debt (100% equity) Debt ratio: 0% Total capital: $200,000 ① Debt: 0 ② Common equity: $200,000 ($20/share) Shares outstanding: 10,000 shares Demand Probability EBIT Terrible 0.05 -60,000 Poor 0.20 -20,000 Normal 0.50 40,000 Good 0.20 100,000 Wonderful 0.05 140,000 Case study Expected EBIT=$40,000 I=0 EBIT 40,000 DFL 1 EBIT - I 40,000 - 0 1 Case study Option 2: 50% debt (50% equity) Debt ratio: 50% Total capital: $200,000 ① Debt: $100,000 (interest rate=12%) ② Common equity: $100,000 ($20/share) Shares outstanding: 5,000 shares Demand Probability EBIT Terrible 0.05 -60,000 Poor 0.20 -20,000 Normal 0.50 40,000 Good 0.20 100,000 Wonderful 0.05 140,000 Case study Expected EBIT=$40,000 I=$100,000×12%=$12,000 DFL 2 EBIT EBIT - I 40,000 40,000 - 12,000 1.43 Case study DFL1=1, DFL2=1.43 Option 2 has higher DFL, also means option 2 has higher financial risk. A high degree of financial leverage implies a high financial risk. 高财务杠杆系数意味着高财 务风险。 Degree of Total Leverage (DTL) The percentage change in EPS that results from a given percentage change in sales. DTL = DOL X DFL DTL = Q(P - V) Q(P - V) - F - I DTL = S - VC S - VC - F - I = = Gross Profit EBIT - I EBIT + F EBIT - I