Fringe Benefits Tax

advertisement

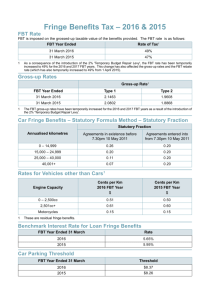

Fringe Benefits Tax “You won’t feel a thing Dr. Schneider. We make a small incision in your wallet and…” Dylan Chan What are fringe benefits? Fringe benefits are benefits, but not salary and wages, provided to employees or their associates by a) employer’s b) an associate of the employer; or c) a third party under an arrangement with the employer or an associate of the employer. Advantages of fringe benefits Can provide flexibility to an employee’s remuneration and provide a taxeffective way of providing part of an employee’s remuneration package where that employee receives less salary and more benefits. The advantage of this is that the employees assessable income is reduced resulting in an overall increase in remuneration with cash flow and budgeting becoming easier. How does Fringe Benefits Tax (FBT) work? Different fringe benefits can vary in the amount of FBT they attract. Some items incur full FBT, some attract concessional rates, others are fully exempt. Where FBT is payable on an item, it becomes the employers liability to pay it. However in such situations the employer will normally stipulate that as part of an employee’s salary packaging arrangement, the cost of the FBT will be passed onto the employee. Employers are generally required to pay FBT in four instalments that are notified on the employer’s BAS. These instalments are based on either the employer’s previous year’s FBT liability or the employer’s estimate of its FBT liability for the current year. In order to calculate FBT we apply gross-up rules to the value of the benefit. These rules are designed to provide a similar tax outcome between the fringe benefits provided and the salary or wages of an employee on the top marginal tax rate. The Government introduced these measures to limit the opportunities available to employees to use salary packaging arrangements as a means of avoiding income-tested surcharges and levies (ie to prevent taxpayers from accessing tax related benefits that they would otherwise not be entitled on the basis of their total remuneration). Where the aggregate value of an employee’s taxable fringe benefits exceeds $1,000, the employer is required to ‘gross up’ this amount by a factor. The ‘grossed up’ amount (referred to as the ‘reportable fringe benefits amount’) is then required to be reported on the employee’s Group Certificate. The rate of fringe benefits tax is 48.5% (for non-concessional and non-exempt benefit). To calculate the tax we use the following formula: Taxable value x 2.1292 x 48.5% = Type 1 rate (GST creditable items) - mobile phone bills - credit cards - car payments Taxable value x 1.9417 x 48.5% = Type 2 rate (GST free or input taxed items) - medical services - education courses - financial supplies (home loans) The difference between the two gross-up rates is the GST burden. In calculating the actual cost of FBT however, the amount that is charged to an employee’s remuneration package should generally be grossed up by 1.9417 regardless of the type of benefit. This is because where the Type 1 gross-up rate is used; the employer claims back the GST input tax credit attached to the benefit. Meaning the actual net FBT cost remains the same whichever method is used. The FBT rate is the highest marginal tax rate – consequently someone who salary packages a non-concessional non-exempt item and is below the highest marginal tax rate would be worse off if they also had to bear the FBT liability. If they had bought it with post tax dollars they would have only needed to earn an extra 30c in the dollar to pay for the benefit. By packaging and incurring the FBT liability, they are charged an extra 48c in the dollar. Why else do we gross-up? Grossing up the value of fringe benefits is also important for calculating the employee’s assessable income with regards to: - the Medicare Levy surcharge - Superannuation contributions surcharge - Calculating child support obligations - HECS repayments. Salary packaging does not reduce the assessable income for these charges. The value of the fringe benefit less the gross-up value is used in the assessment of entitlement for these income tested government benefits. - parental means test for youth allowance - family tax benefit - child care benefit Employers Exempt from FBT Non-profit and public hospitals are considered Public Benevolent Institutions and are exempt from paying FBT on benefits of up to $17,000 of grossed-up taxable value per employee. This equates to $8,755 worth of benefits and a tax saving of $4,246. However in the NSW hospital system, the hospital keeps 50% of this for itself, reducing the benefit to $2,123. In ACT and Victorian hospitals the full tax saving is passed on to the employee. This FBT-free limit of $8,755 applies per employer. Thus if a Doctor in the course of an FBT year were