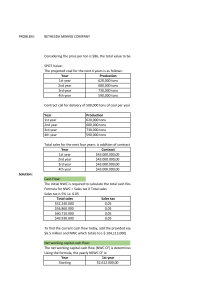

Capital Budgeting Problems & Solutions

advertisement

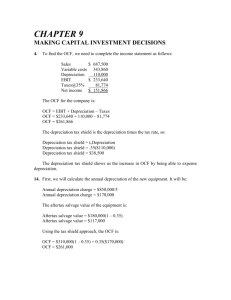

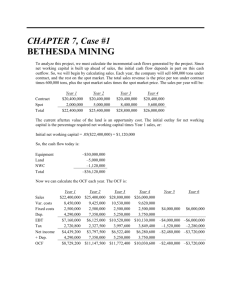

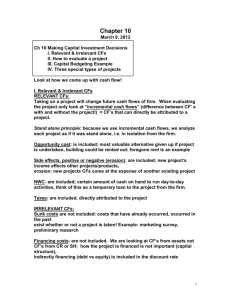

Sample Capital Budgeting Problems 1. A company is considering a project that requires an initial investment of $24M to build a new plant and purchase equipment. The investment will be depreciated as a MACRS 7-year class (see p. 21 in the text) asset. The new plant will be built on some of the company's land which has a current, after-tax market value of $4.3M. The company will produce units at a cost of $130 each and will sell them for $420 each. There are annual fixed costs of $0.5M. Unit sales are expected to be 150,000 each year for the next 6 years, at which time the project will be abandoned. At that time, the plant and equipment is expected to be worth $8M (before tax) and the land is expected to be worth $5.4M (after tax). To supplement the production process, the company will need to purchase $1M worth of inventory. That inventory will be depleted during the final year of the project. The company has $100M of debt outstanding with a yield-to-maturity of 8%, and has $150M of equity outstanding with a beta of 0.9. The expected market return is 13% and the risk-free rate is 5%. The company's marginal tax rate is 40%. Should the project be accepted? Solution WACC: wd = $100M / $250M = 0.4 kd = 8% ws = $150M / $250M = 0.6 ks = 5% + 0.9(13% - 5%) = 12.2% WACC = 0.48%(1-0.4) + 0.612.2% = 9.24% Capital Expenditure: -$24M at date 0 Date 0 1 2 3 4 5 6 7 8 MACRS % 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46% Depreciation $3.430 $5.878 $4.198 $2.998 $2.143 $2.141 $2.143 $1.070 Salvage Cash Flow of New Equipment: Salvage CF = $8M - 0.4($8M - $3.212M) = $6.085M Change in Net Working Capital: -$1M at date 0 +$1M at date 6 Book Value $24.000 $20.570 $14.692 $10.494 $7.496 $5.353 $3.212 $1.070 $0.000 Operating Cash Flows: Sales = 150,000 $420 = $63,000,000 Costs = 150,000 $130 + $0.5M = $20,000,000 OCF = ($63,000,000 - $20,000,000) (1-0.4) + D 0.4 = 25,800,000+D0.4 Date 0 1 2 3 4 5 6 Depreciation OCF $3.430 $5.878 $4.198 $2.998 $2.143 $2.141 $27.172 $28.151 $27.479 $26.999 $26.657 $26.656 Other Relevant Cash Flows: Land The $4.3M is an opportunity cost and must be included at date 0. If the project is accepted, however, the land can be sold in 6 years for $5.4M. Is this an incremental cash flow? Yes, because we wouldn't be selling it then if we reject the project. Total Expected Cash Flows Date 0 1 2 3 4 5 6 Cap. Exp. -$24M NWC -$1M Salvage OCF $27.172M $28.151M $27.479M $26.999M $26.657M $1M $6.085M $26.656M Other (Land) -$4.3M $5.4M Total -$29.300M $27.172M $28.151M $27.479M $26.999M $26.657M $39.141M NPV = -29.3 + 27.172/ 1.0924 + … + 39.141/1.09246 = $99.37M > 0, so accept the project. IRR = 92.53% > 9.24%, so accept the project. 