FBT (Fringe Benefits Tax) Policy

advertisement

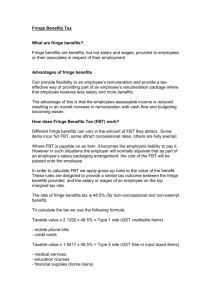

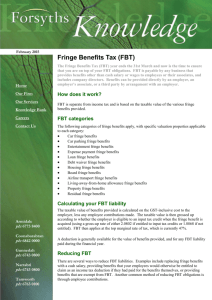

DOCUMENT TYPE ADMINISTRATIVE FINANCE AND RESOURCES PLANNING FINANCIAL OPERATIONS NUMBER P 5 2 1 049 Policy Database Document Reference Number 521049P FBT (Fringe Benefits Tax) Policy Purpose/ objectives The purpose of this policy and its related procedure is to provide a general overview of Fringe Benefits Tax (‘FBT’) and its applicability to La Trobe University (‘the University’). The document and procedure should be the first point of reference in regards to the provision of benefits to employees and the treatment of fringe benefits. Where the issue in question is outside the scope of this document all queries should be referred to the Financial and Tax Accountant. Scope/ Application University operations Policy Statement The University must comply with the obligations arising from Fringe Benefits Tax Assessment Act 1986 (‘FBTAA’) and all associated ATO Tax rulings. All staff involved in any University activities potentially affected by the FBT legislation should familiarise themselves with the requirements of the FBT Act as detailed in this policy, and in particular, the effect of the FBT in their area of work. For example, employees who organise social events need to be aware of the FBT costs associated with organising such an event. Any FBT related queries should be directed to the Taxation Accountant – Finance. Supporting Procedures FBT (Fringe Benefits Tax) Procedure Responsibility for implementation Senior Manager External Reporting, Tax and Compliance Responsibility for monitoring implementation and compliance Senior Manager External Reporting, Tax and Compliance Status New policy, approved at PRC, 3 July 2015, min ref (PRC15/87(M)-95.9. Key stakeholders Chief Financial Officer Approval Body Vice-Chancellor on the recommendation of the Planning and Resources Committee Initiating Body or person(s) Senior Manager External Reporting, Tax and Compliance Related legislation Fringe Benefits Tax Assessment Act (FBTAA) 1986 CCH Australian Fringe Benefits Tax Guide ATO Miscellaneous Tax Rulings V2015-07-03 FBT (Fringe Benefits Tax) Policy Page 1 of 2 DOCUMENT TYPE ADMINISTRATIVE FINANCE AND RESOURCES PLANNING FINANCIAL OPERATIONS NUMBER P 5 2 1 049 Policy Database Document Reference Number 521049P A New Tax System (Goods and Services Tax) Act 1999. Related Policy and other documents Date Effective 1 June 2015 Next Review Date 30 May 2018 Keywords benefits, car, employee, entertainment, FBT, fringe benefit, gross up rate, reportable fringe benefits, travel, tax Owner/Sponsor Chief Financial Officer Author Senior Manager External Reporting, Tax and Compliance Contact person or area Senior Manager External Reporting, Tax and Compliance ERTC@latrobe.edu.au V2015-07-03 FBT (Fringe Benefits Tax) Policy Page 2 of 2