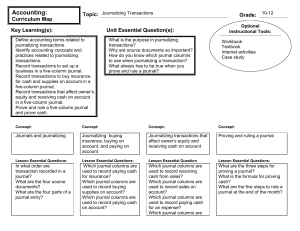

Journalizing Transactions

advertisement

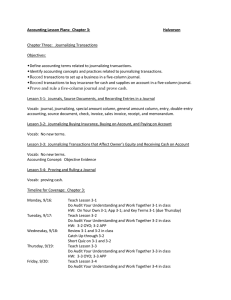

Journalizing Transactions General Notes If a co. receives cash – it is ALWAYS a debit. If a co. pays cash out – it is ALWAYS a credit. An expense is ALWAYS debited. Sales is ALWAYS credited. Drawing is ALWAYS debited. 4.1 Journals, Source Documents, and Recording Entries in a Journal Journals and Journalizing A form for recording transactions in chronological order is called a journal. Recording transactions in a journal is called journalizing. Each business uses the kind of journal that best fits the needs of that business. A Five-Column Journal Encore Music uses a journal that has five amount columns: General Debit, General Credit, Sales Credit, Cash Debit, and Cash Credit. A journal amount column headed with an account title is called a special amount column. A journal amount column that is not headed with an account title is called a general amount column. A Five-Column Journal Con’t Transactions are recorded in a journal in order by date. A Five-Column Journal Con’t Double-Entry Accounting – Information for each transaction recorded in a journal is called an entry. – The recording of debit and credit parts of a transaction is called double-entry accounting. – Double-Entry Accounting assures that debits equals credits. A Five-Column Journal Con’t Source Documents – A business paper from which information is obtained for a journal entry is called a source document. – Objective Evidence is applied when a sourced document is prepared for each transaction. – The amounts must be accurate and true. Checks A business form ordering a bank to pay cash from a bank account is called a check. The source document for cash payments is a check. The checks are prenumbered. Sales Invoices A form describing the goods or services sold, the quantity, and the price is called an invoice. - Used when something is sold on account. An invoice used as a source document for recording a sale on account is called a sales invoice. A sales invoice is prepared in duplicate. – The original copy is given to the customer. – The copy is used as the source document for the sale on account transaction. Receipts A business form giving written acknowledgement for cash received is called a receipt. The receipts are prenumbered to help account for all of the receipts. Memorandums A form on which a brief message is written describing a transactions is called a memorandum. They are prenumbered. A brief note is written on the memorandum to describe the transaction. Calculator Tapes At the end of each day, Encore Music uses a printing electronic calculator to total the amount of cash received from sales for that day. Each calculator tapes is dated and numbered. Journalizing An entry consists of four parts: – Date – Debit – Credit – Source Document 4.4 Proving and Ruling a Journal Proving a Journal Page After a co. uses all but the last line on a journal page, columns are proved and ruled before totals are carried forward to the next page. First verify that total debits on the page equal the total credits. – Add each of the amount columns. – Add the debit column totals and the credit column totals. – Verify that the total debits and total credits are equal. Proving a Journal Page Con’t 1. Rule a single line across all amount columns directly below the last entry. On the next line write the date in the date column. Write Carried Forward in the Account Title and a checkmark in the Post. Ref. Write each column total below the single line. Rule double lines. Starting a New Journal Page 1. Write the page number, 2, at the top of the journal. 2. Write the Date, Brought Forward in the Account Title, and check mark in the Post Ref. 3. Record the column totals brought forward from the previous page. Always prove and rule a journal at the end of each month even if the last page for the month is not full. Starting a New Journal Page Determining that the amount of cash agrees with the accounting records is called proving cash. Cash on hand at the beginning of the month + Total cash received during the month Equals Total -Total cash paid during the month Equals cash balance at the end of the month