Chapter 5 Practicing

advertisement

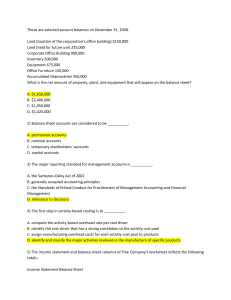

Chapter 5 Practicing A)Dividends account through the Income Taxes Expense account. Retained Earnings account through the Income Taxes Expense B)account. C) revenue accounts through the Income Taxes Expense account. D)Capital Stock through the Interest Expense account. 2 The beginning balance of Retained Earnings was $140,000. Dividends declared and paid were $18,000. The ending balance of Retained Earnings is $120,000. Which of the following istrue? A)Net income was $2,000. B)Net loss was $4,000. C) Net loss was $2,000. D)Net income was $4.000. 3 Consider the following accounts and their respective balances, shown in no particular order: What is the total of current assets? A)$101,000 B)$478,000 C) $66,000 D)$69,000 4 Which of the following is always disclosed in notes to the financial statements? A)Pending lawsuits B)Depreciation policies C) Resignation of the controller D)Loss of shop equipment from theft. 5 After closing entries are posted, which of these accounts will have a balance? A)Salary Expense B)Retained Earnings C) Income Summary D)Revenue 6 After the first year of operations, the Retained Earnings account has a debit balance of $4,000. This most likely indicates which of the following occurred? A)An error in the closing entries B)A reported net loss for the period C) All revenue accounts were not closed D)A posting error 7 Consider the following balances at the beginning of the month: Fifty percent (50%) of the receivables are expected to be collected in the current month. How much additional cash does the company need to meet its current obligations? A)$27,000 B)$5,000 C) $2,000 D)$22,000 8 Consider the following: Calculate the net income percentage to the nearest tenth. A)12.9% B)8.3% 14.3% C) D)204.5% 9 In no particular order, the accounting cycle includes the following activities. What is the correct order of activities of the accounting cycle? A)Activities B, C, D, A, E, F, G, and H B)Activities D, A, E, B, H, C, F, and G C) Activities D, A, E, B, C, H, F, and G D)Activities D, A, E, B, F, G, H, and C 10 When the totals in the debit and credit columns of the Adjusted Trial Balance section of a worksheet are moved to their correct corresponding columns in the Income Statement and Balance Sheet sections of the worksheet, which of the following will occur? The debit column of the Income Statement section will equal the A)debit column of the Balance Sheet section. The dollar amount difference between the debit and credit column totals of the Income Statement section should be equal to the dollar B) amount difference between the debit and credit column totals of the Balance Sheet section. The difference between the credit column of the Income Statement section and the debit column of the Balance Sheet section is equal to C) the net income or net loss for the period. The credit column total of the Income Statement section will be equal D)to the credit column total of the Trial Balance section plus the credit column total of the Adjustments section. Solutions: c, c, d, b, b, b, b, c, b, b