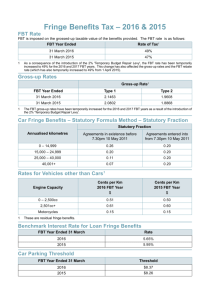

FBT rates to rise For the FBT year ended 31st March 2015, the FBT

advertisement

FBT rates to rise For the FBT year ended 31st March 2015, the FBT rate will rise from 46.5% to 47%. In addition the gross-up rate will increase from 2.0647 to 2.0802. In relation to motor vehicles, the transitional arrangements for motor vehicles purchased after 10th May 2011 has now ended. This means that when using the Statutory formula to calculate the FBT amount on motor vehicles purchased after 10th May 2011, the rate will be 20% regardless of how many kilometers the vehicle has travelled during the year. The rates for motor vehicles purchased before 10th May 2011 remain the same. Although you may not lodge an FBT return, you may employ staff that have salary sacrifice arrangements on their motor vehicles. It may be necessary to review these arrangements to ensure that the amounts being deducted from their salary is correct in line with the above changes. If you require assistance in relation to this matter, please do not hesitate to contact your UHY Haines Norton PRT partner or any of our helpful staff.