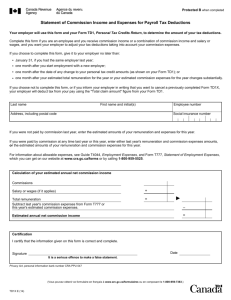

Operating cost method report

advertisement

Operating cost method report For the FBT year of tax from 1 April to 31 March 2014 Administrative details Name of Employer: Name of employee: Make and model of car: Registration number: Original cost: Reduced purchase cost: Date car purchased or first hold by employee: Engine capacity Business use percentage The business use percentage has been calculated with reference to a logbook which was commenced no earlier that 1 January 2009 or where business usage has not varied by more than 10%. Operating cost information Amount (including GST where applicable) Lease payments $___________ Petrol expenses $___________ Registration $___________ Insurance $___________ Maintenance/Repairs • Car washes $ • Services $ • Accident repairs personally paid $ • Other (please specify) $ $___________ Total operating expenses Less: Business use reduction $ Employee contributions $ $___________ Value of Benefit Signed as a true and correct record ____________________________ (to be signed by employer) Dated $___________ ______________________________________