2. A company is considering the purchase of new equipment to replace some old, existing equipment. The old equipment is fully depreciated and has a current market value of $1.2M. The new equipment costs $10.4M and will be depreciated using the 5 year MACRS class. The equipment is used to produce items with constant annual revenues of $18M. Current costs (using the old equipment) are $3M per year. The new equipment will not change the expected revenues (they will remain at $18M per year), but will allow the company to cut costs by $1M per year. The project is expected to last for 4 years, at which time the new equipment would be worth $6.0M. If the old equipment is kept, it will be worthless in 4 years. The company's marginal tax rate is 35%. The company is financed with $50M of preferred stock and $150M of common stock. The preferred stock has a current value of $20 and pays constant dividends of $2 annually. The expected return on the common stock is 14.4%. Should the project be accepted? Solution WACC: wd = 0 ws = $150 / ($150 + $50) = 0.75 ks = 14.4% wps = $50 / ($150 + $50) = 0.25 kps = D1/P0 = $2 / $20 = 10% WACC = 0.7514.4% + 0.2510% = 13.3% Capital Expenditure: -$10.4M at date 0 Date 0 1 2 3 4 5 6 MACRS % Depreciation 20.00% 32.00% 19.20% 12.52% 12.52% 5.76% $2.080M $3.328M $1.997M $1.198M $1.198M $0.599M Book Value $10.4M $8.320M $4.992M $2.995M $1.797M $0.599M $0.000M Salvage value of new equipment (date 4): CF = $6.0M - ($6.0M - $1.797M)0.35 = $4.529M Salvage value of old equipment (date 0): $1.2M - 0.35($1.2M-$0M) = $0.78M Operating Cash Flow: We are only interested in the incremental cash flow. In this case, the incremental change to revenues is $0 and the incremental change to costs is $1M. This gives and incremental OCF of OCF = (S-C) (1-T) + TD = (0 - (-$1M)) (1-0.35) + 0.35$2.08M = $1.378M Year 0 1 2 3 4 Depreciation Sales Costs OCF $2.08 $3.328 $1.976 $1.248 $0 $0 $0 $0 -$1M -$1M -$1M -$1M $1.378M $1.815M $1.349M $1.069M Change in NWC: $0 Total Expected Cash Flows Date 0 1 2 3 4 Cap. Exp. -$10.4M NWC $0 Salvage $0.78M $4.529M OCF $1.378M $1.815M $1.349M $1.069M Total -$9.62M $1.378M $1.815M $1.349M $5.598M NPV = -9.62 + 1.378/1.133 + $1.815 / 1.1332 + $1.349 / 1.1333 + $5.598 / 1.1334 = -$2.665M < 0, so reject the project. IRR = 1.72% < 13.3%, so reject the project. 3. A firm is considering a project that requires an investment of $10M in equipment. The equipment will be depreciated using the 3-year MACRS class, but will be used for a five year project. At the end of the project, the equipment should be worth $3M. The equipment will be used to produce items at a cost of $35 each. Those items will be sold for $60 each. Projected sales are 60,000 each year. Historically, the firm has maintained a inventory to sales ratio of 0.1 (measured in units, not dollars). The firm's marginal tax rate is 35% and its WACC is 12%. Should the firm take the project? Solution Capital Expenditure: -$10M at date 0 Date 0 1 2 3 4 MACRS % Depreciation 33.33% 44.45% 14.81% 7.41% $3.333M $4.445M $1.481M $0.741M Book Value $10.000M $6.667M $2.222M $0.741 $0.000 Salvage value in five years: $3M - ($3M-$0M)0.35 = $1.95M Year 0 1 2 3 4 5 Date 0 1 2 3 4 5 Depreciation Sales Costs OCF $3.333M $6060,000 = $3.6M $3.6M $3.6M $3.6M $3.6M $3560,000 = $2.1M $2.1M $2.1M $2.1M $2.1M $2.142M $2.531M $1.493M $1.234M $0.975M $4.445M $1.481M $0.741M $0.000M Cap. Exp. NWC -$10M -$0.21M $0.21M Salvage OCF $1.95M $2.142M $2.531M $1.493M $1.234M $0.975M Total -$10.210M $2.142M $2.531M $1.493M $1.234M $3.135M NPV = -$10.21 + $2.142/1.12 + +$2.531/1.122 + $1.493/1.123 + $1.234/1.124 + $3.135/1.125 = -$2.6541M IRR: 1.03 reject the project 4. As the director of a firm's capital budgeting department, you have been asked to evaluate a project. After collecting information from various sources, you have determined the