Fringe Benefits Tax

advertisement

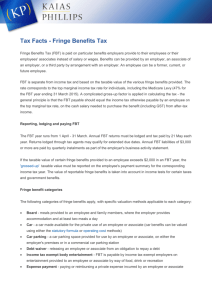

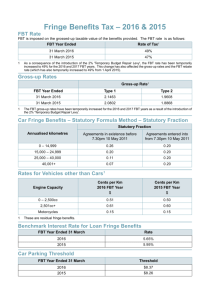

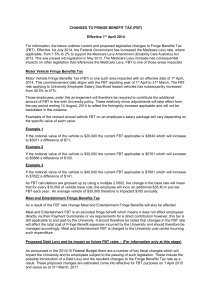

Fringe Benefits Tax What are fringe benefits? Fringe benefits are benefits, but not salary and wages, provided to employees or their associates in respect of their employment. Advantages of fringe benefits Can provide flexibility to an employee’s remuneration and provide a taxeffective way of providing part of an employee’s renumeration package where that employee receives less salary and more benefits. The advantage of this is that the employees assessable income is reduced resulting in an overall increase in remuneration with cash flow and budgeting becoming easier. How does Fringe Benefits Tax (FBT) work? Different fringe benefits can vary in the amount of FBT they attract. Some items incur full FBT, some attract concessional rates, others are fully exempt. Where FBT is payable on an item, it becomes the employers liability to pay it. However in such situations the employer will normally stipulate that as part of an employee’s salary packaging arrangement, the cost of the FBT will be passed onto the employee. In order to calculate FBT we apply gross-up rules to the value of the benefit. These rules are desgined to provide a similar tax outcome between the fringe benefits provided and the salary or wages of an employee on the top marginal tax rate. The rate of fringe benefits tax is 48.5% (for non-concessional and non-exempt benefit). To calculate the tax we use the following formula: Taxable value x 2.1292 x 48.5% = Type 1 rate (GST creditable items) - mobile phone bills - credit cards Taxable value x 1.9417 x 48.5% = Type 2 rate (GST free or input taxed items) - medical services - education courses - financial supplies (home loans) The difference between the two gross-up rates is the GST burden. In calculating the actual cost of FBT however, the amount that is charged to an employee’s renumeration package should generally be grossed up by 1.9417 regardless of the type of benefit. This is because where the Type 1 gross-up rate is used, the employer claims back the GST input tax credit attached to the benefit. Meaning the actual net FBT cost remains the same whichever method is used. The FBT rate is the highest marginal tax rate – consequently someone who salary packages a non-concessional non-excempt item and is below the highest marginal tax rate would be worse off if they also had to bear the FBT liability. If they had bought it with post tax dollars they would have only needed to to earn an extra 30c in the dollar to pay for the benefit. By packaging and incurring the liability they are charged an extra 48c in the dollar. Why else do we gross-up? Grossing up the value of fringe benefits is also important for calculating the employee’s assessable income with regards to: - the Medicare Levy surcharge - Superannuation contributions surcharge - Calculating child support obligations - HECS repayments. Salary packaging does not reduce the assessable income for these charges. The value of the fringe benefit less the gross-up value is used in the assessment of entitlement for these income tested government benefits. - parental means test for youth allowance - family tax benefit - child care benefit Types of Fringe Benefits useful to our clients Superannuation Superannuation contributions are not subject to FBT; however super that is salary sacrificed by an employee is counted as an employer contribution and thus goes towards the employee’s age based contribution limits. Employer Provided Cars Concessional FBT rates applying to cars can make them an attractive option for salary packaging, especially for clients who wish to package a car through their own company. Car Packaging There is a concessionaly FBT rule for motor vehicles make them an attractive