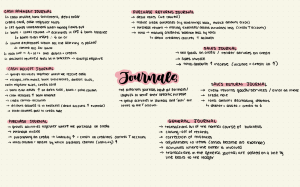

CASH PAYMENT JOURNAL PURCHASE RETURNS JOURNAL issued) ↳ cash invoice, bank statement, debit order -> debit notes credit card, cash register slips -> reduce credit purchases ↳ CP5 groups transactions totalcolumn ↳bank: I bank is an money when -> flows out activities in cp5 asset: N t -> bank balance -> purchase return total -> making - (e.g making send things activity is creditors balance less by -> ↳ discounts A 0E+1 = recieved and SALES JOURNAL -> - in brackets -> always negative sell CASH RECIEPT JOURNAL groups -> activities recepts, cash together cash invoice, bank register slips, credit card -> cash side, bank total - the different column layouts recepts i bank balance credit contra-accounts -> -> discount allowed is -> -> -> -> -> to serve their specific purpose group activities on credit in Journals (debitaccount expense) income (income client returns credit to - 4) JOURNAL goods/services/error credit note -> and 'post' the total -> totals to the T account. 1 amount decreasing debtors ↳ debtor asset credit to t - = other columns post to credit side GENERAL JOURNAL PURCHASE -> credit/render services SALES RETURN journals have dif formats) -> in brackets on total amount Journals where we receive cash statements, deposit slips, 1 on debit bank is an asset -> goods -> sales Invoice -> -> total account posted debits credits must be error (credit account) + ↳ contra acc for bank ↳ each line invoice amount back, expenses/assets purchased less ↳ debit creditors control on Cr ↳ column determines which as the (we groups activities together where we purchase on credit -> purchase Invole purchasing on credit total column: amount -> -> by lability which =credit on creditors control creditors (lability) control account i JOURNAL transactions outof the normal course of closing-off business of records correction of mistakes -> -> adjustment to items casset become an expense) activities where the owner -> -> transactions in the line basis to the is involved general Journal ledger are postedon a line by on invoice