following. The firm's preferred stock pays a constant annual dividend of $2.25 and is currently selling for $20. The firm is expected to pay a common stock dividend of $3 in one year, with anticipated growth of 2% each year thereafter. Currently, the common stock is selling at a price of $23.75. The firm has 8 year bonds outstanding with a coupon rate of 8.75%, paid annually. The bonds are currently selling at par. The firm is currently being financed with $10,000,000 of debt, $20,000,000 of common equity, and $5,000,000 of preferred stock. The project requires the use of equipment valued at $6,200,000. The equipment currently has a book value of $3,000,000 with two years of straight-line depreciation (to zero) remaining ($1,500,000 each year). You anticipate that the equipment can be sold in three years for $2,100,000. Anticipated sales are 1,000,000 units per year based on a sale price of $11 per unit. The cost of producing each unit is $8.50. If the project is accepted, the firm will need to hire an additional manager with an annual salary of $80,000. The product complements another of the firm's products. As a result, you anticipate increased sales of $700,000 per year for that product. Total research (information gathering for project analysis) expenses to date are $26,000. If the project is accepted, the firm will have to forego another project that has a NPV of $584,000. The firm's marginal tax rate is 40%. Should the project be accepted? Solution kps = $2.25/$20 = 11.25% P0 = D1/(ks-g) ks = D1/P0 + g = $3/$23.75 + 2% = 14.63% kd = 8.75% wps = $5,000,000/$35,000,000 = 0.1429 ws = $20,000,000/$35,000,000 = 0.5714 wd = $10,000,000/$35,000,000 = 0.2857 WACC = 0.142911.25% + 0.571414.63% + 0.2857(1-0.4)8.75% = 11.47% Capital Expenditure: -$6,200,000 at date 0 (note that this is an opportunity cost) Date 0 1 2 3 Depreciation $1.5M $1.5M $0M Book Value $3.0M $1.5M $0M $0M Salvage CF = $2,100,000 - ($2,100,000 - $0)0.4 = $1.26M at date 3 Year 0 1 Depreciation Sales Costs OCF $1.5M $11M + $0.7M = $11.7M $8.5M + 0.08M = 8.58M $2.472M 2 3 $1.5M $0M Date 0 1 2 3 Cap. Exp. -$6.2M $11.7M $11.7M NWC $0 $0 $0 $0 8.58M 8.58M Salvage OCF $1.26M $2.472M $2.472M $1.872M $2.472M $1.872M Total -$6.2M $2.472M $2.472M $3.132M Notice that the $26,000 research expense does not appear. It is a sunk cost and therefore should not affect our analysis. NPV = -$6.2 + $2.472/1.1147 + $2.472/1.11472 + $3.132/1.11473 = $0.268M IRR = 13.86% payback = 2.40 years Normally, we would accept the project, but doing so would result in us giving up a $0.584M project (a net loss of $0.316M). We therefore must reject the project. 5. A company is considering two projects and can only accept one of them. The projected cash flows are as follows: Year 0 3 Project A Cash Flow -$10,000,000 $15,000,000 Project B Cash Flow -$15,000,000 $21,700,000 The company's WACC is 10%. Compute the payback, NPV, and IRR for each project. Which project should be chosen? Explain the logic behind your choice. Solution NPVA = -$10 + $15/1.13 = $1.270M NPVB = -$15 + $21.7/1.13 = $1.304M IRRA = ($15/$10)1/3 - 1 = 14.47% IRRB = ($21.7/$15)1/3 - 1 = 13.10% paybackA = 2.67 years paybackB = 2.69 years The choice is a judgement call. The NPVs are very close, but the IRR for A is a good bit higher than the IRR for B. Because we might have errors in our projections, I would tend to favor project A.