ACCOUNTING

advertisement

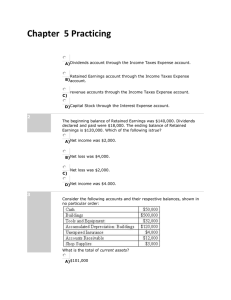

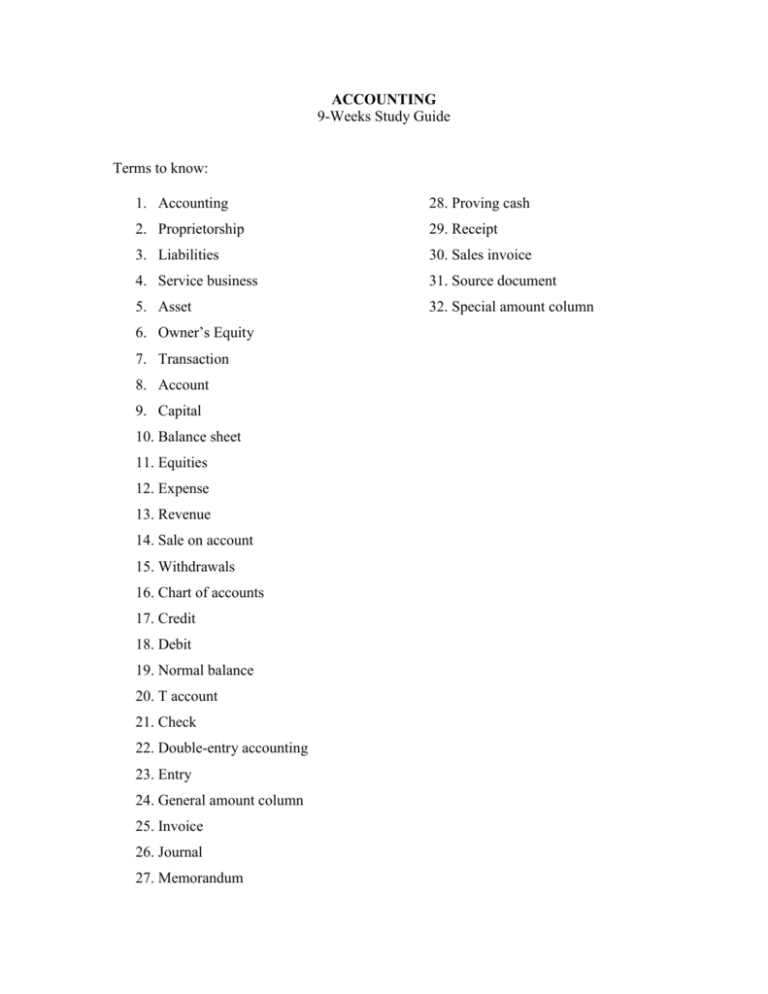

ACCOUNTING 9-Weeks Study Guide Terms to know: 1. Accounting 28. Proving cash 2. Proprietorship 29. Receipt 3. Liabilities 30. Sales invoice 4. Service business 31. Source document 5. Asset 32. Special amount column 6. Owner’s Equity 7. Transaction 8. Account 9. Capital 10. Balance sheet 11. Equities 12. Expense 13. Revenue 14. Sale on account 15. Withdrawals 16. Chart of accounts 17. Credit 18. Debit 19. Normal balance 20. T account 21. Check 22. Double-entry accounting 23. Entry 24. General amount column 25. Invoice 26. Journal 27. Memorandum Short Answer 33. What is the accounting equation? 34. What are the three sections of a balance sheet? 35. When one side of the balance sheet is longer than the other, what adjustment must be made? 36. Generally, when is revenue recorded? 37. What is the common abbreviation for debit? _________ credit? _______ 38. Asset accounts have normal _______ balances. 39. Liability accounts have normal __________ balances. 40. The normal balance side of an expense account is the _______ side. 41. The normal balance side of a drawing account is the _______ side. 42. Explain #40-41. 43. When analyzing transactions into debit and credit parts, what is the first question you ask? 44. What is the name of the account used to record revenue? 45. What is the name of the account used to record transactions when the owner takes assets out of the business for personal use? 46. A journal lists transactions in what type of order? 47. Journal comes from the Latin word diurnalis meaning ___________. 48. Why does a business keep source documents for transactions on file? 49. What are the four parts of a journal entry? 50. Why do companies choose to use special amount columns in journalizing? 51. What are the three steps in proving a journal page? 52. What are the five steps in ruling a journal page? 53. What are the four steps in starting a new journal page? 54. What are the two steps in proving cash? 55. When does a company prove cash? 56. When is a journal ruled? 57. What are the five steps in ruling a journal at the end of the month? 58. How are errors corrected in accounting practices? 59. Words are abbreviated only in what situations? 60. Why should you use 0s in the cents column even though the amount is in even dollars? 61. How do you indicate addition or subtraction? 62. How do you indicate the totals have been verified as correct? 63. Why is neatness so important in accounting? Be able to complete a balance sheet, analyze transactions using T accounts, and complete journal entries. Also be able to prove and rule a journal.