CHANGES TO FRINGE BENEFIT TAX (FBT) Effective 1 April 2014

CHANGES TO FRINGE BENEFIT TAX (FBT)

Effective 1 st April 2014

For information, the below outlines current and proposed legislative changes to Fringe Benefits Tax

(FBT). Effective 1st July 2014, the Federal Government has increased the Medicare Levy rate, where applicable, from 1.5% to 2% to support the Medicare Levy Amendment (Disability Care Australia) Act

2013. This was passed into legislation in May 2013. The Medicare Levy increase has consequential impacts on other legislation that references the Medicare Levy. FBT is one of those areas impacted.

Motor Vehicle Fringe Benefits Tax

Motor Vehicle Fringe Benefits Tax (FBT) is one such area impacted with an effective date of 1 st April,

2014. This commencement date aligns with the FBT reporting year of 1 st April to 31 st March.

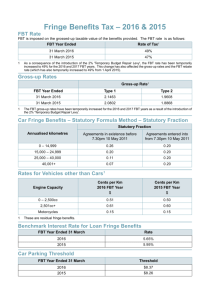

The FBT rate applying to University Employee Salary Sacrificed leased vehicles has subsequently increased from 46.5% to 47%.

Those employees under this arrangement will therefore be required to contribute the additional amount of FBT in line with University policy. These relatively minor adjustments will take effect from the pay period ending 14 August, 2014 to reflect the fortnightly increase applicable and will not be backdated in this instance.

Examples of the revised annual vehicle F BT on an employee’s salary package will vary depending on the specific value of each value.

Example 1

If the notional value of the vehicle is $20,000 the current FBT applicable is $3840 which will increase to $3911 a difference of $71 .

Example 2

If the notional value of the vehicle is $30,000 the current FBT applicable is $5761 which will increase to $5866 a difference of $105.

Example 3

If the notional value of the vehicle is $40,000 the current FBT applicable is $7681 which will increase to $7822 a difference of $141.

As FBT calculations are grossed up by using a multiple 2.0802, the change in the base rate will mean that for every $10,000 of vehicle base cost, the employee will incur an additional $35.40 in pre-tax

FBT each year. An average vehicle of $30,000 therefore is impacted $105 annually.

Meal and Entertainment Fringe Benefits Tax

As a result of the FBT rate change Meal and Entertainment Fringe Benefits will also be affected.

Meal and Entertainment FBT is an excluded fringe benefit which means it does not affect employees directly via their Payment Summaries or via requirements for a direct contribution however, this tax is still applicable to and paid by the University. It should therefore be noted that changes in the FBT rate will affect the total cost of Fringe Benefit expenses incurred by the University and should therefore be managed accordingly. Meal and Entertainment FBT is charged to the University cost centre incurring such expenditure.

Proposed Debt Levy and its impact on future FBT rates – (For information only at this stage)

As announced in the 2014/15 Federal Budget there are a number of key fiscal changes which will impact the University and its employees subject to the passing of such legislation. These include the possible introduction of a Debt Levy and the resultant changes to the Fringe Benefits Tax rate as a result. These proposed changes are estimated come into effective for FBT purposes on 1 April 2015 and cease as at 31 st March, 2017

The introduction of a Debt Levy essentially means that;

1) Taxpayers with taxable incomes of $180,000 and above will pay a levy of 2% of their taxable income over $180,000 commencing 1st July 2014 through to 30th June 2017.

2) As FBT is aligned to the highest marginal tax rate including Levies, the FBT rate will therefore increase from the current 47% to 49% effective 1 st April 2015. This increase will impact all staff with a Salary Sacrificed vehicle regardless of their taxable income level.

Further adjustments may therefore be required to FBT rates applicable to Salary Sacrificed Vehicles.

A further communication will be issued if and when this increase is legislated and is provided for information and planning purposes at this stage.

For any FBT related query please contact Sharan Kaur, UWS Accountant, Tax & Insurance on (02)

4570 1217.

For any other Salary Sacrifice vehicle matters, please contact Procurement, Associate Director Phil

Clark on (02) 4570 1347.

Yours sincerely,

Darren Greentree

Director, Financial Operations