to work for Western Sydney Area Health Service for 6 months of the year, and spend the other 6 months working for Central Sydney Area Health Service, they could potentially package up to $17,510 ($8,755 x 2) worth of benefits FBT free. Private not-for-profit and public hospitals will also not be liable for FBT when the following benefits are provided to their employees: the provision of meal entertainment benefits benefits that are attributable to entertainment facility leasing expenses certain housing benefits. For such benefits, accommodation will be treated as being in a remote area where it is located at least 100 kilometres from a town with a census population of 130 000 or more Certain car parking Example: Dr Simon Harper. Income of $100,000+ . He had packaged c. $5,000 worth of benefits in Sydney. Then he was seconded to Canberra for a period of 6 months. Given the more generous packaging arrangements in place in Canberra Hospital, it was important to make sure he was able to claim the full $8,755 worth of benefits available to him. Types of Fringe Benefits useful to our clients Superannuation Superannuation contributions are not subject to FBT; however super that is salary sacrificed by an employee is counted as an employer contribution and thus goes towards the employee’s age based contribution limits. Employer Provided Cars Concessional FBT rates applying to cars can make them an attractive option for salary packaging, especially for clients who wish to package a car through their own company. The employer will provide the benefit and pay the FBT, reducing the employee’s salary by the corresponding amount (annual cost + FBT liability). An employer who provides a car that is available for an employee’s private use can claim a deduction for the total cost of the car as well as the FBT incurred as they are considered business expenses. There are two methods we can use to calculate the taxable value of the car; that is, the cost base of providing the fringe benefit. Once we have determined the taxable value of the car we can calculate the fringe benefits tax liability based on that value. In determining which method to use, the employer can use whichever one results in the lowest taxable value of the car, and as a corollary the lowest Fringe Benefits Tax payable. The statutory cost method is best used where there is high percentage of private (as opposed to business) use, and where there is significant annual mileage. This method is also useful for those employees who do not wish to keep detailed substantiation records. The operating cost method becomes advantageous to those who use the car for a high percentage of business use. The Statutory Cost Method In order to use the statutory formula method we need to know the following: The base value of the car. This is the original cost price of the car plus any modifications. The statutory FBT percentage. This is the FBT percentage that is applied to the taxable value of the car. It decreases the more kilometres are travelled. Remember, the total km’s need to be annualised! Total km’s travelled annually Less than 15 000 15 000 to 24 999 25 000 to 40 000 Over 40 000 FBT % 26 20 11 7 The number of days in the FBT year that the car was not available for private use by the employee. For example when a car is being repaired or the employee is overseas on a holiday and returned the car to the employer whilst away. The FBT year runs from April 1 to March 31. Any contribution towards the cost of the car made by the employee. We then input the above into the following formula: ( A x B x C ) - E = Taxable Value ( D ) Where: A = the base value of the car. B = the statutory percentage. C = the number of days in the FBT year the car was available for private use by the employee. D = the number of days in the FBT year. E = the employee contribution. Example – Andrew’s employer purchases a car with a base value of $35,000 on October 1 2003. For the whole period October 1 - March 31 (182 days) the car is available for private use by Andrew who travels 9,000 kilometres. Firstly we need to annualise the amount of km’s he travelled!! ( 9,000 kms / 182 days ) x 365 days = 18,049 km’s = 20% statutory percentage Consequently our formula would look like this: ( $35,000 x 20% x 182 days ) = $3,490 taxable value ( 365 days ) Reduction in the base value of the car Using the statutory method only, after four years of owning or leasing, the base value of a car is reduced to two-thirds of its original value on April 1 of the following year. This makes purchasing dates critical. If a car were purchased on 25 March 2003, its base value would reduce to two-thirds of its cost base from 1 April 2007. If a car were purchased on 3 April 2003, its base value would reduce to two-thirds of its cost from 1 April 2008. On which of the dates should the car be bought? Why? Actual Operating Cost Method This