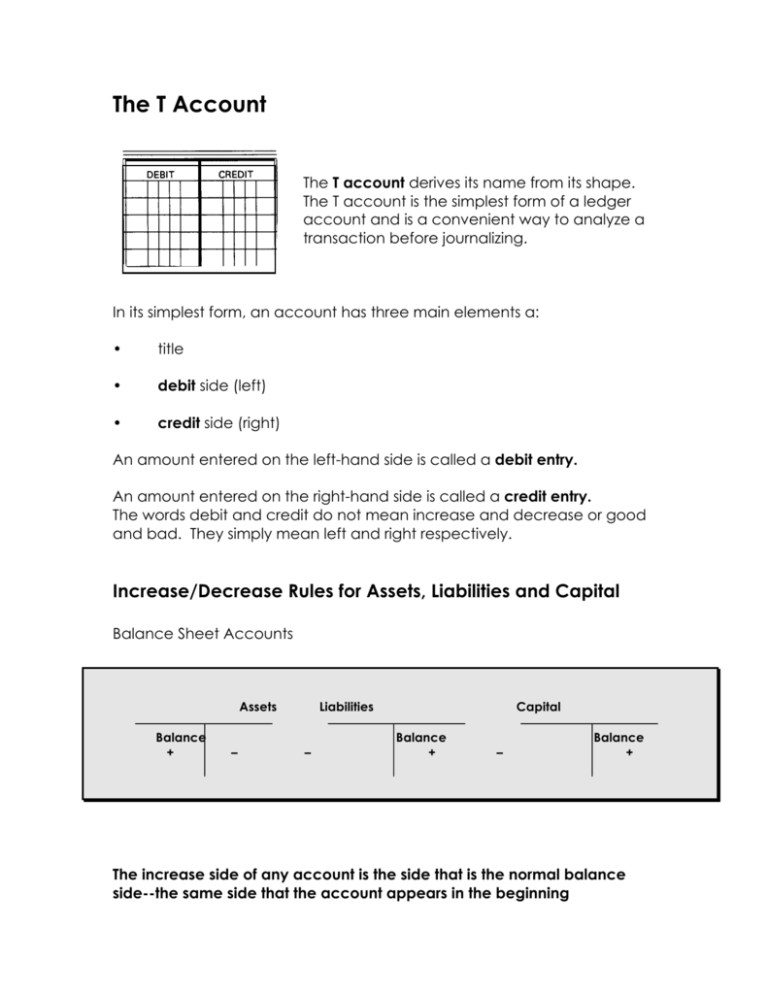

The T Account

advertisement

The T Account The T account derives its name from its shape. The T account is the simplest form of a ledger account and is a convenient way to analyze a transaction before journalizing. In its simplest form, an account has three main elements a: • title • debit side (left) • credit side (right) An amount entered on the left-hand side is called a debit entry. An amount entered on the right-hand side is called a credit entry. The words debit and credit do not mean increase and decrease or good and bad. They simply mean left and right respectively. Increase/Decrease Rules for Assets, Liabilities and Capital Balance Sheet Accounts Assets Balance + – Liabilities – Capital Balance + – Balance + The increase side of any account is the side that is the normal balance side--the same side that the account appears in the beginning accounting equation. The decrease side of an account is the side opposite to that on which the account appears in the accounting equation. Assets usually have debit balances: • To increase an asset--debit • To decrease an asset--credit Liabilities usually have credit balances: • To increase a liability--credit • To decrease a liability--debit Capital always has a credit balance: • To increase capital--credit • To decrease capital--debit Revenue is an inflow of assets resulting from the sale of goods or services. Revenue is an increase in capital resulting from business operations. The most important of these is the Sales account. Expenses are costs incurred by a business in earning revenue. Expenses are a decrease in capital resulting from business operations. Examples include Salaries Expense, Rent Expense, Utilities Expense, and so on. Increase/Decrease Rules for Revenues and Expenses Income Statement Accounts Revenue – Balance + Expenses Balance + – Revenues have credit balances: • To increase a revenue--credit • To decrease a revenue--debit Expenses have debit balances: • To increase an expense--debit • To decrease an expense--credit Capital increases from: • the realization of net income by the business • additional investment by the owner of the business Capital decreases as a result of • expense transactions • withdrawals of assets made by the owner Analyzing Common Transactions To analyze any transaction before journalizing, follow these steps: Step 1: What accounts are involved in the transaction? Step 2: Make the appropriate number of T-accounts. Step 3: What type of accounts are they? (assets, liabilities, owner’s equity) Step 4: Decide whether there is an increase or decrease in each account and apply the rules given above. Step 5: Journalize the T accounts. Study the six entries given below and apply the five analysing steps • Bought a new desk for $500 cash (Asset) Office Furniture (Asset) Cash 500 • 500 Sold an old desk for $200 cash Cash 200 Office Furniture 200 • Received $1 000 cash from revenue Cash Revenue 1 000 • 1 000 Paid telephone bill, $150 cash Telephone Expense Cash 150 • 150 Owner, T. Summers, invested an additional $5 000 cash Cash T. Summers, Capital 5 000 • Owner, T, Summers withdrew $400 cash for personal use 5 000 T. Summers, Drawings Cash 400 400 For more information, refer to pages 24 - 29 and 33 - 39 of the text. Quick Check: Complete the following text book assignment on loose-leaf and hand it in. Century 21 Page 64 4-M