October 16 Chatper 6 Journal BAF3M

advertisement

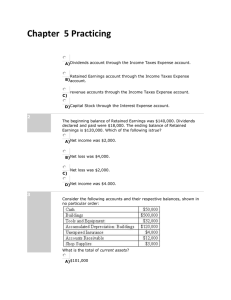

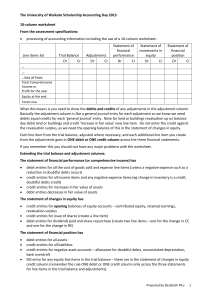

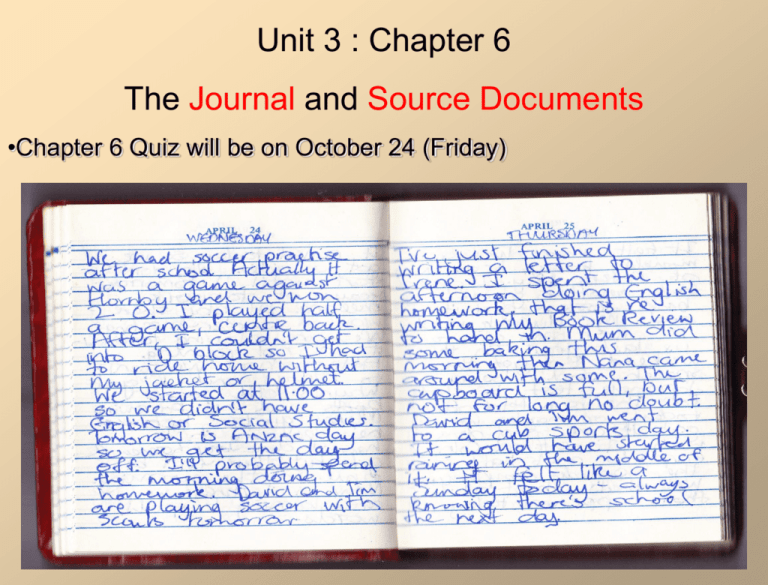

Unit 3 : Chapter 6 The Journal and Source Documents •Chapter 6 Quiz will be on October 24 (Friday) The General Journal • • • Just as people write diaries to record their experiences, thoughts, feelings, facts and details, accountants also use diary called, “General Journal” to record facts and details of a business transactions. Accountants write down on General Journal all the things that they should remember for a long time. So far, we used T accounts whenever we recorded transactions. The General Journal • • • It is easy to use T accounts when the transactions are simple such as one debit entry and one credit entry. In reality, many transactions consist of many accounts, so we have to record the transactions first in the General Journal. (or Journal or Journal Entry) General Journal is a notebook in which accounting entries are first recorded The General Journal • • • • Each transaction is recorded separately in chronological order. Usually there is a blank line between two transactions. GJ is also referred to as the book of original entry Each transaction is recorded a) separately b) in the order that they occur It provides a continuous record of all transactions The First 6 Steps in the Accounting Cycle 1 Transactions occur. 4 Trial Balance 2 Transactions are recorded in the journal in order by date. 5 Adjusting Entry 3 The accounting entries are transferred to the ledger accounts. (or T accounts) 6 Balance Sheet and Income Statement The Two-Column Journal 1. Year recorded at the top of column. 2. Month recorded once with days noting business transactions. 3. Account titles are always capitalized. 4. Explanations are brief but tell ‘the story’. 5. Debits are always recorded first. 6. Credit particulars are always indented. 7. The completed journal entry must balance. 8. Leave a blank line before next entry. The Steps in Recording a Journal Entry • Step 1: Date: Enter the day in the date column (second column) • Step 2: Debit Accounts: Enter the name of the accounts, which is to be debited. Enter the amount in debit column. • Step 3: Credit Accounts: Enter the names of the accounts which is to be credited. They are indented about 1.5 cm. Enter the amount in credit column. • Step 4: Explanation: Write a brief explanation for the entry beginning at the left side of the “Particular” column on the line beneath the last credit item. Example of a Journal Entry • • Let’s say that on Feb 1, you sold your accounting service to your existing client for $180. Customer did not pay on the same date, but she paid on Feb 15 instead. What are the journal entries? Date Particulars PR Debit Credit Feb 1 AR 180 Service fee(Rev) 180 Sold tax return service to Mr. Smith 15 Bank 180 AR 180 Received money from Mr. Smith Invoice 123 Notes about recording a Journal Entry Year recorded at the top of column. 2. Month recorded only once with days noting business transactions. 3. Account titles are always capitalized. 4. Explanations are brief but tell ‘the story’. (What happened?) 5. Debit accounts are always recorded first. 6. Credit accounts are always indented. 1. Notes about recording a Journal Entry 7. The completed journal entry must balance. (=> total debit amounts = total credit amounts) 8. Leave a blank line before next entry. Class Activity Other groups can make a skit, rap song, poem or a sample journal by using chart paper, demonstrating that you can make a journal entry! You can even teach the class with your activity. Create : 1. Group Name 2. Who plays which role?