method involves calculating the taxable value of the car fringe benefit using the operating costs of the car. To do this we need to know the following: The total operating costs of the car for the year, including interest on lease payments, depreciation (wear and tear), insurance and registration and estimated running costs per km travelled (15c per km). The percentage of private use for which the car was used. Any employee contributions towards the running cost of the car. Proof of the amount of employee-incurred expenses is required if this method is used. The following formula is then used: (Operating cost of car x % of private use) – Employee cont. = Taxable Value ($8,160 x 50%) - $0 = $4,080 taxable value Calculating the FBT liability Statutory Formula Method ( $35,000 x 20% x 182 days ) = $3,490 taxable value ( 365 days ) Actual Operating Cost Method ($8,160 x 50%) - $0 = $4,080 taxable value The lowest value will be used to calculate the FBT liability. Therefore using the standard FBT formula: $3,490 x 2.1292 x 48.5% = $3,604 fringe benefits tax. If an employee at the top marginal tax rate were to purchase and meet the total running cost of the car they would use a gross salary of $15,844 ($8,160 x 1.9417). If the same car was salary packaged through an employer by an employee who meets the total running costs plus fringe benefits tax, the cost becomes $15,389. Salary Packaged: FBT payable using statutory method: $3,604 + Annual costs of running the car: $8,160 = Total gross cost: $11,764 $15,844 - $11,764 = $4,080 There is a $4,080 saving to the employee if he salary packages the car through an employer and pays all the associated costs, as opposed to purchasing the car and paying for its running costs himself with after tax dollars* * Assumes an income of at least $60,000 after the car has been packaged. Loans Where a loan provided to an employee by an employer attracts either no interest, or an interest rate at a lower than the benchmark rate, an FBT taxable value will arise. The taxable value can be calculated as follows: Benchmark interest rate – accruing interest paid by employee = taxable value Where an employee is not obliged to pay any interest on a loan received from an employer, then every six months that deferred interest is itself deemed to be a loan. Should the repayment of a loan by an employee be waived in its entirety by an employer, then the amount waived is a debt waiver fringe benefit, and FBT becomes payable by the employer on the waived amount. Car Parking The FBT treatment of salary packaged car parking varies depending on the employer. If the car is parked at, or in the vicinity of the primary place of employment and it is within 1km of a ‘commercial car parking station’, a taxable car parking fringe benefit arises. However, car parking fringe benefits become exempt from FBT where: They are benefits provided by small business employers, where that employer’s ordinary and statutory income is under $10 million a year. The car parking benefits are for disabled persons. The benefits are provided by certain non-profit bodies (scientific institutions, charitable institutions and public educational institutions). Do hospitals fall under the last category? In the ATO fact sheet entitled, “Fringe Benefits Tax Reform - Information for Private Not-for-profit and Public Hospitals”, it states: Private not-for-profit and public hospitals will not be liable for FBT when it provides car parking benefits to its employees. I believe the reason behind this is that the ATO defines charitable institutions as those who carry out charitable purposes. One definition of a charitable purpose according to the ATO is “the relief of poverty or sickness or the needs of the aged”. The ATO goes on to state that PBI’s “carry on their activities without seeking private gain for particular people”. That is, they are non-profit. Consequently, public hospital employees technically should be able to package their car parking in addition to the $8,755 worth of benefits they receive FBT free as employees of PBI’s. Travel If travel is business related and packaged, no FBT is payable. For an portion of a trip that is purely personal, travel costs remain deductible to the employer, but are also subject to FBT on the fully grossed up amount. However, travel and transport costs generally exempt from FBT include: Travel associated with relocation Travel costs to attend a job interview or selection test Exempt Benefits The following items that are primarily use for business purposes are also exempt or FBT free. Laptops and other portable computers (no more than one per year) Protective clothing Briefcases Calculators Tools of trade Subscription to trade and professional journals Business related software Electronic diaries and organisers Car phones and mobile phones where private use will be minor and incidental to primary business use.